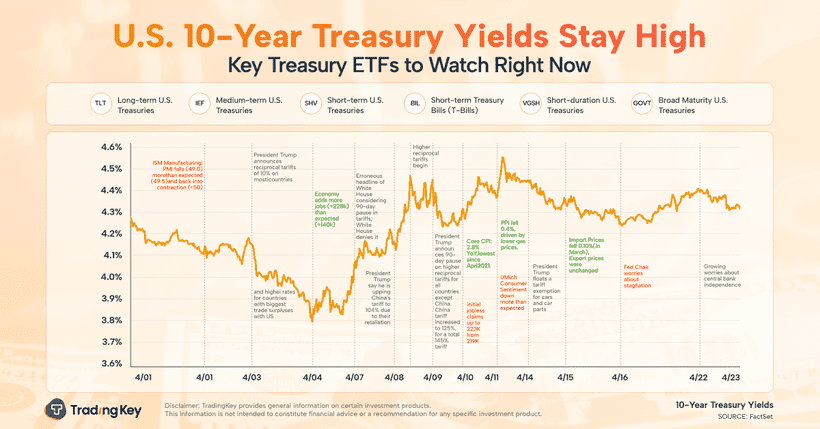

Decoding the Downgrade: Understanding Applied Materials' Market Shifts and Analyst Concerns

Source: Google Finance, Tradingkey.com

Applied Materials, a key player in the semiconductor equipment industry, has seen its stock performance take a turn since July, with a YTD increase of 9.53%. However, recent analyst actions have been bearish, with downgrades and negative outlooks becoming more prevalent. In this article, we'll delve into our perspective on these developments and the concerns underlying the analysts' bearish stance.

Industry Analysis

The semiconductor industry is characterized by significant cyclicality, with each semiconductor cycle typically lasting 3 to 5 years. Currently, we are in the upward phase of the fifth cycle, which began at the bottom of the cycle in Q1 2023. AI is the central technology propelling this cycle forward. Currently, global semiconductor firms are witnessing a negative YoY trend in inventory turnover days across both upstream and downstream segments, signaling effective destocking. This development lays a solid groundwork for the sustained growth of the semiconductor industry.

Global Semiconductor Cycle

Source: MacroMicro, Tradingkey.com

Semiconductor Value Chain

Source: Long-term Investing, Tradingkey.com

We focus on companies that supply capital equipment to semiconductor manufacturers, with demand in this sector largely driven by capital expenditures from major foundries such as TSMC, GlobalFoundries, Samsung, and Intel. After a period of robust growth, semiconductor suppliers have expanded their capacity significantly. While the global economy's cooling led to a decline in semiconductor industry capital spending in 2023, we are now at an inflection point transitioning from passive destocking to proactive restocking, signaling a potential uptick in the industry's growth cycle.

10 Years Historical Capital Expenditures - Total

Source: Refinitiv, Tradingkey.com

Semiconductor Manufacturing Process

Source: TEL Company data, Tradingkey.com; Note: Blue represents Wafer Process (Front-end) and green represents Assembly and Test Process (Back-end)

Wafer Fab Equipment market is projected to generate $133B in revenue for 2024, with 83% from WFE shipments and 17% from services. The market will grow due to advancements in digitalization and semiconductor technologies like 6G, IoT, and Generative AI. By 2029, total revenue is expected to reach $165B, with WFE shipments at $139B (4.7% CAGR) and service revenue at $27B (3.3% CAGR).

Wafer Fab Equipment market value forecast

Source: Yole Intelligence, Tradingkey.com

For equipment shipments, Mainland China accounts for over a third of WFE revenue in 2023 and 2024, followed by South Korea at around 20%, Taiwan at 10-20%, and the USA at 10%. Japan, EMEA, and the rest of Asia each represent single-digit percentages.

2023 WFE Vendor market share-by shipment destinations

Source: Yole Intelligence, Tradingkey.com

The WFE market is predominantly led by the top five vendors, with ASML, Applied Materials, Lam Research, Tokyo Electron, and KLA securing the lion's share. In 2023, their sales revenues stood at $29.01 billion, $25.27 billion, $14.31 billion, $12.45 billion, and $9.19 billion, respectively.

CY2023 SPE Makers Top15

Source: TEL Company data, TechInsights, Tradingkey.com

Within the industry, growth in equipment segments is highly differentiated, propelled by investments in DRAM/HBM and generative AI for processors, while NAND capex remains subdued. Vendors have carved out distinct market niches within these specialized segments.

2023 WFE Vendor market share-by type of equipment

Source: Yole Intelligence, Tradingkey.com

Company analysis—Applied Materials

Business Overview

Applied Materials, a semiconductor equipment manufacturing leader, is recognized for its pioneering work in gate-all-around (GAA) and high-bandwidth memory technologies. The company's revenue is predominantly driven by its Semiconductor Systems segment, which contributed 73.3% in FY24 with a 1.1% YoY growth. Applied Global Services accounts for 22% of total revenue, marking an 8.6% YoY increase, while the Display and Adjacent Markets segment makes up 3.3%, growing 2.0% YoY. Collectively, these segments offer an extensive range of equipment, services, and software to both semiconductor and display sectors.

Revenue Breakdown

Source: Company Data, Tradingkey.com

Within the Semiconductor Systems segment, Foundry, logic, and other contributed 62% of the segment's revenue in FY24, with a YoY decline of -23.8%. DRAM memory and Flash memory accounted for 28.2% and 3.8% of the segment's revenue, respectively, with YoY growth rates of 68.4% and -34.9%.

Semiconductor Systems Revenue Breakdown

Source: Company Data, Tradingkey.com

Company Fundamentals

Growth Drivers:

· AI Revolution: The AI revolution is opening new avenues for growth in the sector.

· Major technology inflections for energy-efficient computing: Applied Materials ranked #1 in materials engineering for leading-edge logic, high-performance DRAM, high-Bandwidth Memory (HBM), and advanced packaging, with its GAA transistors revenue expected to double in FY25F (FY24: >$2.5bn).

· EPIC R&D Platform on track: Its EPIC R&D Platform is a hub for innovation, fostering customer collaboration and accelerating the rollout of breakthrough technologies.

· Steady Revenue Stream: Service segment ensures consistent revenue flow by providing comprehensive lifecycle support for semiconductor equipment.

Margins:

· Achieved a record high Gross profit margin of 47.6% in FY24, with ongoing operational optimizations and advancements in value-based pricing strategies to maintain robust margin performance.

Capital allocation:

· Applied Materials deploys its cash to bolster R&D, enhance infrastructure, and increase its dividend per share.

Quarterly DPS and Shares Outstanding

Source: Company Data, Tradingkey.com

Investor Concerns

· China Market Weakness: Declining revenue from China, down from 44.7% in Q1 FY24 to 30.3% in Q4 FY24, poses a significant risk to its revenue.

Geographic Revenue Distribution

Source: Company Data, Tradingkey.com

· Export Restrictions: The specter of tightened export controls could curtail market access and impact short-term sales and long-term growth, especially considering the company's emphasis on high-end products and technologies.

· New entrants: Export restrictions may prompt downstream companies seeking alternative vendors, creating opportunities for competitors based in other countries and potentially eroding Applied Materials' market share in key segments.

Export Restriction‘s Impact

· US Market Share Decline in China: From 2020 to 2023, the US semiconductor equipment market share in China dropped from 53% to 43%, while Japan's share rose from 17% to 21%, and the Netherlands' increased from 16% to 19%.

· Policy Impact on Applied Materials: Anticipated stability in 1QFY25F outlook stems from recent policies sustaining traditional equipment sales and prior adjustments to advanced equipment sanctions. Post-October 2022 US export controls, Applied Materials forecasted a potential FY2023 revenue loss of $1.5 to $2.5 billion, nearly 10% of its FY2022 revenue. Therefore, while the immediate impact is minimal, the long-term uncertainties in policy, potential escalations, and the continuous development of high-tech products pose significant risks to the company's sustained growth.

Assumptions and Valuation

Assumptions:

· We project a total revenue growth rate of 6-8% YoY for the forthcoming three years, predominantly fueled by our Semiconductor Systems and Applied Global Services segments.

· We also anticipate a GPM of 48-49% and an EBIT margin of 29-30% for next 3 years, reflecting an optimized value model, technology advancements, high-end product growth, and enhanced operational efficiency.

Valuation:

· The company's LTM P/E ratio currently stands at 19.5x, which is relatively lower compared to its competitors. However, the valuation may be justified by its comparatively lower growth rate, and its PEG ratio for FY25F is at 1.3, which is almost the highest among its peers.

· Taking into account the aforementioned risks, i.e. policy volatility, diminished market share in China from export constraints, we recommend not buying the stock at this time.

Valuation Matrix

Source: Refinitiv, Tradingkey.com