Crypto Today: Cardano, XLM, FLOKI lead $3.1 trillion rally, Russia bans crypto mining, Bitcoin eyes $95K

- The global cryptocurrency market capitalization grew 3% on Wednesday, crossing the $3.1 trillion mark.

- The cryptocurrency sector valuation has now hit a new all-time high in three consecutive days, signaling strengthening bullish momentum.

- In the crypto ETF markets, Bitcoin ETFs pulled in $834.6 million while Ethereum ETFs faltered with 81 million outflows on November 19.

Altcoin Market Updates: Cardano, Stellar (XLM) emerge top gainers, while Ethereum’s FLOKI outperformed Solana memes

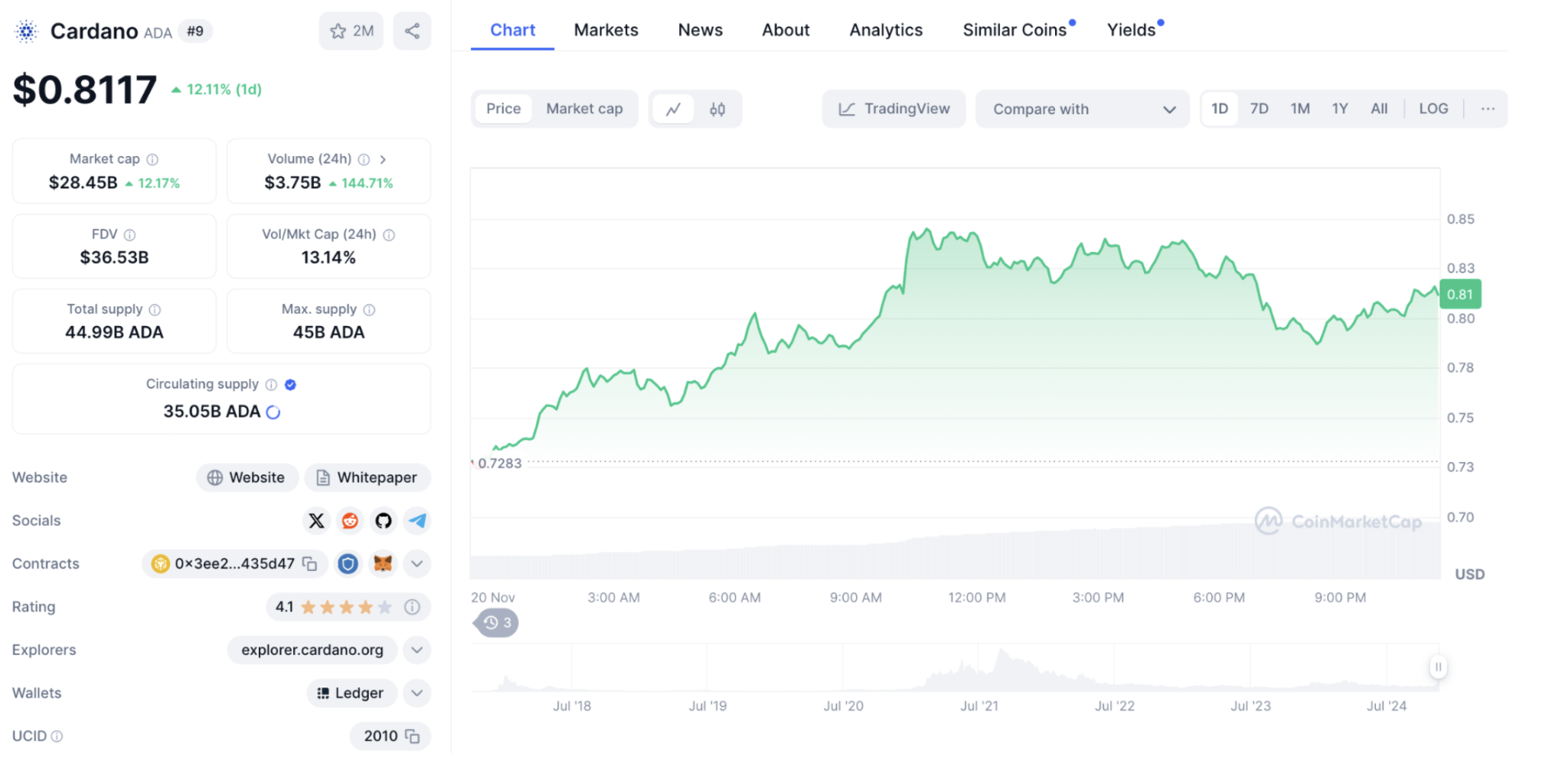

- Cardano (ADA) price emerged top gainer among the top 10 ranked crypto assets, scoring 11% gains to cross the $0.82 mark within the daily timeframe.

Cardano (ADA) price action

Cardano (ADA) price action

ADA’s ongoing rally has been attributed to rumors that the Trump administration could collaborate with the Cardano network to build a blockchain voting system. ADA now looks likely to gain more ground as Trump’s January 20 inauguration date approaches.

- Ethereum’s second largest memecoin Floki Inu (FLOKI) also made headlines on Tuesday, rising 10% to reach $0.0003, while trending Solana memes including WIF, BONK, and PNUT all declined within the daily timeframe.

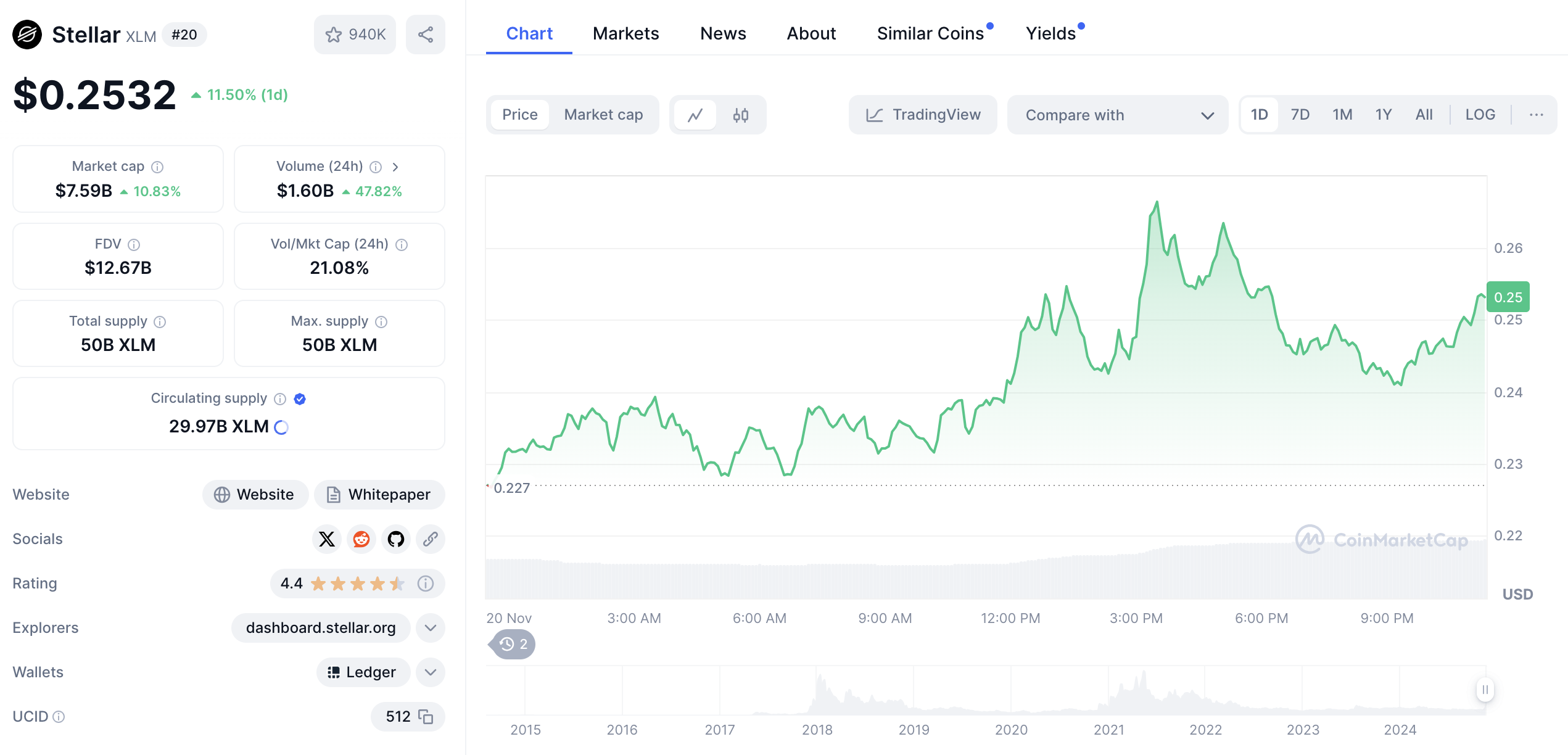

- Stellar (XLM) also rose 10% to reclaim the $0.25 territory on Wednesday, tailing XRP’s recent breakout amid several other bullish catalysts.

Stellar (XLM) Price Action | November 20, 2024

Notably, Stellar founder, Jed McCaleb, was also a co-founder of Ripple Labs. As such XLM price has maintained close correlation to XRP price movements since inception.

Hence, market reports suggest the XLM’s 10% rally on Wednesday could be attributed to Ripple (XRP)’s recent breakout to new 3-year peaks after its relisting on US-based exchanges Coinbase and Robinhood.

More so, Stellar has also recently secured strategic partnerships with global fintech giants, Mastercard, and Stripe, which has also deepened XLM mainstream adoption and credibility.

Chart of the day: Bulls mounting pressure as Bitcoin price tops $94K

Bitcoin price bounced 3% to reach a new all-time high of $94,831 on Wednesday as bulls continue to push for the milestone $100,000 breakout. Major catalysts driving BTC this week include, Microstrategy, Marathon digital and rising ETF inflows

After Microstrategy acquired 51,000 BTC for $4 billion on Monday, founder Michael Saylor is now set to pitch the bitcoin acquisition strategy to Microsoft.

Meanwhile, US-based bitcoin miner Marathon digital has increased its BTC acquisition plan to $1 billion, after initially proposing a $700 million debt note. Likewise, Bitcoin ETFs also snapped up another $1.09 billion inflows since the start of the week.

Bitcoin price action | November 20

Bitcoin price action | November 20

With all of these bullish catalysts in play, technical indicators on the BTCUSDT daily chart are flashing signals of another imminent breakout attempt towards $100,000

Based on trading data culled from Binance, Bitcoin price trading at $94,162 at press time, has now moved above its Volume Weighted Average Price of $93,154, while the Volume Delta also flipped into positive values for the first time this week.

First, the Volume Weighted Average Price (VWAP) suggests that the majority of active BTC traders are currently bidding marginally higher to get their order filled quicker rather than wait for market-clearing prices.

Additionally, the Volume Delta metric measures the net difference between buying and selling volumes within a given period.

The positive shift in Volume Delta indicates that bullish buy orders now outnumber active sell orders, a move that often precedes a major price breakout.

If these conditions persist, Bitcoin price could be on the verge of breaching the vital $95,000 resistance territory.

Crypto news updates:

- Russian authorities have moved to ban crypto mining in occupied Ukrainian territories from December 2024, to mitigate electricity shortages.

The mining suspensions extend across key regions including Donetsk, Luhansk, Zaporizhia, and Kherson.

- MicroStrategy’s market capitalization crossed the $100 billion mark on Wednesday and now moves to surpass rival IT giant Intel's $102 billion valuation.

Notably, Microstrategy’s MSTR share price has increased by 254% over the past month as the firm doubled down on its BTC acquisition strategy.

- Gary Wang, former CTO of FTX, avoided prison at his sentencing in a Manhattan federal court on Wednesday.

US District Judge Lewis Kaplan’s decision followed Wang’s guilty plea to four felony charges of fraud and conspiracy.

According to Reuters’ reports, Wang had cooperated with prosecutors, testifying in the trial of Sam Bankman-Fried, the FTX founder convicted of fraud.

Wang and Bankman-Fried’s partnership began at a high school math camp and extended through their time at MIT, ultimately leading to FTX’s creation.

- CHILLGUY token, a newly launched memecoin hit $500 million market cap, after recording a staggering 20,000% growth in five days as a viral TikTok trend fuelled its popularity.

Having secured its first exchange listing with Crypto.com, CHILLGUY looks set for busier market activity in the days ahead.