Bitcoin’s Potential For A Short-Term Growth Hinted By Coinbase Premium

Bitcoin, the largest cryptocurrency asset, could be set for positive movement once again. Recent developments around Coinbase Premium spark the potential for a short-term rally, suggesting a positive outlook for BTC in the upcoming weeks.

Short-Term Rally For Bitcoin On The Horizon

The Coinbase Premium, a key indicator that measures BTC’s price differences on the Coinbase platform and other cryptocurrency exchanges, is displaying a possible optimistic movement for Bitcoin’s price in the near term. This implies institutional investors in the United States are heavily purchasing the crypto asset, indicating rising demand and bullish sentiment in the US market, which could cause a short-term upswing for BTC as these investors seeks to capitalize on its growing strength.

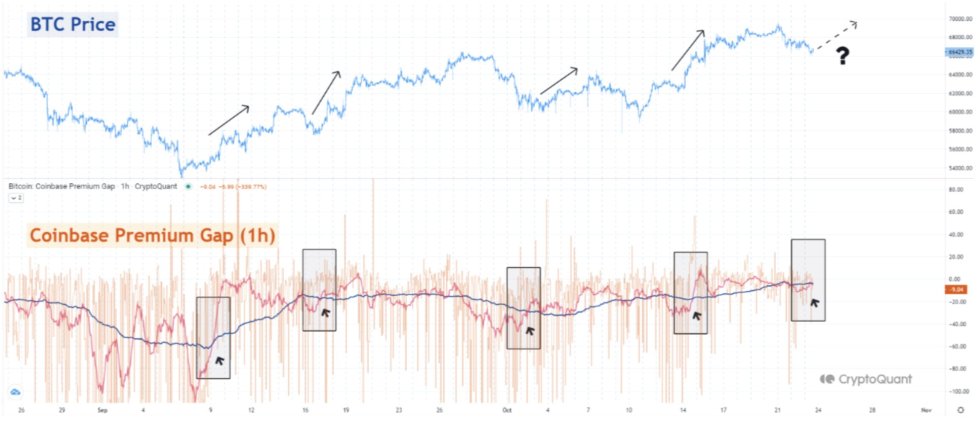

Yonsei Dent, a market expert and enthusiast, reported the development in a recent quicktake post on the leading on-chain analytics platform, CryptoQuant. The expert predicts that a brief leg up may be imminent after analyzing the Coinbase Premium Index on the 1-hour time frame and using the 24-hour and weekly moving averages to identify short-term momentum.

Following the thorough investigation, Dent discovered that when the daily moving average decisively broke through the weekly moving average, significant results were also seen in the price movement.

Considering past movements in Bitcoin, the expert highlighted that there was also a short-term rise in price when BTC attempted to create a golden cross. This is due to the fact that notable price movements have historically occurred immediately after the 1-day moving average forms a golden cross, which takes place when it strongly crosses over the weekly moving average.

In addition, the weekly moving average has been momentarily overtaken by the current daily moving average, with the current price positioned at the $66,400 level, a section where support for the September high might be anticipated, as indicated by the black arrow on the chart.

As a result, Yonsei Dent anticipates the market will develop a clear rising structure as long as the higher highs and lows, where the lows and highs have progressively increased since August, continue.

A Possible Price Correction For BTC

While the Coinbase premium may flash an impending short-term rally, Kyle Doops, a technical analyst and host of the Crypto Banter show has pointed out a potential price correction for the flagship digital asset in the coming days. Kyle Doops’s pessimistic forecast is based on an analysis of Bitcoin‘s quarterly performance by contrasting its market capitalization with its realized cap, which revealed crucial patterns for the market.

After examining the metric, the expert warned of possible selling pressure and bearish signals should the market cap growth surpass the realized cap. However, a steady realized cap during downturns may suggest market bottoms. “With trends echoing 2021, a price correction might be on the horizon,” he added.