Pantera Capital Founder Projects Bitcoin Market Cap To Soar To $15 Trillion

Dan Morehead, founder and managing partner of Pantera Capital Management, has reiterated his bullish stance on Bitcoin, predicting that the pioneering cryptocurrency could eventually command a $15 trillion market cap. Morehead’s comments came during a recent interview on CNBC’s “Squawk Box,” where he also highlighted Pantera’s original Bitcoin fund surpassing a 1,000x return since its inception in 2013.

$740,000 Per Bitcoin In April 2028?

According to Morehead, institutional exposure to crypto is still woefully inadequate. He notes that “the median institutional ownership of blockchain is zero,” and even trailblazing investors typically hold just 1–2% of their allocations in digital assets. He characterized the opportunity as massive, citing that “95% of financial wealth has no investments in blockchain whatsoever,” which translates to minimal overall exposure—often a fraction of a percent.

Reflecting on the early days of crypto, Morehead recalls years of unclear regulations deterring institutions from making meaningful commitments. With Donald Trump to take office, he envisions more supportive frameworks for digital assets, hinting that the US government could mirror its early internet-era strategy: “93% of the [crypto] market cap is based outside the United States,” he said, underscoring the need for domestic regulatory clarity.

When asked about the possibility of President-elect Trump establishing a Strategic Bitcoin Reserve, Morehead commented: “I think there are two versions of that. One is that the president-elect said he will not sell the Bitcoins the US already owns. The United States owns 1% of the world’s Bitcoins. That seems easier to do than getting passage to buy additional Bitcoins. I think it is a great strategy. The US is the reserve currency of the world. We don’t have another currency to save our reserves in. So saving in Bitcoin would be a great strategic move.”

Despite Bitcoin’s meteoric gains, Morehead believes there is room for further growth, especially as many large investors remain skeptical. He recounted raising only $1 million during 170 investor meetings in 2016—an experience that reinforced the notion that widespread adoption was still years away. Now, with mainstream financial giants offering Bitcoin, Morehead no longer worries about BTC price going to zero. “50 million people in the US, 300 million globally own it. Blackrock and Fidelity are selling it. It has reached escape velocity,” Morehead remarked.

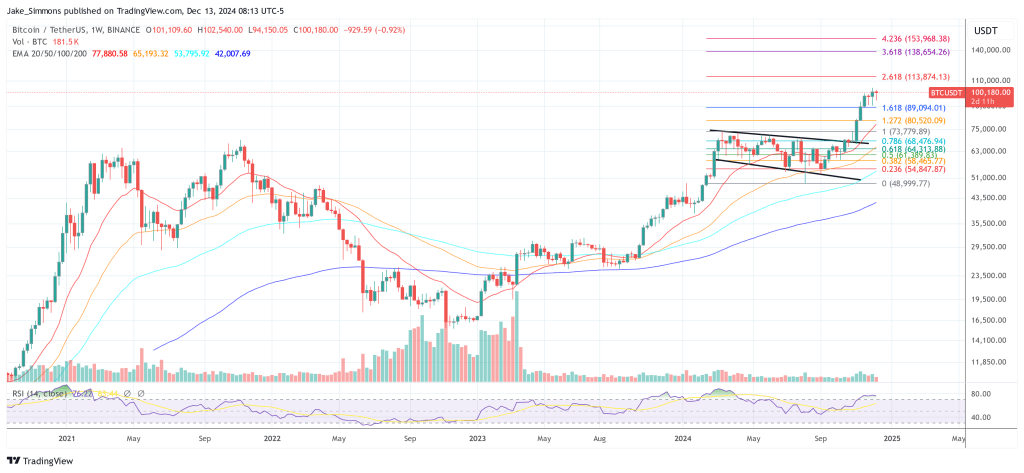

Looking ahead, Morehead outlined a vision of BTC’s market cap reaching $15 trillion, with the price per coin potentially rising to $740,000: “It has gone up three orders of magnitude since we launched our fund, I think it can go up a fourth. And that puts it at a $15 trillion market cap, which still seems relatively small compared to $500 trillion of financial assets. That’s doable.” In a recent investor note, Morehead revealed that BTC could reach this target as early as April 2028.

At press time, BTC traded at $100,000.