After Another Impressive Quarter for Shopify, Is Shopify Stock Headed Back to Its All-Time High?

There's a lot of excitement around e-commerce company Shopify (NYSE: SHOP) of late. It reported some strong earnings numbers for the third quarter, and the stock has been rallying as a result of that. It has hit a new 52-week high recently, and there could be even more upside for Shopify as the business still sees a lot more growth ahead for the current quarter.

Given its strong results, could the stock get back to the all-time high it hit in 2021?

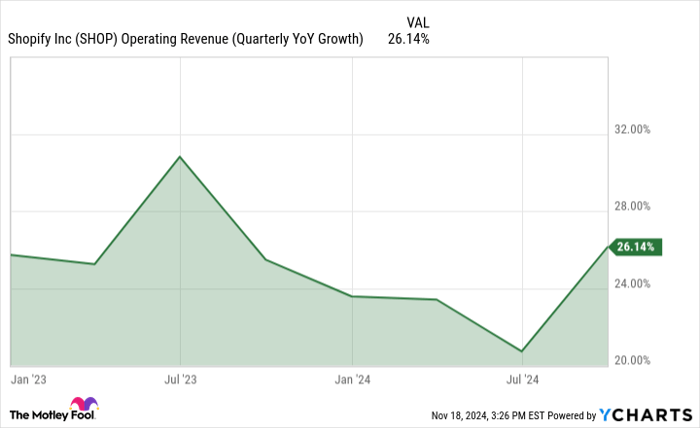

Shopify's growth rate is picking up

Over the past few years, Shopify's growth rate has been volatile due to a myriad of economic conditions, including supply chain constraints, inflation, and an overall slowdown in spending after a surge during the early stages of the pandemic. And investors were concerned that with the economy potentially heading for a recession, Shopify could be facing even greater headwinds in the near future.

The good news, however, is that the company's growth rate accelerated this past quarter, turning around a downward trend for the business. The impressive results appeared to surprise investors, as the e-commerce stock would jump by 21% after the earning numbers came out.

SHOP Operating Revenue (Quarterly YoY Growth) data by YCharts

The company's revenue totaled $2.2 billion for the period ending Sept. 30, which grew by 26% year over year. Shopify says that when excluding its logistics business, which it sold last year, it has achieved more than 25% revenue growth for six straight quarters. And heading into the last quarter of the year, the company projects that its revenue growth rate will still be in the mid- to high 20s range.

Is Shopify's stock cheap?

Shopify's stock hasn't been trading this high since the early part of 2022, which is when it started falling in value amid a worsening outlook for the economy. Months earlier, the stock would hit its highest closing price ever at $169.06. For Shopify to reach those levels gain, it would need to rise by around 60%.

The stock's valuation, however, is a bit rich right now. Shopify is trading at close to 100 times its trailing earnings, and even based on analyst expectations, it's trading at 75 times next year's profits. While the company has made improvements to its operations by focusing on the bottom line and not just top-line growth, its profits are still a bit light to support much more of an increase in the current share price.

In 2021, when Shopify's stock hit its peak, investors were focused primarily on growth, while valuations and earnings multiples were often an afterthought, which allowed many stocks to reach sky-high prices. Shopify, as good of a growth stock as it was and still is, arguably shouldn't have been trading at those levels in the first place.

Based on its modest price/earnings-to-growth ratio (PEG ratio) of 1.1, Shopify can be a good long-term buy at its current price for investors who are willing to hang on for multiple years. However, unless meme-stock mania takes over again, odds are that Shopify probably won't get back to its all-time high anytime soon.

Shopify has a lot more upside left, but investors should temper their expectations

Shopify may not rise by 60% in a year or two to get back to its all-time high, but it can still make for an excellent growth stock to put in your portfolio for years. The company has a broad market reach as it works with businesses around the world, in 175-plus countries, helping them growth their operations. It still has a lot more growth on the horizon and can be a good buy-and-forget stock to own for the long haul -- but investors should be careful not to set their expectations too high given the current economic conditions.