CrowdStrike: Can This Hot Cybersecurity Stock Beat on Q4 FY2025 Results?

TradingKey - In the present day, scarcely anything is more important to companies and government worldwide than protecting their data.

Malicious actors are known to sabotage firms’ data and use it for nefarious purposes. One of the big obstacles to this sort of behaviour is to deploy sufficient cybersecurity measures. Fortunately, there are a host of companies that can help companies and governments protect themselves from hacks.

One of the most well-known cybersecurity firms out there is CrowdStrike Holdings Inc (NASDAQ: CRWD). The company has been a consistent grower and its shares are up over 640% over the past five years and have also advanced 24% in the past 12 months.

So, with CrowdStrike set to report its latest Q4 FY2025 results (for the three months ending 31 January 2025) on Tuesday (4 March) after the market closes in the US, it’s a prime opportunity for investors to see how the company is faring. Here’s what they should be watching.

Watch for top-line growth from CrowdStrike

With all growth stocks, particularly those in cybersecurity, sentiment will come down to whether the company can consistently grow their “top line”, otherwise known as revenue or sales.

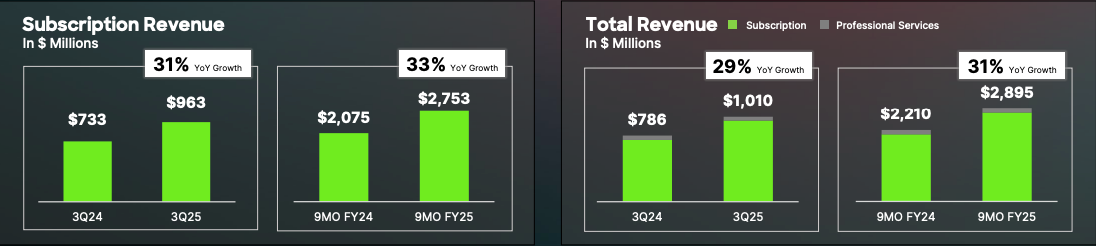

For its most recent Q3 FY2025 period, CrowdStrike posted revenue of US$1.01 billion, which was up 29% year-on-year from the same period a year earlier. Meanwhile, the firm’s subscription revenue in Q3 FY2025 came in at US$926.7 million, a 31% year-on-year increase.

Subscription growth for CrowdStrike is tied to adoption

Beyond that, investors will be keen to see increasing adoption rates from CrowdStrike’s suite of products. Its Falcon platform has various modules that clients can adopt, from endpoint and cloud cybersecurity to data protection and exposure management.

As of the end of Q3 FY2025, CrowdStrike’s module adoption rates among clients grew to 66%, 47%, 31%, and 20% for five or more, six or more, seven or more, and eight or more modules, respectively.

That expansion shows that CrowdStrike’s clients find its suite of services critical to its operations. Any extra progress – i.e. higher adoption rates – on that front will be something investors will be hoping to see.

Subscription revenue growth and total revenue growth for CrowdStrike

Source: CrowdStrike Q3 FY2025 earnings presentation

This is also tied to subscription growth and investors can see that CrowdStrike’s subscription (so, recurring) revenue is actually growing at a faster clip than its overall top line.

That resulted in annual recurring revenue (ARR) – a key metric – hitting over US$4 billion in Q3 FY2025. Investors will be watching closely to see if CrowdStrike can expand this ARR figure at a faster clip than overall revenue growth.

What are the market’s expectations for CrowdStrike?

For context, the expectations for CrowdStrike heading into its earnings are not a huge bar to beat. Wall Street is expecting Q4 FY2025 earnings per share (EPS) of US$0.85 and total revenue of US$1.03 billion, which would imply 22.3% year-on-year revenue growth versus the year-ago period.

Of course, any beat on this front could be a positive catalyst although what’s more likely is that investors will be focusing on guidance. CrowdStrike guided for revenue in Q4 FY2025 of US$1.04 billion at the high end of its range.

Finally, investors will also want to hear more on the recent investigation by the Department of Justice (DOJ) and Securities and Exchange Commission (SEC) into a US$32 million deal between CrowdStrike and a technology distributor to provider cybersecurity tools to the Internal Revenue Service (IRS).

On the back of the news report on this, CrowdStrike shares fell 6.5% and are still down over 4% since the end of that trading day (21 February). Any potential probes and anti-trust action from regulators, as well as the fact that any reversal of revenue recognition from the deal could impact earnings, could weigh on CrowdStrike’s shares in the short term.

However, for longer-term investors, any disappointment on the revenue front (as long as business remains strong and ARR keeps expanding) could provide a buying opportunity should shares sell off on the back of earnings.