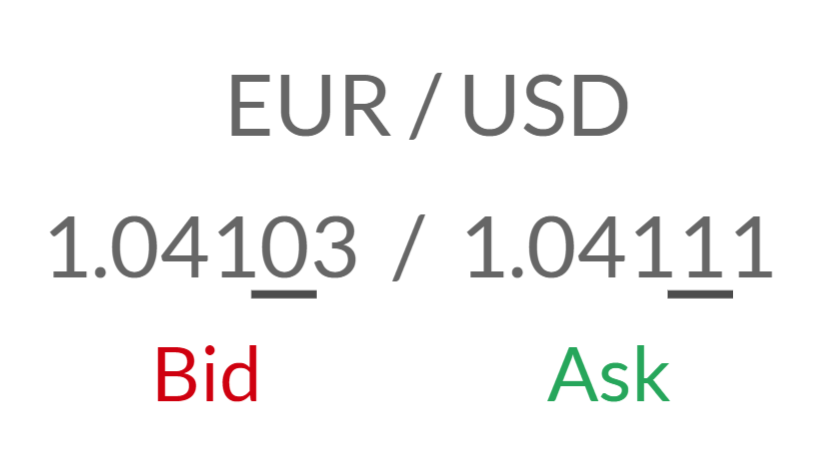

When traders trade through foreign exchange brokers, they will see two different prices displayed: buying price and selling price

Buying price (ASK): The buying/ask price refers to the price that traders can BUY the base currency in exchange for the quote currency from the broker.

Selling price (BID): The selling/bid price refers to the price that traders can SELL the basic currencies in exchange for the quote currency from the broker.

The price difference between the two prices is also known as the spread. Also known as the "bid-ask spread".

This is one of the ways that "no-commission brokers" earn money. This spread is the fee for providing transaction immediacy. This is why the terms “transaction cost” and “bid-ask spread” are used interchangeably.

Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade. From a business standpoint, this makes sense. The broker provides a service and has to make money somehow. They make money by selling the currency to you for more than they paid to buy it. And they also make money by buying the currency from you for less than they will receive when they sell it. This difference is called the spread.

How is it measured?

In most cases, spread is already calculated into the price quote that you're looking at. As a trader, all you have to do is find the difference between the bid & ask price.

fig 1. For currency pairs and quotes displayed to 5 decimal places

fig 2. For currency pairs and quotes displayed to 3 decimal places

Types of Spreads

The types of spreads you'll see on a trading platform depends on the broker. They are categorized into 2 types;

- Fixed

- Variable (also known as "floating")

Fixed spreads are usually offered by brokers that operate as a market maker or “dealing desk” model while variable spreads are offered by brokers operating a “non-dealing desk” model.

Fixed Spread

Regardless of the time and any market conditions, the spread remains unchanged, which means that no matter how the market fluctuates, the spread is always the same. Fixed spread is often used by market makers or "dealing desk" model. These market makers buys large positions from their liquidity provider(s) and sell these positions to retail investors. By doing so, the broker acts as the counterparty to the clients' trades. This allows the broker to control the prices they display to their clients.

Variable Spread

As the name suggests, variable spreads are ever-changing. With variable spreads, the difference between the bid-ask prices of currency pairs is constantly changing. Variable spreads are offered by non-dealing desk brokers. Non-dealing desk brokers get their pricing of currency pairs from multiple liquidity providers and pass on these prices to the trader without the intervention of a dealing desk.

This means the broker have no control over the spreads. And spreads will widen or tighten based on the supply and demand of currencies and the overall market volatility.

Typically, spreads widen during economic data releases as well as other periods when the liquidity in the market decreases (like during holidays and when there's global economic events).

Overview of Pros and Cons

Pros | Cons | |

|---|---|---|

Fixed Spread | Usually have smaller capital requirements Predictable cost of transaction | Requotes; during high volatility periods, the broker may not be able react in time. In return, the broker will "block" your trade and ask you to accept a different price. Slippages; When prices are moving fast, the broker is unable to consistently maintain a fixed spread and the price that you finally end up after entering a trade will be totally different than the intended entry price |

Variable Spread | Variable spreads have lower chances to experience requotes. Higher Transparency | Variable spreads aren’t ideal for scalpers. The widened spreads can quickly eat into any profits that the scalper makes. Variable spreads are just as bad for news traders. Spread may widen so much that what looks like a profitable can turn into an unprofitable within a blink of an eye. |

How to calculate spread?

To accurately calculate the actual transaction cost, you'll need to know two additional things;

- Value per pip

- Volume of trade

Example 1

With the price quote above, the spread would be the difference between 1.04103 and 1.04111 is 8 points or 0.8 points.

To find out the transaction cost, you'll need to multiply the value per pip and the number of lots you're trading.

If you're trading one mini lot (10,000 units), the value per pip will be $1, so the cost incurred to open this trade will be;

1 Mini Lot (10,000 units)

0.8pips x 1 mini lot x $1 (value per pip) = USD0.80

Example 2

5 Mini Lot (50,000 units)

0.8pips x 5 mini lot x $1 (value per pip) = USD4.00

If you increase your volume or lot size, you'll need to multiply the cost per pip by the number of lots accordingly to determine the transaction cost.