SEC vs Ripple case: Regulators yet to settle dispute as XRP stretches decline

- XRP has witnessed heavy losses since the beginning of the week, dropping nearly 15% as the crypto market stretches its losses.

- Ripple community members continue to expect an end to the SEC's multi-year lawsuit as the agency closes another investigation.

- XRP could hold the support near $2.18, aiming for a bounce to tackle a descending triangle's resistance.

Ripple's XRP declined toward the $2 level on Wednesday as Trump's tariff threats on international trading partners sparked double-digit losses across top cryptocurrencies in the past three days.

Meanwhile, community members strongly anticipate the Securities & Exchange Commission (SEC) will drop its case against Ripple amid a growing dismissal of legal cases against companies in the crypto sector.

SEC accelerates dismissal of cases against crypto companies but drags feet on Ripple's case

In the past week, the crypto industry has witnessed the new SEC administration scale down its enforcement actions against crypto companies.

The new administration has recently closed several legal cases, including enforcement investigations and actions.

These various legal proceedings were initiated under former SEC Chair Gary Gensler's administration, which was tagged anti-crypto by many.

The agency dismissed its multi-year case against the crypto exchange Coinbase and dropped legal action against the NFT marketplace OpenSea on Friday with no further charges.

Robinhood Crypto joined the list on Monday after the SEC dropped its investigation into the company.

Uniswap was next on the line on Tuesday, while Gemini joined the train on Wednesday.

The SEC's action to end these cases reflects the agency's attempt to implement regulatory frameworks favoring crypto companies.

Meanwhile, crypto community members also anticipate an end to the SEC's extended lawsuit against Ripple following its recent actions.

The SEC vs. Ripple case is among the regulatory battles that have garnered much attention over the years.

Ending the case against Ripple may be more complicated than the cases that the agency dismissed in the past week. A judge has already rendered a verdict in this case, and the SEC filed an appeal prior to Gensler's resignation on January 20.

As a result, the lingering case still casts a shadow over XRP's price, which has seen steady declines in the past few days.

XRP is down over 4% at the time of writing, stretching its weekly performance to a double-digit decline.

XRP could hold $2.18 support amid the crypto market crash

XRP saw $13.18 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $10.18 million and $3 million, respectively.

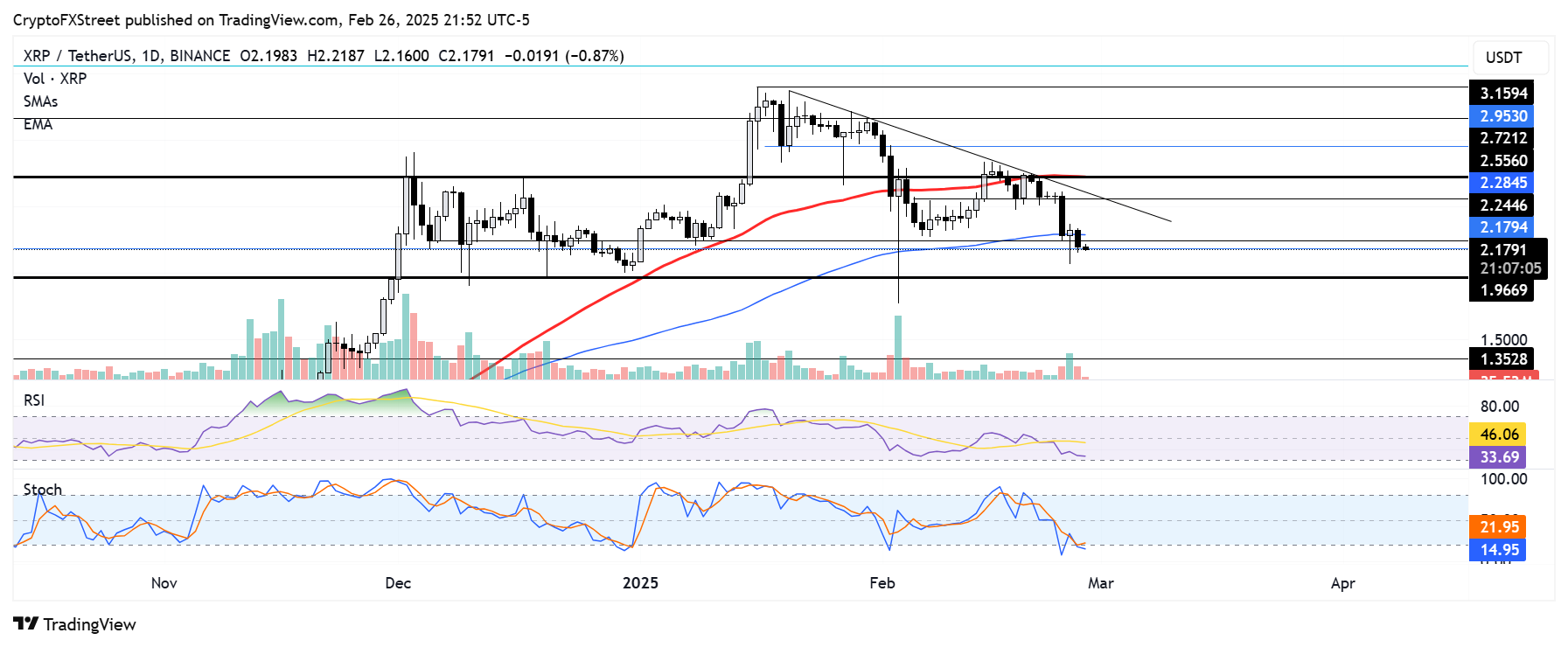

XRP has declined over 15% since seeing a rejection near the descending trendline of a descending triangle.

XRP/USDT daily chart

The remittance-based token is looking to hold the $2.18 level as support following the recent wider bearish crypto market pressure.

If XRP holds this level, it could bounce to test the triangle resistance. A sustained breakout above the triangle could flip the market trend bullish for XRP.

On the downside, XRP could bounce off the $1.96 support if it fails to hold the $2.18 level. A decline below $1.96 will accelerate the bearish pressure.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are near their oversold region, indicating dominant bearish momentum and a potential reason for reversal.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.