Weekly Market Outlook: U.S. September Payrolls in Focus; Powell and Fed Officials to Speak

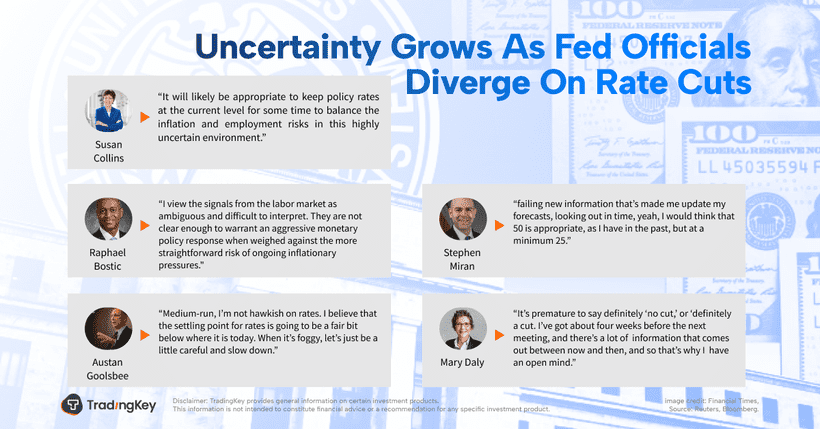

TradingKey – The September non-farm payroll report will be the central focus this week, as it plays a critical role in shaping market expectations amid the ongoing influence of the Federal Reserve's easing cycle. A weaker-than-expected labor market may prompt the Fed to accelerate its pace of rate cuts.Currently, markets see a slightly higher chance of a 50-basis-point cut in November over 25 basis points. Fed officials, including Powell, are scheduled to speak, which could provide critical insights on future monetary policy.

Meanwhile, U.S. stocks are entering earnings season, with investors focusing on inflation, economic growth, and corporate profits. These factors are critical for further stock market gains. Key earnings reports to watch this week include Nike, Carnival, Levi’s, and McCormick.

The Fed’s preferred inflation gauge, the PCE index, cooled further in August, boosting confidence in continued rate cuts. Traders now see a higher probability of a 50-basis-point cut in November. Several Fed officials made dovish remarks, including New York Fed President John Williams, who stated that lowering rates is appropriate as inflation trends toward the 2% target. Moreover, Micron Technology (MU-US) beat Q4 expectations, driven by strong demand for AI equipment, earning praise from Wall Street.

- U.S. September Non-Farm Payroll

The cooling labor market is critical to the Fed’s rate cut decisions. On Friday, October 4th at 8:30 AM ET, the U.S. Labor Department will release September’s non-farm payroll report. Economists expect 145,000 new jobs, slightly above August’s 142,000, with unemployment steady at 4.2%. Average hourly wage growth is forecast to dip from 0.4% to 0.3%.

If the data shows a sharper slowdown, markets may increase bets on a 50-basis-point cut. A strong report, however, could support the dollar and reduce expectations for aggressive cuts.

- Fed Chair Powell’s Speech

This week, Fed Chair Powell set to speak at the NABE Annual Meeting, where he will address the economic outlook. With U.S. inflation steadily cooling and nearing the Fed’s 2% target, traders are now betting that the Fed is likely to implement a second significant rate cut of 50 basis points in November. Currently, futures contracts reflect a 54% probability of a 50-basis-point rate cut in November, while the likelihood of a 25-basis-point cut remains high at 46%.

- Nike to Report Q3 Earnings

Nike is set to release Q3 earnings after the market closes on Tuesday. The company recently announced that CEO John Donahoe will retire on October 13th, with veteran executive Elliott Hill taking over. Analysts see this leadership change as an attempt to boost performance amid rising competition, though short-term improvements may be difficult.

Major Events:

- Monday: ECB President Christine Lagarde speaks at a European Parliament hearing.

- Tuesday: Powell speaks at the NABE Annual Meeting.

- Friday: John Williams speaks at a New York Fed event.

Key Data:

- Tuesday: U.S. September ISM Manufacturing PMI

- Wednesday: U.S. September ADP Employment Change

- Friday: U.S. September Non-Farm Payrolls

Key Earnings:

- Tuesday: Nike (NKE.N)

- Wednesday: Levi’s (LEVI)