Bitcoin Price Forecast: BTC rebounds above $80,000 ahead of US CPI data release

- Bitcoin price recovers slightly on Tuesday after declining nearly 3% the previous day.

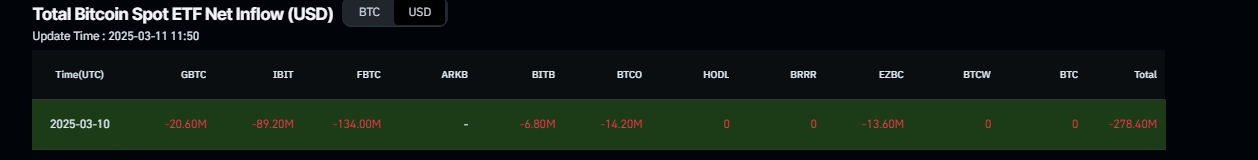

- US spot ETF data continues to show weakness, with $278.40 million outflow on Monday.

- The upcoming US CPI on Wednesday and PPI on Thursday could increase volatility for risky assets like Bitcoin.

Bitcoin (BTC) price recovers slightly, trading above $80,000 on Tuesday after declining nearly 3% the previous day. US spot Exchange Traded Fund (ETF) data continues to show weakness among institutional investors, with $278.40 million outflow on Monday. The upcoming US macro data releases CPI on Wednesday and PPI on Thursday could increase volatility for risky assets like Bitcoin.

Bitcoin rebounds after reaching a low of $76,606

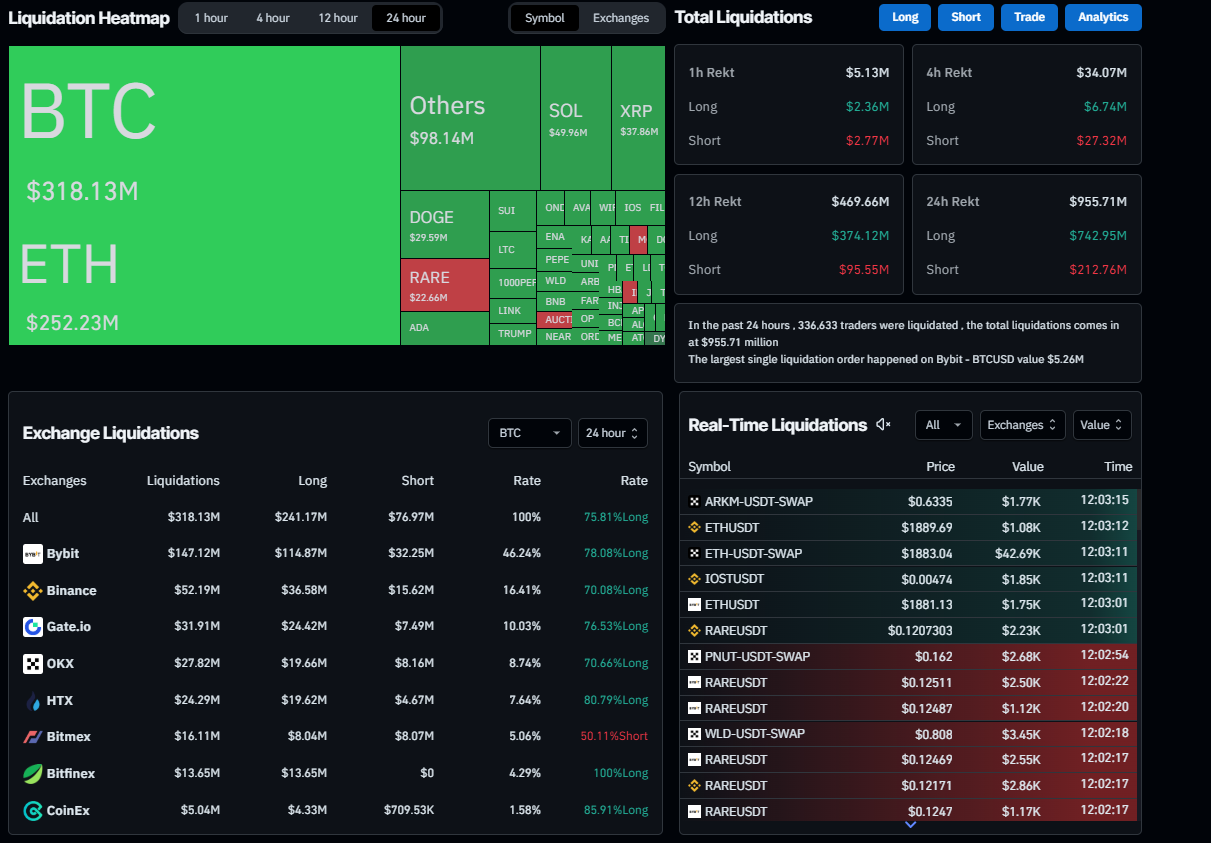

Bitcoin price reached a low of $76,606 during the Asian trading session on Tuesday but rebounded, trading above $80,000 during the early Europen session after falling almost 3% the previous day. The recent price correction triggered a series of liquidations across the crypto market, totaling $955.71 million in the past 24 hours. The largest single liquidation order happened on Binance- BTCUSDT, valued at $5.26 million and a total of $318.13 million only in BTC, according to Coinglass data.

Liquidation Heatmap chart. Source: Coinglass

In an exclusive interview, Agne Linge, Head of Growth at WeFi, told FXStreet, “The crypto market continues to exhibit risk-on behavior, with investor sentiment remaining cautious despite key developments.”

Linge continued to explain that since volatility set in on March 3, there has been no slowdown in sell-offs despite the announcement of a Bitcoin reserve in the United States. Market data shows that millions of dollars have been lost in the form of liquidations in the past few days. This market downturn has mostly affected long traders as a reduced open interest accompanied the sell-off.

Linge further explained that the same factors that triggered the earlier crypto market downturn remain in play. The ongoing trade war between the United States, China, Mexico, and Canada continues to weigh on investor sentiment.

“The escalation of tariffs is expected to drive inflationary pressures, raising the possibility of broader macroeconomic fallout in the coming weeks. These trends have edged the market, and the push for a rebound in the short term is likely hinged on some unforeseen trigger,” Linge told FXStreet.

Upcoming US macroeconomic data could bring more volatility for BTC

Bitfinex’s report on Monday highlights that the current macroeconomic conditions are not pointing to a clear direction moving forward. US job market, productivity, and manufacturing sector data are decidedly mixed, with steady employment growth, rising wages, and efficiency gains offset by inflationary pressures, trade disruptions, and cautious business expansion.

The report further explains that the US job market remains resilient, with 151,000 jobs added in February, though the unemployment rate ticked up to 4.1% due to government job cuts. Wage growth remains strong, but rising labor costs and inflation pressures could challenge expectations of multiple Federal Reserve (Fed) rate cuts this year.

Eren Sengezer, European Session Lead Analyst at FXStreet, reports, “Growing fears over an economic downturn in the US and its potential activity on the global economic outlook triggered a sell-off in major equity indexes at the start of the week.”

Sengezer continued, “On Tuesday, the US economic calendar will feature NFIB Business Optimism Index for February and JOLTS Job Openings data for January. Meanwhile, investors will keep a close eye on political headlines and the action in stock markets.”

The upcoming US macro data releases – Consumer Price Index (CPI) on Wednesday and Producer Price Index (PPI) on Thursday – could bring in more volatility for risky assets like Bitcoin.

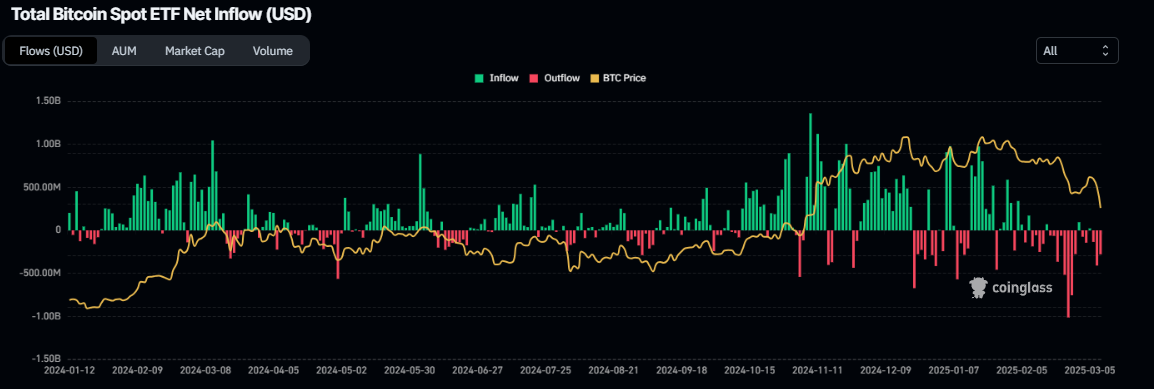

Bitcoin institutional demand weakens

Bitcoin’s institutional demand continues to weaken as the week begins. According to Coinglass, Bitcoin spot Exchange Traded Fund (ETF) data recorded an outflow of $278.40 million on Monday after net outflows of $739.2 million last week. If the magnitude of the outflow continues and intensifies, the Bitcoin price could see further corrections.

Total Bitcoin Spot ETF net inflow chart. Source: Coinglass

Lookonchain data shows that the defunct cryptocurrency exchange Mt. Gox moved another 11,833.6 BTC worth over $932 million on Tuesday after last week’s transfer of 12,000 BTC worth over $1 billion. During Tuesday’s transfer, 11,501.58 BTC ($905.06 million) was sent to a new wallet, and 332 BTC ($26.13 million) was moved to a warm wallet.

Traders should be cautious as transferring such a large amount of Bitcoin to wallets often signals an intent to sell or distribute and can create bearish sentiment as market participants anticipate increased supply.

However, some signs of optimism for BTC include Spanish bank BBVA’s approval to offer Bitcoin and Ethereum trading services and MicroStrategy’s $21 billion capital raise through its 8.00% Series A Perpetual Strike Preferred Stock issuance.

Bitcoin Price Forecast: RSI bounces off oversold conditions

Bitcoin price broke and closed below its 200-day Exponential Moving Average (EMA) at $85,754 on Sunday and declined 8.80% until Monday. At the time of writing on Tuesday, it reached a low of $76,606 during the Asian trading session but rebounded, trading above $80,000 during the early Europen session.

If BTC continues its downward trend and closes below $78,258 (February 28 low), it could extend the decline to retest its next support level at $73,072.

The Relative Strength Index (RSI) on the daily chart reads 36, pointing upwards after bouncing off from 30 on Monday, indicating fading bearish momentum and a potential shift from oversold conditions. However, the RSI must move above its neutral level of 50 for the recovery rally to be sustained.

BTC/USDT daily chart

If bullish momentum mounts, BTC could extend the recovery to $85,000.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.