Maker shows resilience amid crypto market decline

- Maker price extends its gains on Wednesday after rallying almost 12% so far this week.

- On-chain metrics paint a bullish picture as MKR’s daily active addresses, revenue collection and trading volume rise.

- The technical outlook suggests a rally continuation targeting additional double-digit gains.

Maker (MKR) price is extending its gains, trading around $1,680 on Wednesday after rallying almost 12% despite the overall crypto market correction so far this week. On-chain metrics paint a bullish picture as MKR’s daily active addresses, revenue collection and trading volume rise. The technical outlook suggests a rally continuation targeting additional double-digit gains.

Maker on-chain metrics show bullish signs

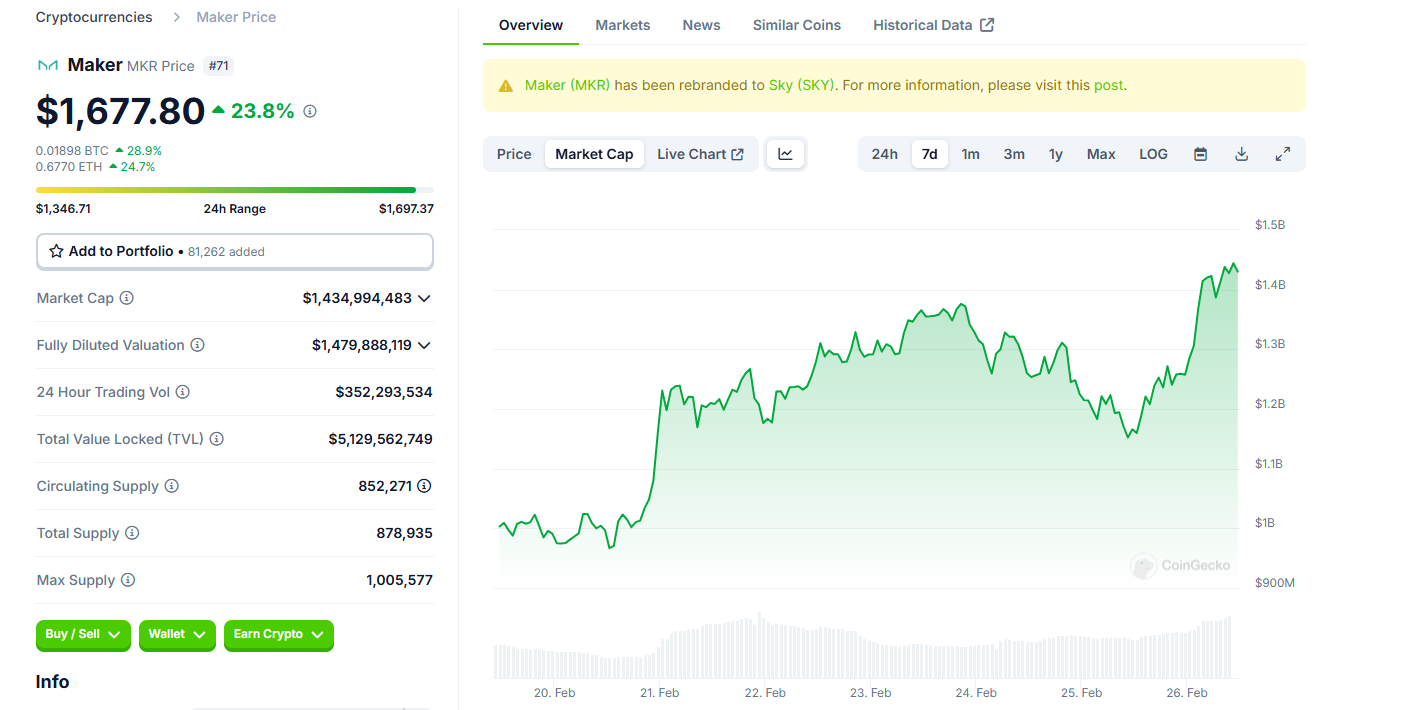

Maker price continues to trade in green, reaching a high of $1,715 during the Asian trading session on Wednesday after rallying nearly 17% the previous day. This upward trend surged the market capitalization of MKR to $1.43 billion, according to CoinGecko data.

Maker market capitalization chart. Source: CoinGecko

Diving deep into Maker’s on-chain metrics further supports its bullish outlook. Santiment’s Daily Active Addresses index helps track network activity over time. A rise in the metric signals greater blockchain usage, while declining addresses point to lower demand for the network.

In MKR’s case, Daily Active Addresses have risen 37% this week. This rise is the highest since the end of November and indicates that demand for MKR’s blockchain usage is increasing, which could propel a rally in Maker price.

%20[09.53.16,%2026%20Feb,%202025]-638761466218343759.png)

Maker active addresses chart. Source: Santiment

Another aspect bolstering the platform’s bullish outlook is a recent surge in traders’ interest and liquidity in the MKR chain. Santiment data shows that Maker Chain’s transaction volume rose from 109,790 on February 18 to 936,740 on Friday, the highest yearly transaction.

%20[09.52.19,%2026%20Feb,%202025]-638761466642374848.png)

Maker Transaction volume chart. Source: Santiment

DefiLlama data shows that Maker generated $734,640 in revenue on Monday, the highest daily revenue since January 2, 2025, further bolstering the bullish outlook.

Maker daily revenue chart. Source: DefiLlama

Maker Price Forecast: MKR bulls aiming for double-digit gains

Maker price broke and closed above the descending trendline on February 12 and rallied 9.28%, closing above $1,023 on February 17. MKR continued its rally by nearly 59% in the next 8 days. At the time of writing on Wednesday, it continues to trade higher, around $1,680.

If the MKR continues its upward trend and closes above the $1,700 resistance level, it could extend the rally by 28% from the current levels to retest the weekly resistance of $2,175.

The Relative Strength Index (RSI) on the daily chart reads 74, above its overbought levels, indicating strong buying momentum and might be due for a pullback or correction. However, there is a possibility that the RSI may remain above its overbought levels and continue its rally.

MKR/USDT daily chart