NEAR Protocol price set for a rally as on-chain data shows positive trends

- NEAR Protocol price breaks above the descending trendline, eyeing a rally ahead.

- On-chain data shows that NEAR’s open interest and TVL value are rising, indicating new buying and greater blockchain usage.

- A daily candlestick close below $4.256 would invalidate the bullish thesis.

NEAR Protocol (NEAR) continues its gains on Tuesday after rallying more than 14% on Monday and breaking above the descending trendline. This bullish outlook is further supported by NEAR’s rising open interest and Total Value Locked (TVL), which suggests new buying and greater blockchain usage is occurring, all hinting at a rally ahead.

NEAR Protocol is poised for a rally as it breaks above its descending trendline

Near Protocol price broke above the descending trendline (drawn by connecting multiple high levels with a trendline from May 26) and rallied 14.4% on Monday. It also closed above its 100-day Exponential Moving Average (EMA) around $4.745, which had previously acted as a resistance barrier. Some retracement generally follows such a massive rally. At the time of writing on Tuesday, it trades at around $5.199.

If NEAR retraces, it could find support around the trendline breakout level and the 100-day EMA around $4.745. At this level, sideline traders looking for buying opportunities can enter positions.

If this support holds, NEAR’s price could rally 34% from $4.745 to retest its daily resistance level at $6.354.

The Relative Strength Index (RSI) indicator on the daily chart shows that the NEAR protocol is approaching its overbought level of 70, which currently trades at 68. If it enters the zone on a closing basis, traders will be advised not to add to their long positions, although the rally may continue. If it enters overbought and then exits back into the neutral level of 50, it will be a sign of a deeper correction.

NEAR/USDT daily chart

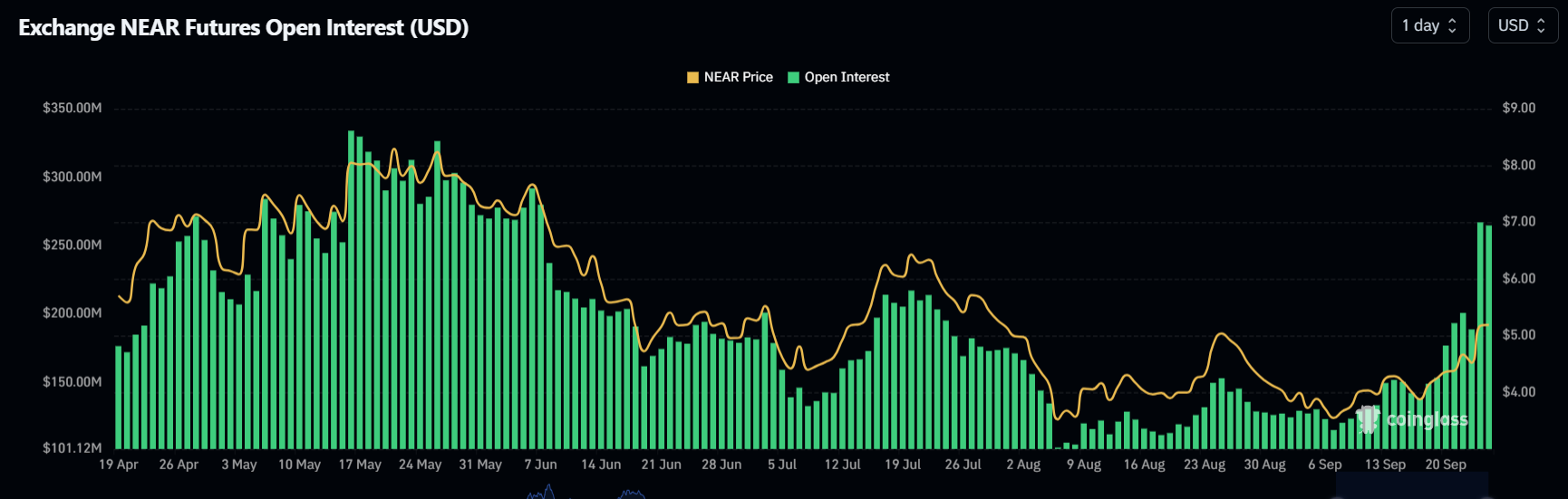

NEAR Protocol’s on-chain data further supports the bullish thesis. Coinglass’s data shows that NEAR's futures’ Open Interest (OI) at exchanges is also increasing. The OI indicates the total number of outstanding derivative contracts that have not been settled (offset by delivery) and whether money flows into the contract are increasing or decreasing.

Increasing OI represents new or additional money entering the market and new buying, which suggests a bullish trend. On the contrary, when OI decreases, it is usually a sign that the market is liquidating, more investors are leaving, and prices may decrease.

The graph below shows that NEAR’s OI increased from $176.77 million on Friday to $266.88 million on Tuesday, the highest level since June 7. This rise indicates that new or additional money is entering the market and new buying is occurring.

NEAR Open Interest chart

Crypto intelligence tracker DefiLlama also aligns with the bullish perspective. Data shows that NEAR's TVL increased from $199.28 million on September 18 to $244.42 million on Tuesday, the highest since the end of July.

This 23% increase in TVL indicates growing activity and interest within the NEAR Protocol ecosystem. It suggests that more users deposit or utilize assets within NEAR-based protocols.

NEAR TVL chart

Even though on-chain metrics and technical analysis support the bullish outlook, if NEAR Protocol makes a daily candlestick close below $4.256, the bullish thesis would be invalidated by creating a lower low on the daily chart. This development could see NEAR’s price decline by an additional 10% to retest its September 17 low of $3.832.