2 Super Semiconductor Stocks (Besides Nvidia) to Buy Hand Over Fist in 2025

We're just days away from ringing in the new year, and the holiday break can be a good time for investors to review their portfolios and examine potential opportunities for 2025. Artificial intelligence (AI) was a dominant theme in the stock market during 2024, and tech giants are poised to spend a record amount of money developing the technology over the next 12 months.

That will benefit suppliers of data center chips and hardware components, and Nvidia (NASDAQ: NVDA) is likely to remain one of the biggest potential winners. However, while Nvidia stock continues to climb to new highs, other prominent AI chip stocks have pulled back in recent months.

Share prices of Advanced Micro Devices (NASDAQ: AMD) and Micron Technology (NASDAQ: MU) have both plunged by more than 40% from their 52-week highs, despite recently posting record amounts of AI revenue. Below, I'm going to explain why investors should consider buying both stocks on the dip in 2025.

Image source: Getty Images.

The case for Advanced Micro Devices (AMD)

AMD's chips can be found in some of the world's most popular consumer electronics, including Sony's PlayStation 5, Microsoft's Xbox, and even the infotainment systems in Tesla's electric vehicles. However, the company also released a lineup of AI graphic processing units (GPUs) for data centers last year, which have already attracted some of Nvidia's top customers.

AMD's MI300X AI GPU was designed to compete with Nvidia's industry-leading H100, and according to the company, customers like Meta Platforms and Oracle are yielding better performance and lower costs by using it. AMD also just started shipping its newer MI325X GPU, but investors are already focused on its MI350 series, which will start shipping in the second half of next year.

The MI350 will be an important piece of hardware because it's designed to compete with Nvidia's new Blackwell-based GPUs which, in some workloads, are 30 times more powerful than its original H100. AMD says the MI350 will yield around 35 times more performance than the MI300, so the early signs are promising.

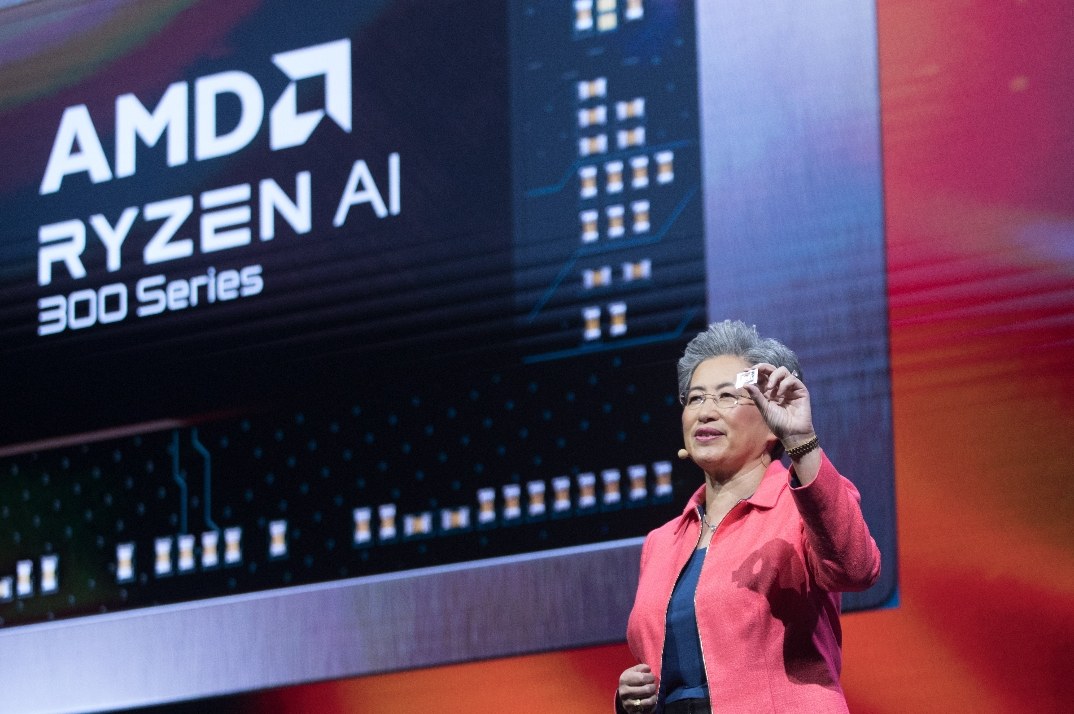

During the recent fiscal 2024 third quarter (ended Sept. 28), AMD's data center revenue soared 122% year over year to a record $3.5 billion, led by GPU sales. AMD CEO Lisa Su says the company will generate around $5 billion in GPU revenue for the whole of fiscal 2024, which is 150% higher than her original estimate of $2 billion at the beginning of the year.

AMD also saw a 29% increase in its client segment revenue during the quarter, to $1.9 billion. This is where it accounts for sales of its Ryzen AI chips for personal computers (PCs), which could become a major source of growth for the company over the next few years.

Unfortunately, AMD's strong AI results were offset by weakness in its other segments, like gaming, which saw a 69% year-over-year drop in revenue. That's part of the reason AMD stock is down from its 52-week high. However, the company does expect a recovery in gaming when it launches a new generation of chips in 2025.

Plus, AMD's valuation is becoming hard for investors to ignore. Wall Street's consensus estimate suggests the company could generate $5.13 in earnings per share during its upcoming fiscal year 2025. That places its stock at a forward price-to-earnings (P/E) ratio of just 24.4, which is a 22% discount to Nvidia's forward P/E ratio:

Data by YCharts.

Investors looking for value in the AI GPU space should consider buying AMD stock for 2025, especially because it also offers exposure to the emerging AI PC market. That could be the next frontier in the hardware space as more AI workloads are processed on-device while relying less on external data centers.

The case for Micron Technology

Micron is a leading supplier of memory and storage chips, which are increasingly important in AI workloads. Memory chips complement the GPUs designed by Nvidia and AMD by storing information in a ready state so it can be called upon instantly, which is critical for data-intensive AI workloads.

Micron's HBM3E (high-bandwidth memory) is the best in the industry in those applications. It delivers 50% more capacity while consuming 30% less energy than competing hardware, which is why Nvidia chose it to power its new Blackwell-based GB200 GPUs. Micron is now completely sold out of its data center memory chips until 2026, and it's already working on a HBM4E solution that will deliver a further 50% improvement in performance.

During its recent fiscal 2025 first quarter (ended Nov. 28), Micron generated $4.4 billion in data center revenue, which was a whopping 400% increase from the year-ago period. It was also the first time its data center segment accounted for more than half of the company's total revenue (which was $8.7 billion during the quarter).

The market for data center HBM is worth $16 billion annually right now, but Micron estimates it could grow to $100 billion by 2030. Therefore, this is one of the biggest financial opportunities in the company's history, of which it has barely scratched the surface based on its current revenue.

But Micron's AI opportunity is expanding beyond the data center. Manufacturers of PCs and smartphones are requesting more and more memory capacity to process AI workloads, which translates into more expensive chips, and more revenue for Micron. The company says PCs fitted with AI processors require DRAM memory capacity of between 16 gigabytes and 24 gigabytes, compared to an average DRAM requirement of 12 gigabytes in non-AI PCs last year.

Additionally, more than 60% of the smartphones fitted with Micron's hardware required at least 8 gigabytes of memory capacity during the recent quarter, which is up from last year.

Wall Street's consensus estimate (provided by Yahoo) suggests Micron could generate $8.90 in earnings per share during its fiscal year 2025. That places its stock at a forward P/E ratio of just 10.1, so it's substantially cheaper than Nvidia and even AMD. Considering the company's HBM3E sales will be directly tied to Nvidia's GB200 GPU sales -- which are in astronomically high demand -- such a heavily discounted valuation doesn't make much sense.

As a result, I think Micron could be a great AI semiconductor stock for investors to take into 2025.