Alphabet’s AI Empire: The $75B Power Move

- AI Expansion & CapEx Surge – Alphabet is investing $75 billion in 2025 to scale AI infrastructure, betting big on Gemini and Cloud.

- Search & Cloud Drive Growth – Q4 Search revenue hit $54B (+13%), while Cloud surged 30% to $12B, with margins expanding to 17.5%.

- Valuation & Upside Potential – DCF valuation pegs fair value at $197, offering a 15.99% margin of safety at the $165.49 stock price.

- Risks & Competitive Pressures – AI rivals (Microsoft, OpenAI), rising CapEx, and regulatory scrutiny could challenge Alphabet’s dominance despite strong monetization across ads, Cloud, and AI.

TradingKey - Alphabet (GOOG) (GOOGL) is rewriting its future with AI at the center—transforming from a search-first ad giant into a vertically integrated AI powerhouse. With Gemini models now embedded across Search, Cloud, YouTube, and Android, the company is positioning itself as the operating system of the AI era. But ambition comes at a cost. A staggering $75 billion in planned CapEx, intensifying pressure from rivals like Microsoft and OpenAI, and growing regulatory scrutiny raise a pivotal question: Can Alphabet’s AI-first vision unlock the next trillion in value—or is it already priced in?

From Search to Systems: Alphabet’s Strategic foray into AI Infrastructure

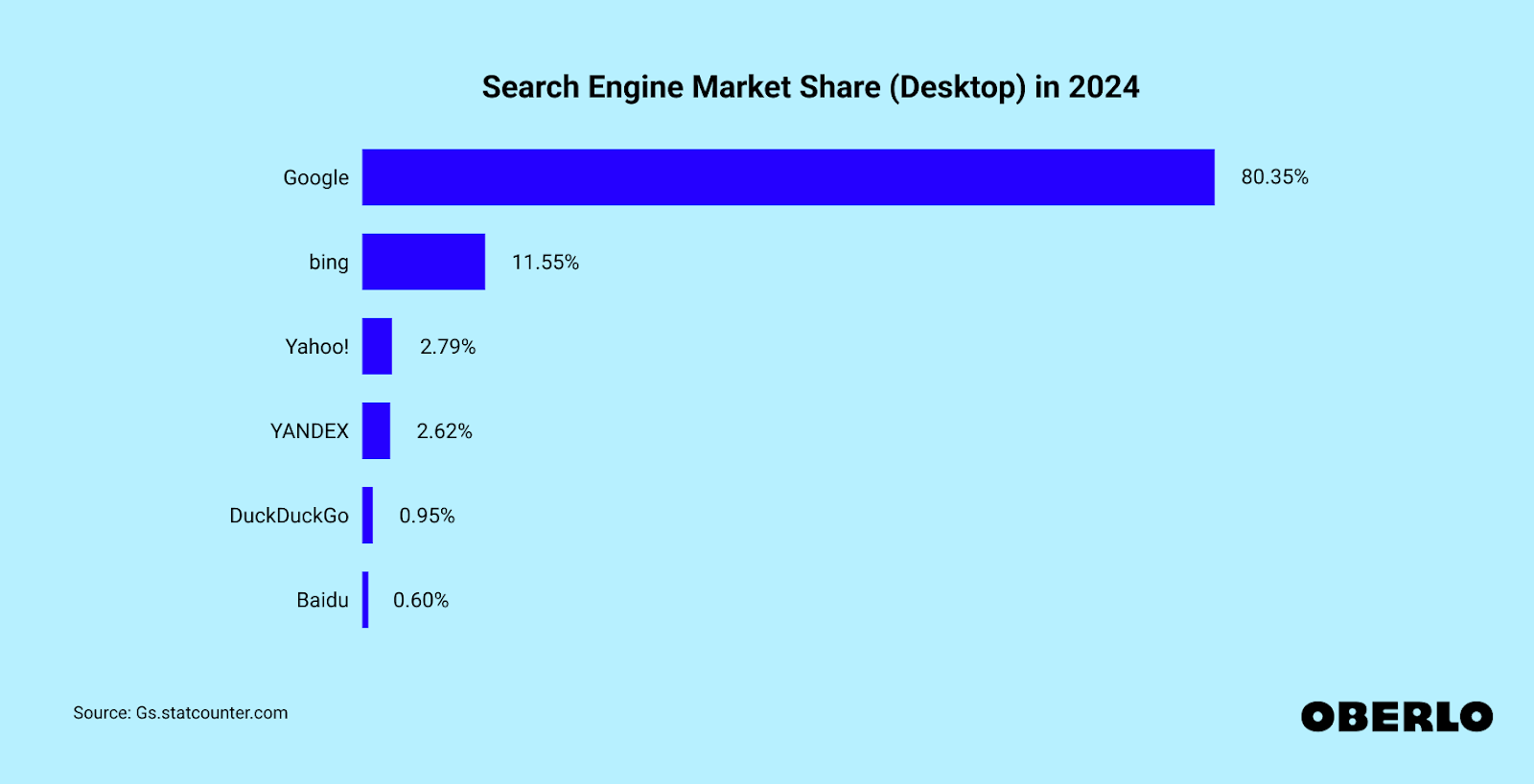

Google continues to dominate the search engine landscape, commanding an overwhelming 80% market share on desktop in 2024—far ahead of its closest competitor, Bing (11.55%), reinforcing its stronghold in digital advertising and search-based AI innovations. Alphabet’s Q4 results are more than a reflection of cyclical strength—more a statement of strategic intent.

Source: Oberlo

Alphabet is repositioning itself as AI times’ operating system, shifting away from legacy status as a digital ad giant to a vertically integrated AI infrastructure giant. With Gemini models now integrated across Google’s consumer and enterprise stack, Alphabet is going all-in on a full-stack vision. It owns chips, it owns cloud, it owns interface, and increasingly it’s owning use cases. This architecture is not hypothetical. It’s appearing in usage and revenue across Search, YouTube, and Cloud, with Q4 2024 results offering a snapshot of execution.

Google Search, Alphabet’s still-economic powerhouse, generated $54 billion in revenue for the quarter, a 13% increase on a year-to-year basis on account of product enhancements like AI Overviews and Circle to Search. Already rolled out to over 100 countries, these enhancements are proving not to be experiments—they’re becoming integral features. Circle to Search now powers over 10% of searches by users who employ it, and Alphabet claims AI-powered queries provide near-parity monetization to traditional search ads. That’s important to know, because it eliminates one of the biggest investor fears: that shifting toward generative responses would dilute ad revenue. Instead, Alphabet can refresh the interface without compromising on economics.

.png)

Source: Alphabet’s Q4 Earnings

Meanwhile, YouTube’s ecosystem is growing both in engagement and monetization. Q4 ad revenue was $10.5 billion, up by 14% on last year. Shorts monetization—historically a weak spot—increased by 30 points in the U.S., getting closer to long-form video. YouTube Shopping and Podcasts are even meaningfully contributing now with over 400 million hours of podcast viewing on living room devices each month. It’s no longer about video; it’s about building a commerce and content hub around creators.

But perhaps the most dramatic news is in Google Cloud, where Alphabet is moving from third-place contender to profitable champion. Q4 Cloud revenue increased 30% to $12 billion, and more importantly, operating margins hit 17.5%, up from last year’s 9.4%. Key enablers are increased adoption of Google’s Vertex AI platform, which saw a fivefold increase in customers and a twentyfold increase in usage in 2024.

It’s not just startups and mid-sized companies. Mercedes-Benz, Wayfair, and Citadel are using Google’s AI Hypercomputer and sixth-generation TPUs to modernize everything from training models to optimizing retail operations. The Cloud organization signed several multi-year, billion-dollar deals and doubled deals worth over $250 million. Alphabet’s bet on integrating tightly its chip design, model development, and cloud interface is paying off—though with a very costly capital bill.

Competitive forces in the AI Gold Rush: Strength in Scale, Competition in Speed

While Alphabet is building out in search, cloud, and enterprise AI on solid foundations, it is doing it in the shadow of formidable competition. Microsoft has moved with speed and aggression with Azure-OpenAI and has rolled out GPT-4 to Office 365, Azure products and services, and Bing.

OpenAI has built a recognizable consumer brand in ChatGPT. Together, the duo has positioned AI as a productivity revolution. Alphabet’s strategy is broader and arguably more integrated but slower to monetize. Gemini is technically impressive—leading on performance and efficiency benchmarks—but doesn’t yet benefit from ChatGPT’s consumer brand recognition. While Alphabet has in excess of 4.4 million developers using Gemini models (double six months ago), there remain question marks around retention, developer monetization, and commercial stickiness.

In cloud infrastructure, Alphabet is still behind AWS and Azure in market share and catching up through differentiated products like Trillium TPUs and agentic capabilities. Its strength is specialization—custom tooling, efficient training of models, and hardware-to-application end-to-end tuning. Its multi-modal, multi-language, and low-latency design philosophy gives it a competitive advantage in inference cost.

On the earnings call, Sundar Pichai was clear: Gemini 2.0 Flash is one of the most efficient LLMs in production and is besting many open-source alternatives on latency and per-query cost. However, Alphabet’s AI triumph will hinge on how deeply it can embed Gemini into day-to-day workflow, from search queries to workspace documents and beyond.

Hardware is also a war zone. Devices like the Pixel 8 and future XR wearables will become on-ramps for generative AI. In practice, hardware is a low-margin game and won't move the financial needle in the near term. Where it can make a difference is in establishing a Gemini-native ecosystem—a space in which Alphabet has control of silicon, software, and service layers.

But perhaps least valued of all is advertising. Meta is investing heavily to improve its AI-targeting engines, Amazon is broadening its ad platform by linking with commerce, and TikTok is still commanding Gen Z attention. Alphabet has countered by doubling down on AI-powered performance campaigns with products like Demand Gen and Performance Max now optimized through Gemini. The company claims that clients are achieving 275% higher ROAS and significantly reduced cost-per-clicks in pilot tests. Advertisers are becoming more ROI-focused, and if AI-based ads are commoditized, Alphabet will have to differentiate on not just targeting but creative tooling and end-user experience.

Beneath the Hood: Growth Drivers, Financial Performance, and Scaling Efficiency

Alphabet’s AI-first strategy is underpinned by top-line strength and improved operating rigor. Full-year revenue in 2024 was $350 billion, up 14% on a full-year basis. Google Search & Other and YouTube Ads each increased by 13%, and Google Cloud was up by 30%. Q4 operating income was up 31% sequentially to $31 billion, expanding the margin to 32%, a multiyear peak. Of particular note is that free cash flow was $72.8 billion for the year—a lot of dry powder to reinvest and return capital.

Alphabet is also controlling costs with increasing precision. While Q4 total CapEx was $14 billion, it has signaled $75 billion of planned expenditure in 2025 that is primarily going towards servers, data centers, and subsea cable. That's an ambitious investment to keep up with the runaway demand for AI inference that is now outgrowing available compute capacity for the company.

Management says inference spend has surpassed training on a usage basis—a big trend that justifies the infrastructure build-up. That sort of heavy CapEx naturally stretches depreciation, which rose by 28% year-on-year in 2024 and is going to grow even more rapidly in 2025.

.png)

Source: Bloomberg

Despite this considerable investment, Alphabet is finding ways to achieve margin leverage. Q4 operating expenditure reduced by 1% to $24.9 billion despite increasing R&D expenditure by 8% to support AI development. Sales and marketing expenditure reduced by 5%, backed by a timing action in Pixel promotions and general promotional effectiveness. General & administrative expenditures reduced by 15% through consolidation in property and internal streamlining. Alphabet also provided guidance for modest headcount growth in 2025 on Cloud and AI roles only to support its resource priority strategy.

Retention and monetization are also trending in tandem. Google Workspace, for example, is seeing growing average revenue per seat, especially as Gemini capabilities become accessible to Business and Enterprise users. Vertex AI usage is growing exponentially—its 2024 increase by 20x is more than a user trend; it’s a signal that enterprises are beginning to anchor critical workflows on Google’s AI platform. On the consumer side, subscription revenue on YouTube Music, TV, and Google One is growing in a high-single to low-double digit rate. These non-advertising revenues, modest in share though they are, provide Alphabet margin-insulating diversification.

Alphabet’s AI Bet: Undervalued Powerhouse or a Costly Expansion Gamble?

Alphabet is priced around 23x forward earnings or around 18x after adjusting for its $96 billion cash balance. EV/EBITDA is around 13x—lower than Microsoft’s (MSFT) but higher than its historic average. From a free cash flow yield perspective, it’s generating nearly $73 billion annually, a 4% FCF yield that’s reasonable given its quality and growth profile. That yield may tighten, though, should CapEx increase higher than projected, or should AI monetization hit resistance.

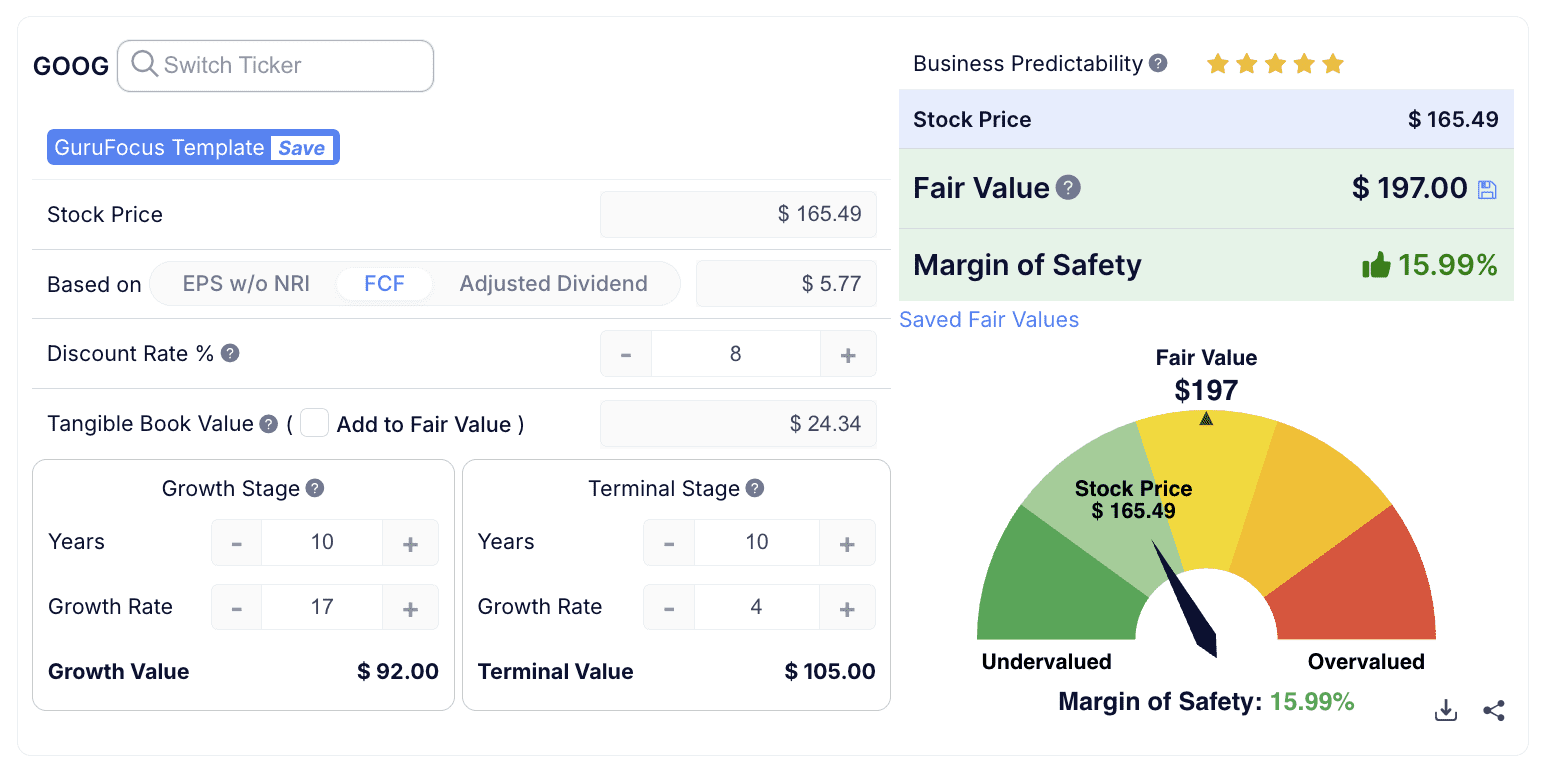

Alphabet’s DCF valuation is now set at a fair value of $197 with a margin of safety of 15.99% based on a share price of $165.49. It is calculated based on free cash flow (FCF) estimates with a consistent 21.10% 10-year FCF growth rate consistent with past trends by Alphabet. Revenue is projected to grow by 20.50% per annum for 10 years with operating income of 22.50% and EBITDA of 21.60%, consistent with AI-driven expansion by Alphabet.

Valuation is calculated with a 17% growth rate for the first 10 years before reducing to 4% in the terminal stage and using an 8% discount rate for risk. While Alphabet’s $75 billion CapEx for 2025 is a cause for concern about costs, Alphabet’s ability to grow AI monetization and keep margins high is a support for its undervaluation story and is a good long-term bet.

Source: GuruFocus

Threats to this vision are internal and external. Macro-wise, a strengthening dollar and a leap-year base effect can trim Q1 revenue. Structurally, regulation is on the horizon. Alphabet’s default search engine status, utilization of web content for AI models, and dominance of digital advertising are all subject to antitrust scrutiny in both Europe and the U.S. Additionally, Alphabet’s full-stack AI strategy, while powerful, can be subject to regulatory resistance should it be deemed anti-competitive.

The biggest technological threat is commoditization of AI inference. Competitors are hurrying rapidly into cheap serving with customized silicon and edge optimization while Gemini models are already efficient. If inference costs reduce across the entire sector, Alphabet’s CapEx advantage can become a liability rather than a moat.

Still, if it can deliver like it did in 2024—balancing infrastructure build with monetization agility—then it is poised to be one of the AI economy’s most durable growth franchises. The investment thesis is clear but not seamless: Alphabet is a foundational AI play, but only if it can make it clear that its size is not just expensive—just defensible.

Concluding Thoughts

Alphabet is positioning itself as the backbone of the AI era, evolving from a search and advertising leader into a vertically integrated AI powerhouse. With Gemini models fueling growth across Search, Cloud, YouTube, and Android, Alphabet is embedding AI at every layer of its ecosystem. Despite aggressive $75 billion CapEx plans and rising competition from Microsoft and OpenAI, its AI infrastructure strategy, high-margin Cloud expansion, and dominance in digital advertising present a compelling investment case.