Crypto Today: All Bitcoin holders in profit, TRON partners with Chainlink, DOGE miners in $145M buying spree

- Bitcoin price reached a new all-time high of $75,120 on November 6 as markets reacted to Donald Trump’s victory in the 2024 US presidential election.

- The global cryptocurrency sector valuation (TOTALCAP) grew by $190 billion (7.31%) within the daily time frame as bullish momentum spilled over into the altcoin market.

Bitcoin, Dogecoin and XRP market updates

- Bitcoin’s 7.3% gain on November 6 marks its highest single-day rally since August 8 when the crypto market surged 11% on expectations of the first US Fed rate cut in four years.

- According to IntoTheBlock data, 100% of all 19.8 million addresses holding BTC are now in profit as the pioneer cryptocurrency enters a price discovery phase.

- Dogecoin market capitalization briefly exceeded XRP on November 6, with Ripple Labs having declared support for Kamala Harris with an $11 million donation during the election season.

- Derivative market trends show strategic traders have mounted $28 million worth of XRP short positions around the $0.55 level, signaling that XRP could struggle to breach that $0.55 resistance despite the broader market rally.

Chart of the day: Bitcoin’s $75,120 ATH rally puts all BTC traders in profit

Former President Donald Trump was declared winner of the 2024 US presidential election overnight. Trump’s victory sparked a major rally across global risk asset markets, including the cryptocurrency sector, on November 6.

The chart below shows that after Bitcoin’s record-breaking price action in the aftermath of the election verdict, all current BTC holders are now in profitable positions.

Bitcoin Global In/Out of the Money data, November 6, 2024 | Source: IntoTheBlock

Bitcoin Global In/Out of the Money data, November 6, 2024 | Source: IntoTheBlock

IntoTheBlock’s Global In/Out of the Money data groups all current BTC holders according to their entry prices. At the time of publication on November 6, all 19.8 million addresses holding BTC are now in profit.

When such a large number of investors are in profitable positions, the majority are likely to be unwilling to sell.

This could clear the path for more upside, potentially driving BTC toward the $80,000 mark if the post-election frenzy across US markets persists in the days ahead.

Market updates

- Crypto bettors who wagered on Trump win have racked up massive profits. According to data culled from Arkham Intelligence, an anonymous whale wallet was spotted booking gains in excess of $29 million.

- In his congratulatory statement, Ripple CEO Brad Garlinghouse has called on Donald Trump to replace SEC chief Gary Gensler within 100 days of resuming office.

- Justin Sun’s TRON DAO has announced a partnership with Chainlink (LINK) to integrate oracle price data deeds and enhance security for its native DeFi applications.

On-chain updates

- Dogecoin miners have acquired 750 million DOGE in 120 days despite prices rising 104% within the past month.

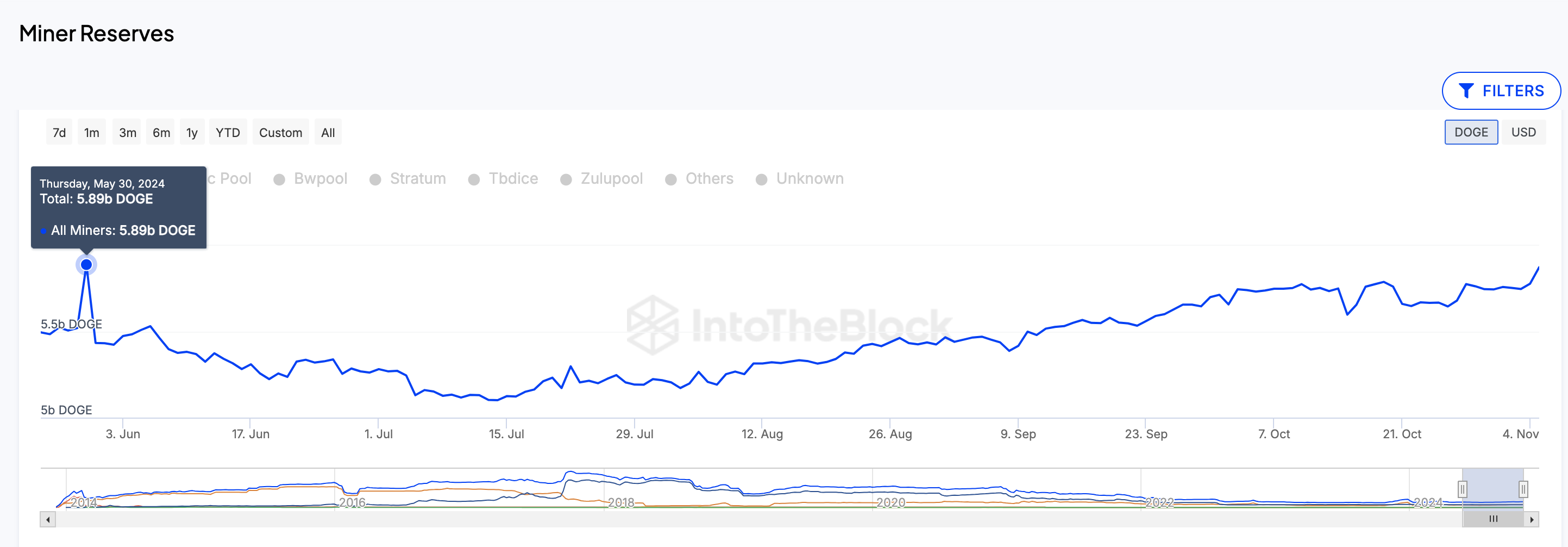

IntoTheBlock’s miner reserves metric tracks real-time balances held in wallets controlled by recognized miners and mining pools. As seen in the chart below, Dogecoin miners held a total of 5 billion DOGE in their cumulative reserves as of July 5.

Since then, the miners have entered an accumulation spree amid growing positive sentiment from Elon Musk’s involvement in Trump’s victorious political campaign.

The latest data shows as of November 5 that miners’ reserves have now skyrocketed towards 6 billion DOGE, the highest since May 30. This reflects an increase of 750 million DOGE in the miners’ balances, worth approximately $145 million, over the last 120 days.

Dogecoin Miners Reserves, May 30 - Nov 5, 2024 | Source: IntoTheBlock

Dogecoin Miners Reserves, May 30 - Nov 5, 2024 | Source: IntoTheBlock

When miners keep accumulating their block rewards during a major market rally, strategic investors consider it a bullish signal for two key reasons.

First, it signals that the majority of key stakeholders within the DOGE community are still anticipating more price upside in the near term.

More importantly, miners storing up their block rewards means fewer newly mined coins flowing into the market supply, paving the way for rapid price upsings.