Summary

- Leverage is the use of borrowed funds to increase one's trading position.

- Traders are can choose from a range of leverage ratios offered by the broker.

- Leverage is a double-edged sword; it can amplify your profits, likewise your losses.

We've discussed this previously. Leverage allow traders to use a smaller capital to trade larger amounts of money by utilizing margin.

What exactly is Leverage and Margin?

The textbook definition of Leverage; it refers to the the ability to control a large amount of money by the use of a significantly smaller trading capital (security deposit also known as margin) and borrowing the rest.

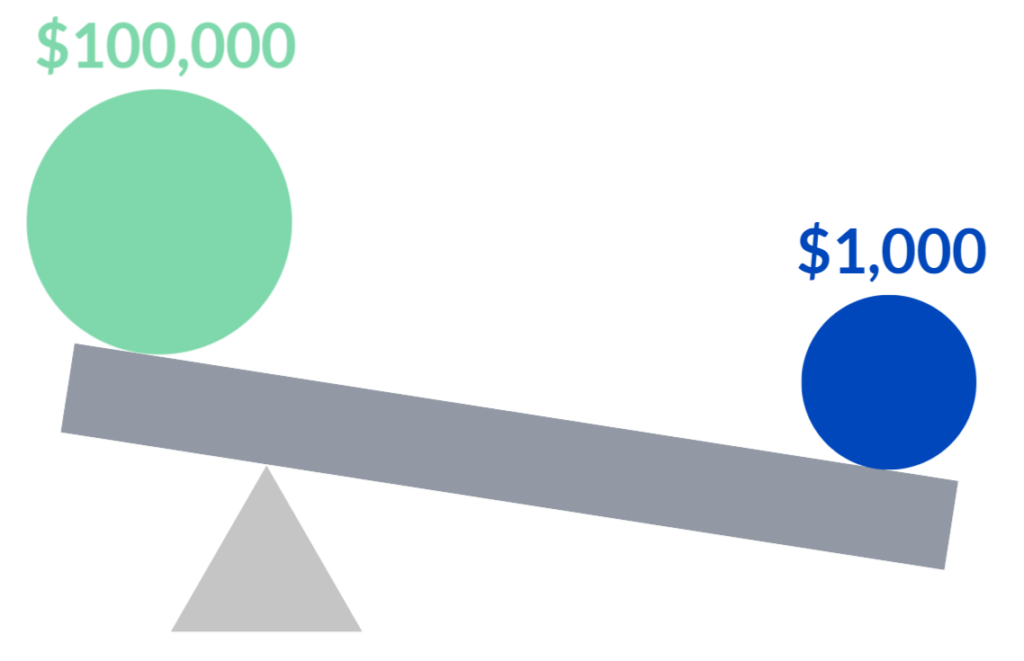

For example, to control a $100,000 trade position, the broker will set aside $1,000 from your account as margin. This also means, you're controlling a trade position of $100,000 with $1,000. This is commonly expressed in ratios, in this case; 1:100 and the margin required is 1%.

Leverage 1:100

In most cases, brokers will offer a range of leverage ratios that start from 1:1 to 1:200 and in some cases even going up to 1:500. The table below will show how leverage and margin goes hand-in-hand;

Margin Required | Leverage |

|---|---|

5% | 1:20 |

2% | 1:50 |

1% | 1:100 |

0.5% | 1:200 |

0.2% | 1:500 |

Margin required based on Leverage

Here's a scenario of how the different leverage and margin works.

Scenario 1: Leverage 1:100

If the trader wants take on a trade position of $100,000, the broker requires a margin of 1%, that would be $1,000.

Scenario 2: Leverage 1:50

If the trader wants take on a trade position of $100,000, the broker requires a margin of 2%, that is $2,000

Scenario 3: Leverage 1:200

If the trader wants take on a trade position of $100,000, the broker requires a margin of 0.5%, that would be $500.

How does that affect me?

- Let's say the price for EUR/USD is 1.26837 and the trader decides to trade 1 Lot, which means the trader decides to take on a long position(buy trade) worth 1.268837 x 100,000 = $126,837

If the trader opts for the leverage of 1:200 that is offered by the broker, the margin required will be $126,837 x 0.5% = $634.19.

EUR/USD 1.26837

| Leverage 1:1 (No Leverage) | Leverage 1:200 |

|---|---|---|

Trade Amount / Volume | 1 Lot (100,000) | 1 Lot (100,000) |

Amount of margin required | 126,837 USD | 634.19 USD |

Notice how the amount of margin required differs. Now lets say the price of EUR/USD went up 3pips, from 1.26837 to 1.26867, this will amount in the following profits:

EUR/USD 1.26837 ➜1.26807

| Leverage 1:1 (No Leverage) | Leverage 1:200 |

|---|---|---|

Trade Amount / Volume | 1 Lot (100,000) | 1 Lot (100,000) |

Amount of margin required | 126,837 USD | 634.19 USD |

Profits | 126,867-126,837 = 130USD | 126,867-126,837 = 130USD |

Likewise if the price falls by 3pips, from 1.26837 to 1.26807.

EUR/USD 1.26837 ➜1.26807

| Leverage 1:1 (No Leverage) | Leverage 1:200 |

|---|---|---|

Trade Amount / Volume | 1 Lot (100,000) | 1 Lot (100,000) |

Amount of margin required | 126,837 USD | 634.19 USD |

Losses | 126,807-126,837 = -130USD | 126,807-126,837 = -130USD |

There's a common analogy in the financial world that, Leverage is a doubled-edged sword. Even if the profit/loss dollar value is the same, the percentage gain based on capital requirement is vastly different.

Based on examples above, with a price movement of 3pips;

If a trader doesn't uses leverage (1:1), the profit/loss in terms of percentage is 130 ÷ 126,837 = 0.1%.

But if the trader opts for leverage ratio 1:200, the traders profit/loss in terms of percentage will be 130 ÷ 634.19 = 20%.