Is Apple’s China iPhone Business in Trouble? Here’s What Investors Should Know

TradingKey - It’s no secret to investors that tech giant Apple Inc (NASDAQ: AAPL) makes the majority of its profits from its flagship iPhone. With annual refreshes to its smartphone, Apple counts on individuals either upgrading – or switching phones by converting to its iOS platform – for continued profits.

That has worked extremely well over the past 15 years as the iPhone has become the dominant high-end smartphone for most of the world. Yet the law of large numbers means that Apple’s market share could be peaking.

That’s certainly how it looks in China, where news has just come out that in November 2024, foreign mobile phone shipments in the world’s second-largest economy fell 47.4% year-on-year to 3.04 million. Given Apple makes up the majority of smartphone sales, that’s not a good sign for Apple shareholders.

Here’s what investors need to know about the latest smartphone sales numbers from China and what it means for Apple.

Domestic smartphone brands shine bright

The latest figures from China’s smartphone market confirm a trend that has already been in progress for some time – the increasing preference of Chinese consumers for domestic brands over foreign ones. Apple’s dominance in the smartphone sector in China is no longer assured.

Indeed, domestic brands have proven to be extremely innovative and competitive on cost. Huawei, which had been forced to build its own operating system after being effectively banned from selling phones with Google’s Android system, has come roaring back.

Its new operating system (Harmony OS 4) isn’t yet at the scale that it wants but it’s making fast progress and its latest smartphone model – Mate XT – received over 2.7 million pre-orders in September 2024. With new models consistently rolling out from the likes of OPPO, Vivo, and Xiaomi Corp (HKEX: 1810), Apple has found itself on the back foot in China.

Perhaps it’s no surprise that Apple’s market share has been falling in China’s smartphone segment. As recently as Q1 2023, Apple had a market share of smartphone sales in China of 19.7%, according to Counterpoint Technology Market Research. However, in Q3 2024, that had fallen to 13.5% and it badly trailed Huawei, Xiaomi, and Vivo – all of which recorded year-on-year sales increases.

China smartphone market sales share by OEM, Q3 2023 vs. Q3 2024

Sources: Counterpoint Market Pulse Service

Apple’s upcoming earnings one to watch

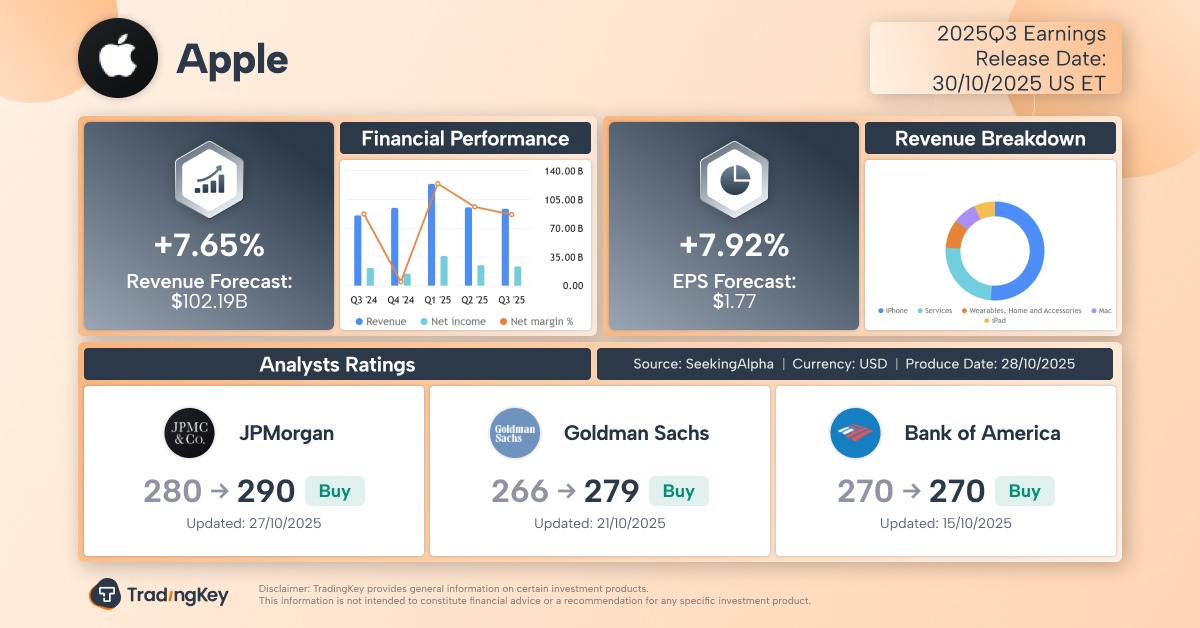

Apple’s most recent quarterly earnings, released at the end of October, only covered two weeks’ worth of sales in terms of the new iPhone 16’s release.

So, these latest sales numbers for November in China don’t bode well for Apple in China. Having said that, CEO Tim Cook did say that the iPhone grew in every geographic market in its September-quarter – insinuating that its China business could have been impacted by the rest of its product line-up.

Either way, Apple’s upcoming earnings release – slated for 30 January – is going to be a big one to watch as investors will get a full quarter worth of iPhone sales in China. That should give Apple investors a better idea of how bad the situation really is for Apple’s iPhone business there. Higher margin and higher-end prices from its new iPhone 16 could potentially offset volume weakness for Apple in China.

Yet the unmistakable trend that local brands are eating Apple’s market share in China is one that can’t be denied. Therefore, among other things, investors should be focused on how the US tech giant plans to grab back more smartphone market share in China over the medium to long term.