Bitcoin's Next Move: Will the Drop Continue, and Where Is the Bottom?

Takeaways:

- Short-Term Prospect: Bitcoin's recent price correction, coupled with declining liquidity and increased selling pressure from long-term holders, suggests the possibility of further downside. Key support levels and on-chain trends indicate that the bottom may not yet be in, and caution is advised in the near term. The next short-term bottom may emerge in Q1 2025 after Trump's inauguration.

- Long-Term Prospect: Despite short-term volatility, the continued accumulation by institutions, shrinking exchange balances, growing regulatory acceptance, and historical bullish cycle pattern point to a strong bullish outlook for Bitcoin over the long run.

Market Overview: Decelerating Momentum and Current Risks

Signs of weakening momentum for Bitcoin began to appear in early December, although Bitcoin briefly surged above the $100,000 afterward, it failed to sustain that level. Some holders preemptively realized profits, and the market witnessed a pullback following hawkish remarks from Jerome Powell during the December FOMC meeting. Alongside Bitcoin, the U.S. stock market also experienced a correction. "Trump trade" now appears to be nearing its end, with rate cuts no longer proceeding as smoothly as before. The rate cutting path forward remains uncertain, influenced by signals of rising inflation and the unpredictability of Trump’s trade policies.

The post-election Bitcoin rally was largely driven by optimism surrounding Trump’s expected crypto-friendly policies. However, as the market begins to rationalize and assess the feasibility of these policies, there’s a risk that unmet expectations could lead to a short-term market selloff. While crypto enthusiasts envision Bitcoin eventually replacing gold and even encroaching on the market share of Visa and Mastercard, these shifts are likely to take 5–10 years to materialize. Such fundamental changes will not happen overnight, even under favorable policies.

One thing, however, is certain: Trump’s administration is expected to keep expanding fiscal deficits alongside loose fiscal policies. This will likely lead to continued money printing, further eroding the purchasing power of the dollar.

Hence, it may be prudent to reduce exposure to BTC before Trump officially takes office on January 20th, locking in profits and mitigating risks from potential drawdowns.

Historical Trends

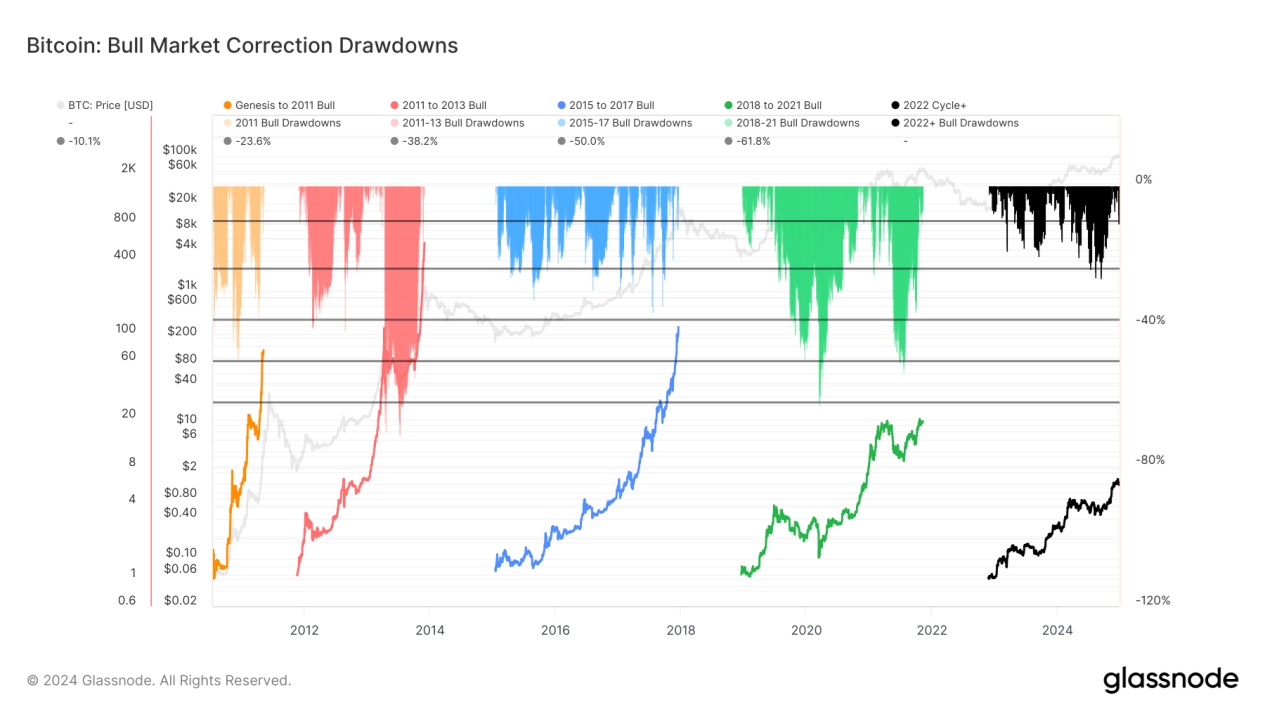

Looking back, Bitcoin’s price bottomed out at approximately $16,000 in November 2022. From that low, Bitcoin has entered a new bullish phase that has now lasted over two years, showing similarities to previous bull market cycles.

In recent weeks, Bitcoin briefly crossed the $100,000 mark before correcting by 15%. This pullback is relatively mild compared to historical bull market corrections. For example, the largest retracement in this cycle occurred in August, reaching -30%, while prior bull markets have seen drawdowns of 50–60% from their peaks, with corrections of 20–30% being normal. The reduced volatility compared to previous cycles can likely be attributed to the introduction of ETFs and the growing participation of institutional investors, which have helped stabilize the market.

To date, Bitcoin has delivered approximately a 6x gain in this cycle—a substantial return, but still less than that of previous cycles. The bull market still has room for further upside. Even if a 20–30% correction occurs in the near future, there is no need to worry too much. For long-term holders, these corrections are a natural part of the larger bullish trend and do not compromise Bitcoin’s long-term potential.

Source: Glassnode

ETF Adoption and Institutional Involvement

Bitcoin ETFs and more institutional participants have played a pivotal role, tempering volatility and increasing overall market maturity. For instance:

- Russia’s Adoption of Bitcoin for International Payments: Russian Finance Minister stated on last Wednesday, that following legislative adjustments to allow the use of Bitcoin and other cryptocurrencies in response to Western sanctions, Russian businesses have begun using these assets for international transactions. Russia, a leading nation in Bitcoin mining, has also taken steps to legalize cryptocurrency mining, further integrating Bitcoin into its financial system.

- Hong Kong’s Bitcoin ETF and Web3 Push: Hong Kong has accelerated its licensing process for virtual asset platforms. The region aims to position itself as a Web3 hub in Asia. However, the scale of Hong Kong’s Bitcoin ETF market remains small compared to the U.S., as mainland China imposes significant restrictions, limiting access to these products.

- Singapore’s Digital Asset Expansion: In 2024, Singapore issued 13 licenses to crypto operators, including major exchanges such as OKX and Upbit, doubling the number of licenses granted the previous year. This contrasts with Hong Kong’s slower licensing progress, highlighting the competitive landscape in Asia’s digital asset ecosystem.

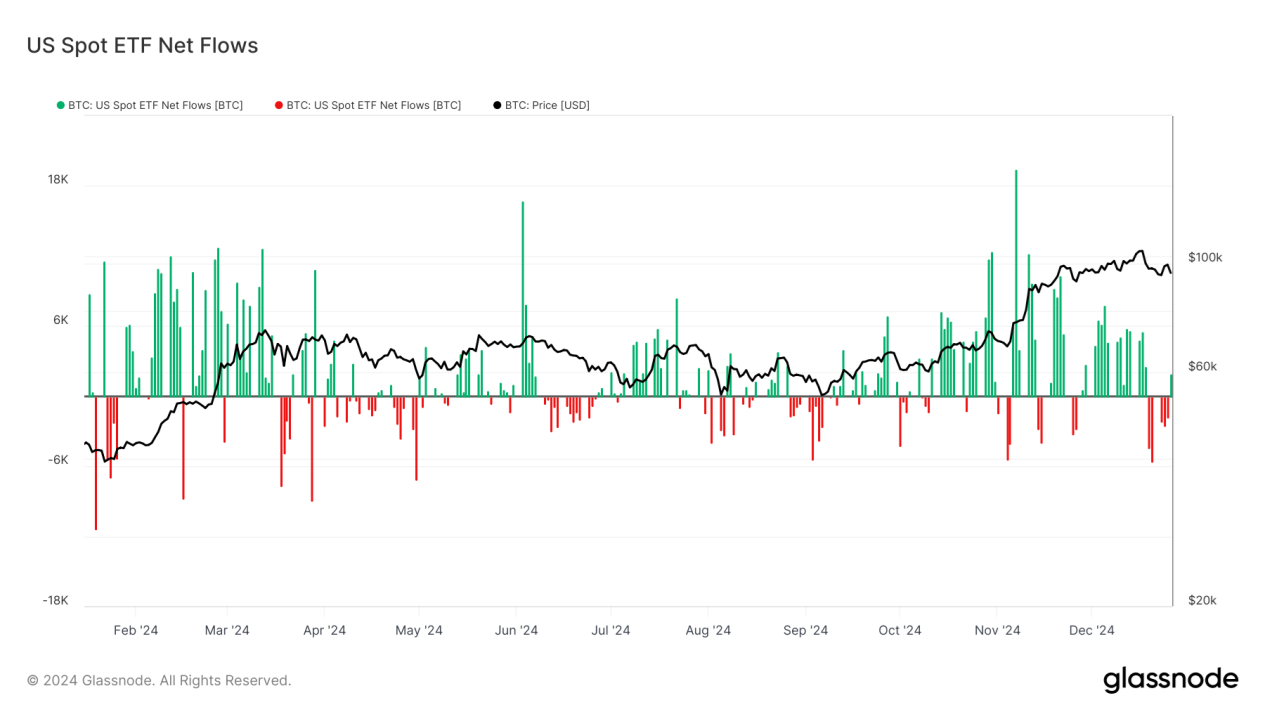

Fund Inflows and Outflows

While institutional adoption has been promising, recent data shows that net inflows into U.S. spot ETFs have turned negative, with funds flowing out as Bitcoin prices undergo a correction. Futures open interest has also been declining, further signaling a slowdown in market activity.

Source: Glassnode

Meanwhile, companies like MicroStrategy continue to accumulate Bitcoin aggressively. Data from Saylortracker.com reveals that MicroStrategy significantly increased its Bitcoin holdings in November, raising its average cost basis to approximately $60,000. This highlights the persistent confidence of institutional investors in Bitcoin’s long-term value.

Source: Saylortracker.com

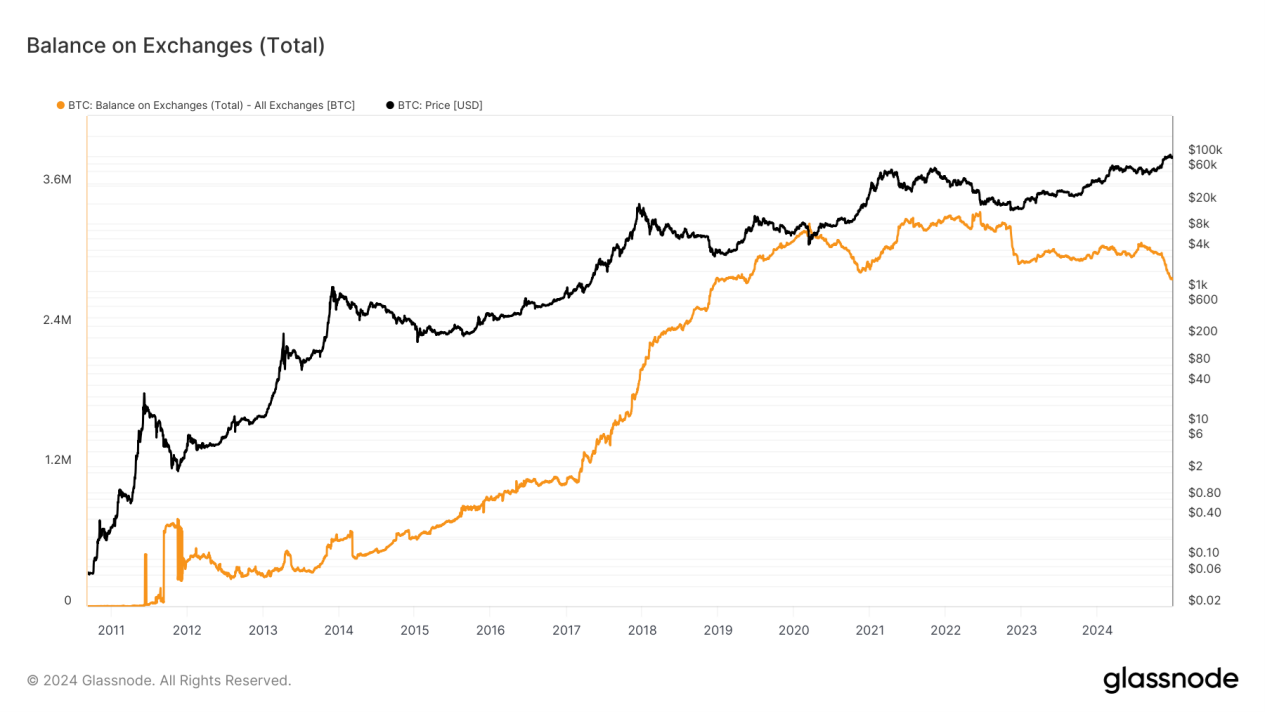

Shrinking Exchange Balances: Bullish for Long-Term

The continued and accelerated decline in Bitcoin balances on exchanges indicates that more investors are moving their coins to cold wallets. This trend suggests growing long-term confidence in Bitcoin, as these holders are unlikely to sell in the short term. Instead, they are positioning themselves to benefit from future price appreciation.

Source: Glassnode

On-Chain Analysis

USDT/USDC Circulating Supply

The circulating supply of USDT has been declining, signaling reduced market liquidity. This trend could lead to lower trading volumes and indicate capital outflows, which may exert selling pressure on Bitcoin.

Source: Glassnode

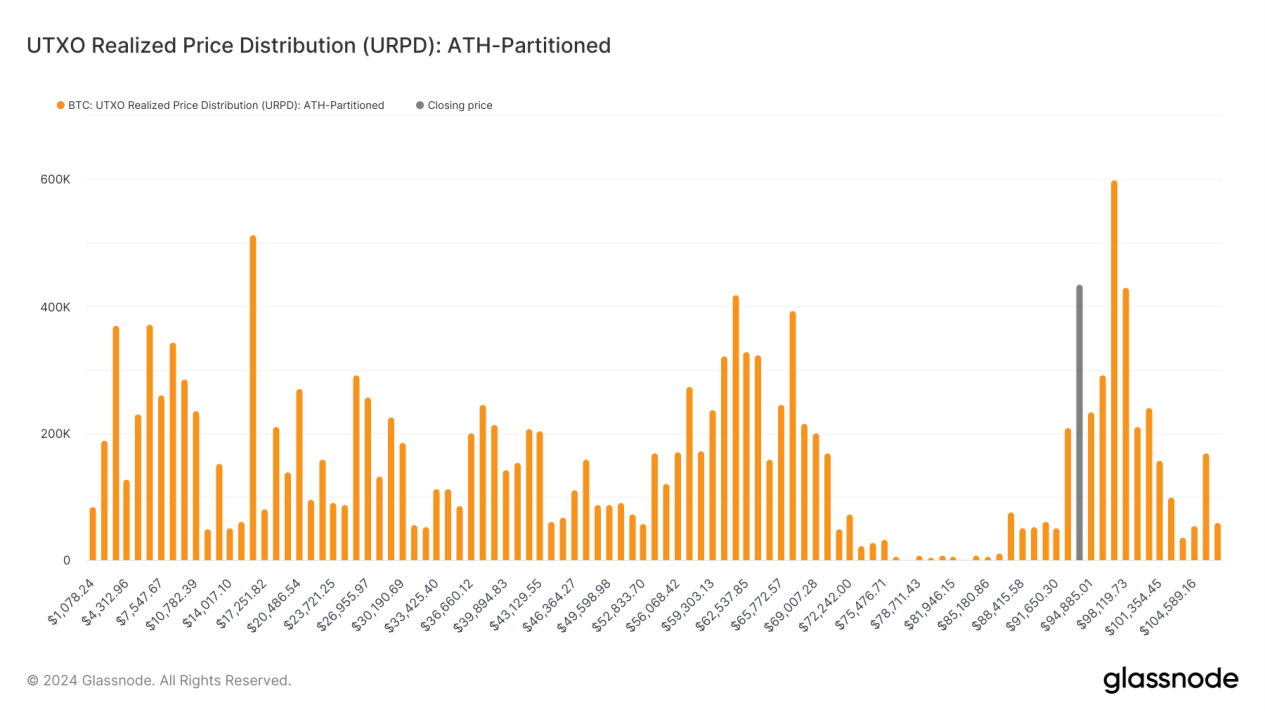

Key Resistance Levels

Analysis of Bitcoin’s Realized Price Distribution shows a significant concentration of trading activity at the $98,000 level, accounting for 3% of total volume—markedly higher than other price bands. This level now serves as resistance. If Bitcoin price can break above it, this price point could transform into solid support in the future.

Source: Glassnode

Holder Behavior

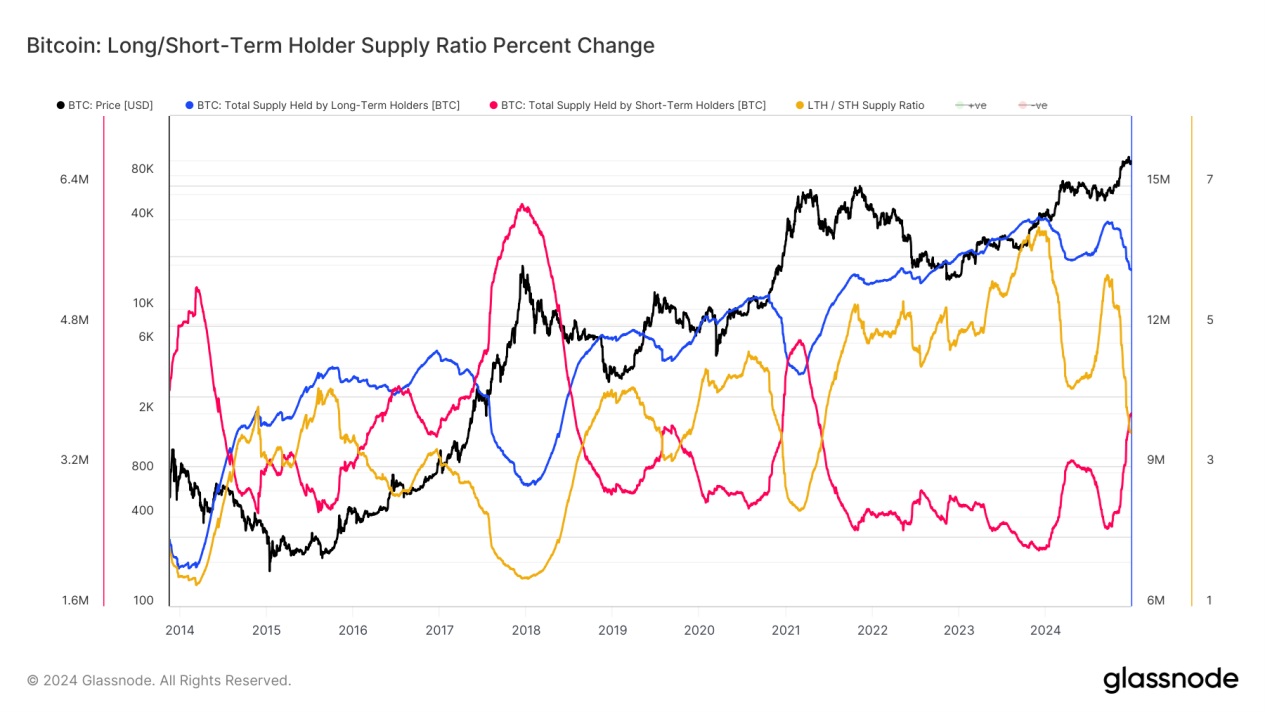

Further examination of long-term and short-term holders reveals that during the $60,000 to $100,000 rally, long-term holders have been consistently distributing coins to short-term holders. While demand from short-term holders remains robust, selling pressure from long-term holders has placed downward pressure on Bitcoin’s price.

Source: Glassnode

Long-Term Holder Net Position and Unrealized Profit

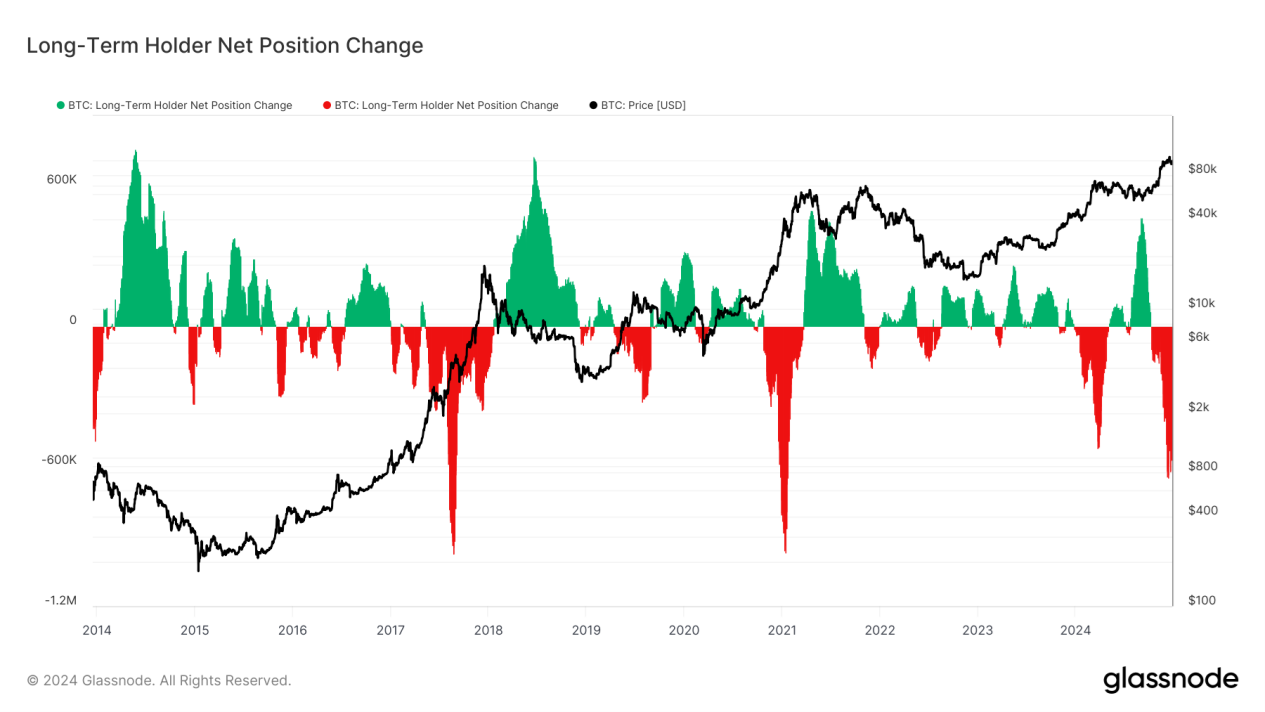

The Long-Term Holder Net Position Change shows that these holders have been reducing their positions at an accelerated pace, exceeding levels seen in March but not yet reaching the extremes of previous bull markets. Historically, Bitcoin tends to find a short-term bottom after long-term holders begin accumulating again, which has not yet occurred.

Source: Glassnode

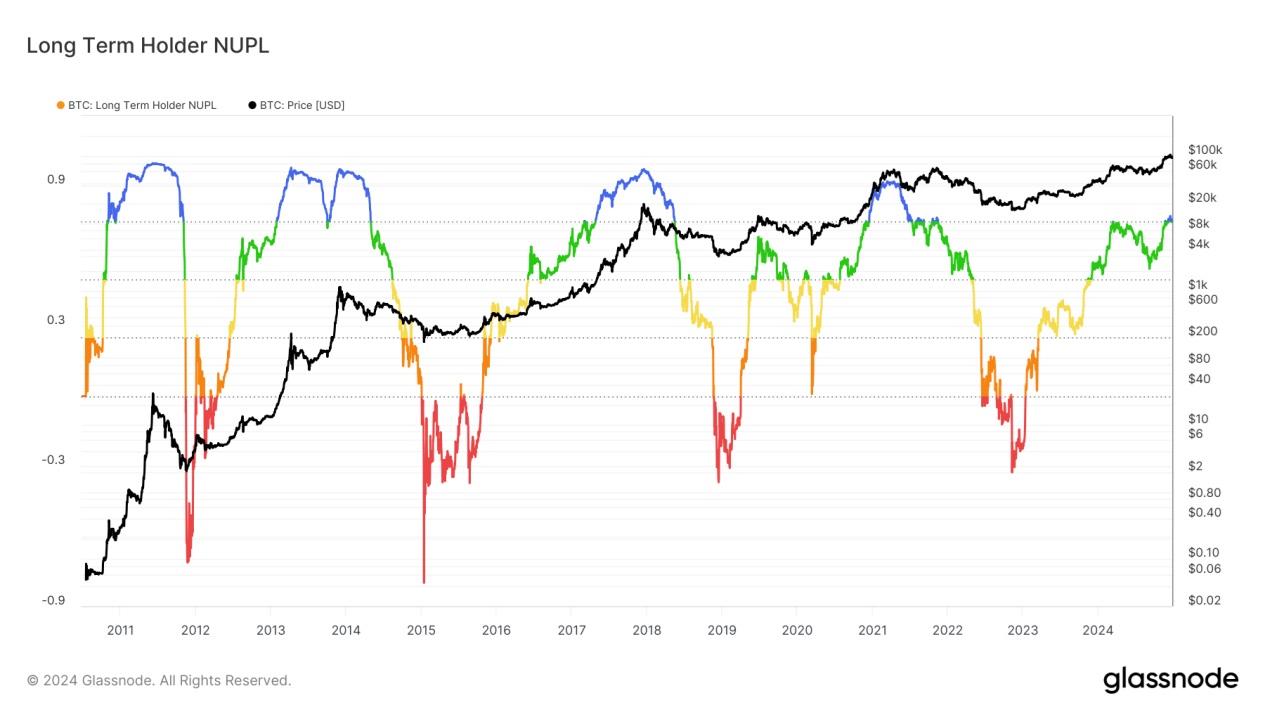

Additionally, Long-Term Holder Net Unrealized Profit (LTH NUPL) has reached relatively high levels. This indicates that long-term holders have significant unrealized profits and are incentivized to take profits, particularly at psychological price levels($100,000) or after sharp rallies. Such profit-taking could increase selling pressure and weigh on Bitcoin’s price in the near term.

Source: Glassnode

.jpg)