Crypto Today: XRP gains 10%, Solana and BTC hit new peaks as Gensler steps down January 20

- The global cryptocurrency market capitalization grew by $160 billion on Wednesday, crossing the $3.2 trillion mark.

- The cryptocurrency sector valuation has scored its highest daily timeframe gains since November 11.

- Amid the market rally, Bitcoin dominance (BTC.D) fell by 0.66%, signaling that investors are increasingly leaning into altcoins.

Altcoin Market Updates: Solana, XRP, and BNB, surge as traders front-run Gensler’s exit

News of Gary Gensler’s exit from the US SEC on January 20 has sparked bullish momentum across the crypto markets.

Zooming in, investors leaned towards assets that have underperformed in recent years under litigation from Gensler’s SEC regime, Solana, Ripple (XRP), Binance Coin (BNB).

- Arguably, the most litigated crypto asset under the current SEC regime, Ripple (XRP) price surged 12.7% on Thursday, briefly breaching the $1.20 mark.

XRP price action, November 21 | XRPUSDT (Binance)

XRP price action, November 21 | XRPUSDT (Binance)

Notably, most of XRP’s daily time-frame gains came within four hours after Gensler’s exit confirmation, signaling investors' positive reaction.

- Solana (SOL) price also scored 10.30% gains, peaking at $259.80 on Binance, just a few cents shy of its all time highs.

- Binance Coin (BNB) snapped a two-day losing streak as it bounced 5% to hit the $629 level after Gensler’s exit confirmation on Thursday.

Chart of the day: Bitcoin whales’ buying streak enters 12th day as $100K breakout looms

Bitcoin price gained 5% to hit $98,988 on Thursday, setting a new all time high for the fourth consecutive day.

While Gary Gensler’s imminent exit from the SEC dominated media headlines, behind-the-scenes, on-chain data suggest the rally is being mainly driven by persistent buying pressure from large investors.

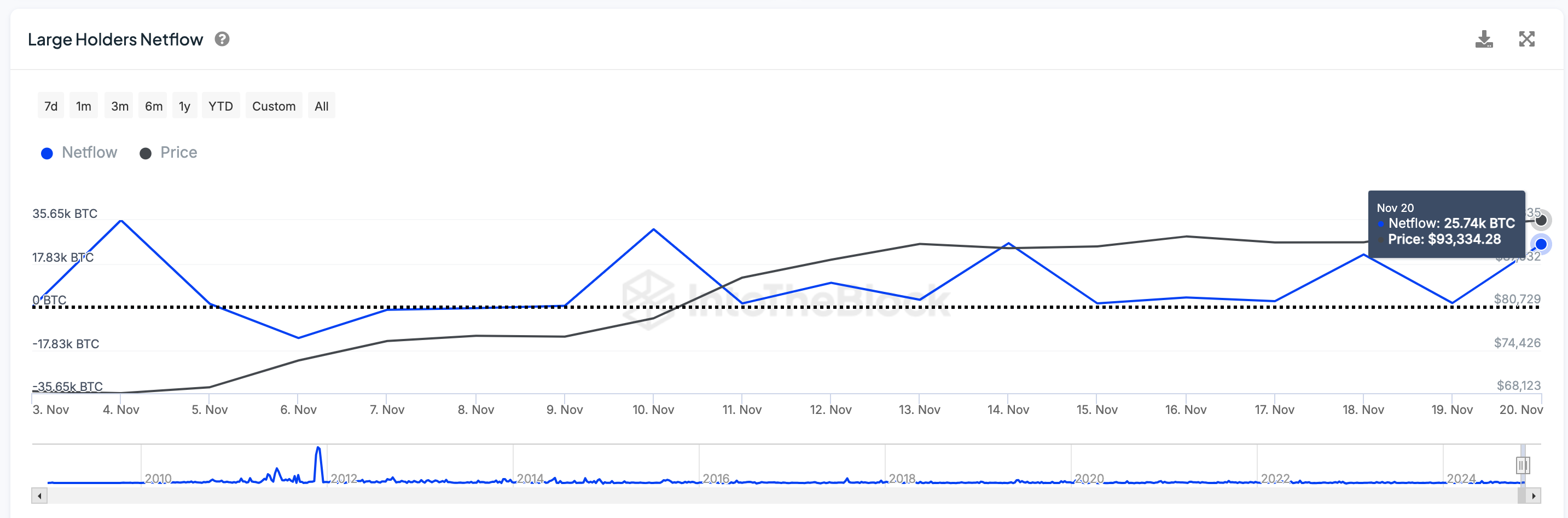

IntoTheBlock’s chart below tracks the netflow of deposits and withdrawals in wallets that control at least 19,000 BTC ($1.9 billion).

Bitcoin price vs. Large holders netflow | Source: IntoTheBlock

At first glance the chart shows that Bitcoin whales acquired 25,740 BTC on November 20, the highest single-day net inflow this week.

Zooming in, the whales have also recorded positive netflows in each of the last 12 trading days dating back to November 9.

During that period, the whale wallets acquired a total of 128,448 BTC worth approximately $21.2 billion.

Such large whale accumulation over an extended period effectively reduces Bitcoin's circulating supply on exchanges, tightening market liquidity.

This scarcity effect has evidently played a pivotal role in driving BTC to new all time highs in each of the last 4 consecutive days.

If it persists an imminent breakout above the $100,000 milestone could be on the cards.

Crypto news updates:

- Charles Schwab set to offer crypto trading services.

Rick Wurster, the President, and incoming CEO of US trading platform, Charles Schwab, has outlined plans to begin offering spot crypto trading.

During a Bloomberg interview, Wurster expressed optimism about a positive shift in US regulatory stance towards cryptocurrencies under Donald Trump.

“We will get into spot crypto when the regulatory environment changes, and we do anticipate that it will change, and we’re getting ready for that eventuality,”

- Rick Wurster, Incoming CEO, Charles Schwab

Founded in 1986, Charles Schwab is one of the largest trading platforms in the US, offering a wide range of financial services including brokerage, banking, and advisory services.

Schwab already offers crypto-linked ETFs and crypto futures, but the move into spot trading would see the firm take a more central role, competing directly with early movers like Robinhood and Webull.

- MicroStrategy seals a deal to issue $3 billion convertible notes offering to buy more Bitcoin.

The Michael Saylor-led firm has already acquired over $6 billion worth of BTC this month, in two transaction tranches, on November 11 and November 18 respectively.

MicroStrategy Bitcoin holdings as of November 21, 2024 | Source: SaylorTracker

MicroStrategy Bitcoin holdings as of November 21, 2024 | Source: SaylorTracker

The $3 billion convertible notes, will keep MicroStrategy on pace to fulfill Michael Saylor’s plan to acquire $42 billion over the next three years.

At press time on November 21, MicroStrategy now holds a total of 331,200 BTC worth approximately $32.7 billion, with 97% unrealized gains.

- Donald Trump’s Media Company Eyes Crypto Payments with Trademark for “TruthFi”

Donald J. Trump’s media company, Trump Media & Technology Group, has filed a trademark application for TruthFi, signaling plans to launch a cryptocurrency payment platform.

The proposed service includes features such as financial custody and digital asset trading capabilities, positioning the company for potential entry into the crypto sector.

Notably, earlier this week Trump Media entered acquisition talks with Bakkt, a publicly traded crypto trading platform.

US President-elect Donald Trump owns approximately 57.3% of Trump Media, with his stake valued around $3 billion, making it his most significant asset. His son, Donald Trump Jr., plays an active role, serving on the company’s board.