SOL rallies near all-time high upon news of SEC engaging with Solana ETF applications

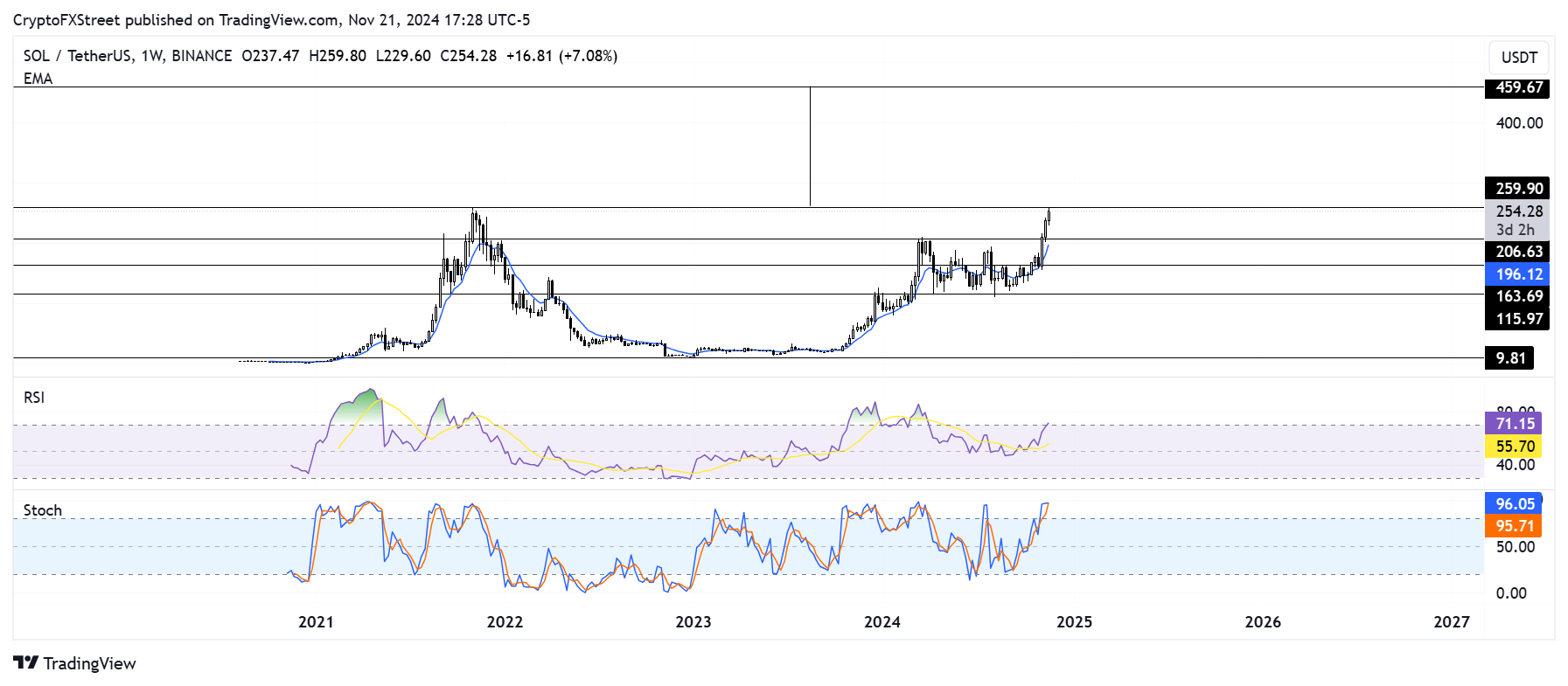

- Solana surged over 7% as it looks to flip its all-time high resistance of $259.9, eyes $459 price level.

- The rally follows news of the SEC engaging with issuers concerning the potential approval of a Solana ETF.

- VanEck, 21Shares and Canary Capital have all filed S-1 applications for Solana ETF, with Bitwise also showing interest.

Solana (SOL) tested its all-time high resistance of $259.9 on Thursday after recent reports suggested that the Securities & Exchange Commission (SEC) has begun reviewing proposals for Solana exchange-traded funds (ETFs).

SOL eyes 70% rally as SEC begins processing S-1 filing for Solana ETFs

Solana is one of the top trending assets among top cryptocurrencies by market capitalization after testing its all-time high resistance of $259.9 with a 7% rally in the past 24 hours.

The resistance, which marked a peak in SOL's price on November 6, has lasted for over three years. With the recent rise, Solana has now stretched its monthly and yearly gains to over 50% and 370%, respectively.

A move above the resistance will validate a cup and handle pattern, meaning SOL could stage over a 70% rally to $459 in the coming weeks.

SOL/USDT weekly chart

The rally comes after the SEC began reviewing applications and a possible launch in 2025 for a Solana ETF, according to Fox Business's Eleanor Terret.

Terret notes that exchanges such as Cboe may file a form 19b-4 on behalf of issuers over the next few days. The form 19b-4 filing proposes changes to trading rules and is essential for listing crypto ETFs.

So far, only four asset managers have shown interest in the Solana ETFs, including VanEck, 21Shares, Canary Funds and Bitwise — which stated its interest on Wednesday.

While the new development indicates higher chances of the product seeing approval in 2025, it does not guarantee that the SEC will give the green light.

However, most Solana proponents are confident, considering SEC Chair Gensler — whose administration targeted fierce regulations toward the crypto industry — has confirmed he would resign in January 2025, according to a press release by the agency.