Bitcoin Outlook 2025: Is It Time to Go “All In” Or Be Wary?

TradingKey - The cryptocurrency markets have been a hot commodity for investors over the past year. While there have always been a host of crypto coins out there, the big one that everyone talks about is Bitcoin.

That’s understandable as Bitcoin is the “OG” of cryptocurrencies and has been on an absolute tear so far in 2024. That’s been down to several factors; rising optimism surrounding president-elect Trump’s victory in the US, the mainstream acceptance of Bitcoin by institutions, and longer-term fears over the “de-dollarisation” of the global economy.

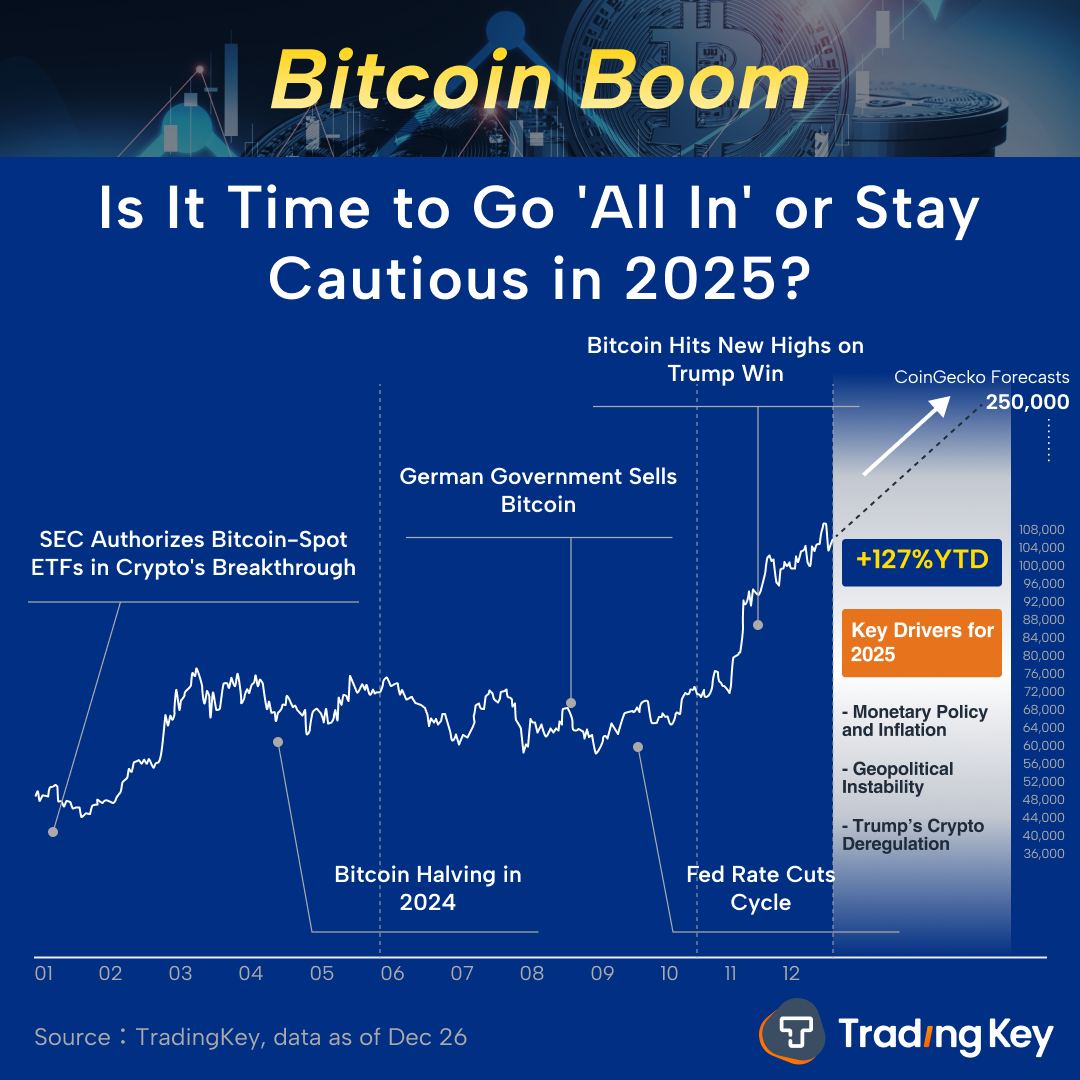

As a quick recap, the price of Bitcoin has skyrocketed by 127% so far in 2024. So, what’s driving these gains and what’s the outlook for the world’s biggest cryptocurrency in 2025?

Bitcoin in 2024: A year to remember

Bitcoin kicked off the year on a high note as a host of big asset managers launched Bitcoin ETFs after the US Securities and Exchange Commission (SEC) approved spot Bitcoin ETF products for sale in the US.

As a result, the price of Bitcoin surged and went on to hit a record high in mid-March. There was a Bitcoin “halving” in April – referring to the reduction in the rate at which new coins are created, thus lowering the available amount of new supply. This mechanism was originally created to counter inflationary effects on Bitcoin and also helps increase its scarcity value.

While previous halving events for Bitcoin have usually resulted in strong price appreciation in the months after, the most recent one in April didn’t actually do that. Instead, Bitcoin’s price fell around 20% compared to its pre-halving price.

Bitcoin only really powered higher in October as it became clear there were more crypto-friendly policies coming from both US presidential candidates, particularly Donald Trump.

And when Trump clinched victory, that was really the rocket fuel for the sustained rally in Bitcoin, with the cryptocurrency rising 63% from the beginning of October to 18 December – a span of less than 12 weeks.

What’s driving the outlook for Bitcoin in 2025?

Mainstream institutional acceptance

For most investors, while the political landscape should provide some level of support for Bitcoin in 2025, it’s actually likely to be the mainstream acceptance and use of Bitcoin by institutions that will have more of an impact on the long-term trend of the cryptocurrency.

Indeed, in 2024, there was the development of more sophisticated Bitcoin solutions for institutions – including innovative products like “liquid staking”. Staking in general, where holders of crypto can earn rewards by locking coins in a staking contract (effectively earning a “yield” on their holdings), is seeing more adoption by institutions.

Meanwhile, liquid staking is the issue of derivative tokens that represent staked assets but allows institutions to maintain liquidity while also earning staking rewards. This is just one example of how institutions are making better use of solutions in the Bitcoin space and could drive further capital inflows into the world’s biggest cryptocurrency.

With more high-net-worth individuals (HNWIs) and asset managers looking to increase their allocation to “alternative assets”, Bitcoin also provides a unique allocation that is being more widely accepted by asset allocators. As evidence of this, BlackRock’s Investment Institute recently made the case for Bitcoin to make up 1% to 2% of a traditional “60/40” investment portfolio.

Monetary policy and regulation

While Bitcoin was touted as an inflationary hedge before the market correction of 2022 in the US, now it’s being recognised as an asset that is tightly correlated to broader investor sentiment.

It has been coined “digital gold” and, like the yellow metal, Bitcoin could indeed benefit from further interest rate cuts by the US Federal Reserve (Fed). That’s because lower rates could free up more capital for investors to plough into Bitcoin.

Furthermore, regulation is thought to be more favourable under Trump’s second term as President. While current SEC Chair Gary Gensler actually approved spot Bitcoin EFTs, he’s been seen as broadly anti-crypto by the industry given his cautious approach to the asset class.

There have been reports that regulation of crypto could move from the SEC to the Commodity Futures Trading Commission (CFTC) under Trump, with the latter agency seen as a better department to handle both Bitcoin and Ethereum regulation.

With talk of a “strategic Bitcoin reserve” under Trump, investors will have to see whether that plays out in practice once he takes office in January 2025. Despite that, the proliferation of more Bitcoin ETFs on US exchanges will certainly provide more support for the price heading into the first half of next year.

Where will Bitcoin end 2025?

The projections for Bitcoin’s ending price in 2025 vary wildly, with Street projections as low as US$45,000 all the way up to US$250,000, a more than 140% rise from its current price.

Most forecasts are on the bullish side and a few factors are driving that, with the halving being cited as one big reason given there won’t be another Bitcoin halving event until 2028. That means there will continue to be limited supply of Bitcoin.

Overall, the further adoption of Bitcoin as an asset allocation option by institutional investors should continue to support Bitcoin through 2025. However, there will be certain risks to the price next year, including whether there’s a global recession and whether the Fed will cut as quickly as the market currently expects.

Despite these risks, the outlook for Bitcoin – as the dominant cryptocurrency worldwide – in 2025 continues to be bright.