Bitcoin Price Forecast: BTC consolidation continues as market prepares for the next major move

- Bitcoin price has been consolidating between $94,000 and $100,000 since early February.

- Glassnode reports weakening capital inflows and declining derivatives activity, with short-term holder accumulation resembling challenging market conditions.

- YouHodler Chief of Markets Ruslan Lienkha stated that a prolonged high-rate environment adds selling pressure to the markets, making Bitcoin trade sideways without any clearly defined trend.

Bitcoin (BTC) has been consolidating between $94,000 and $100,000 since February 5. Glassnode reports weakening capital inflows and declining derivatives activity, with short-term holder accumulation resembling challenging market conditions.

In an exclusive interview, YouHodler Chief of Markets Ruslan Lienkha told FXStreet that a prolonged high-rate environment adds selling pressure to the markets, making Bitcoin trade sideways without any clearly defined trend.

Bitcoin consolidation triggers wider digital asset cooldown

Bitcoin has been consolidating between $94,000 and $100,000 for several weeks and is trading within a relatively stable range. At the time of writing on Thursday, it trades just above $97,000.

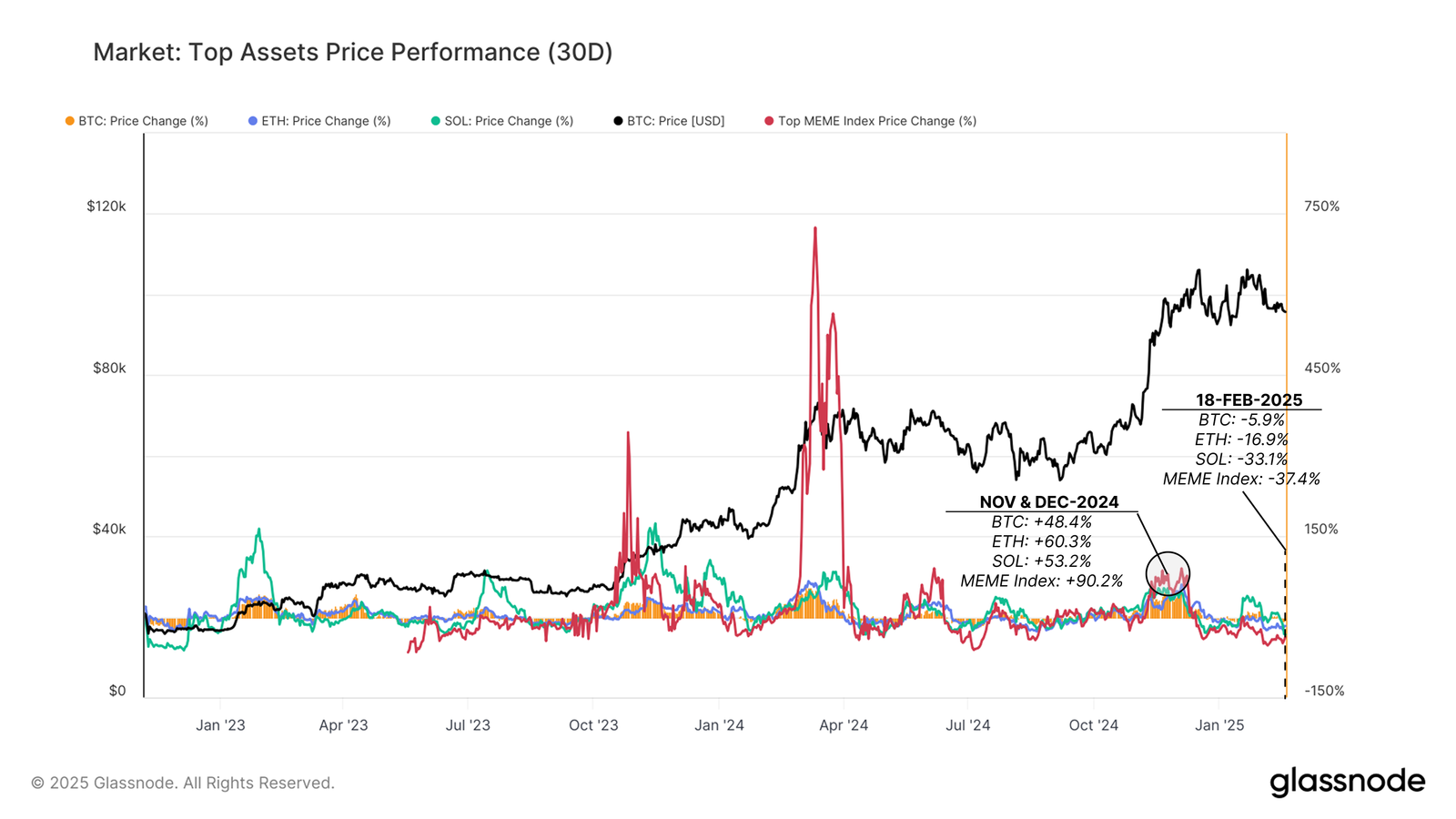

On Wednesday, Glassnode’s ‘Falling Tides’ report states, “The same cannot be said for the wider digital asset landscape, with Ethereum, Solana, and Memecoins all seeing significant drawdowns from their cyclical highs.”

The report explains that demand for memecoins has significantly cooled, as evidenced by capital outflows, sharp price declines, and bearish sentiment in futures markets.

Market: Top assets price performance 30-day chart. Source: Glassnode

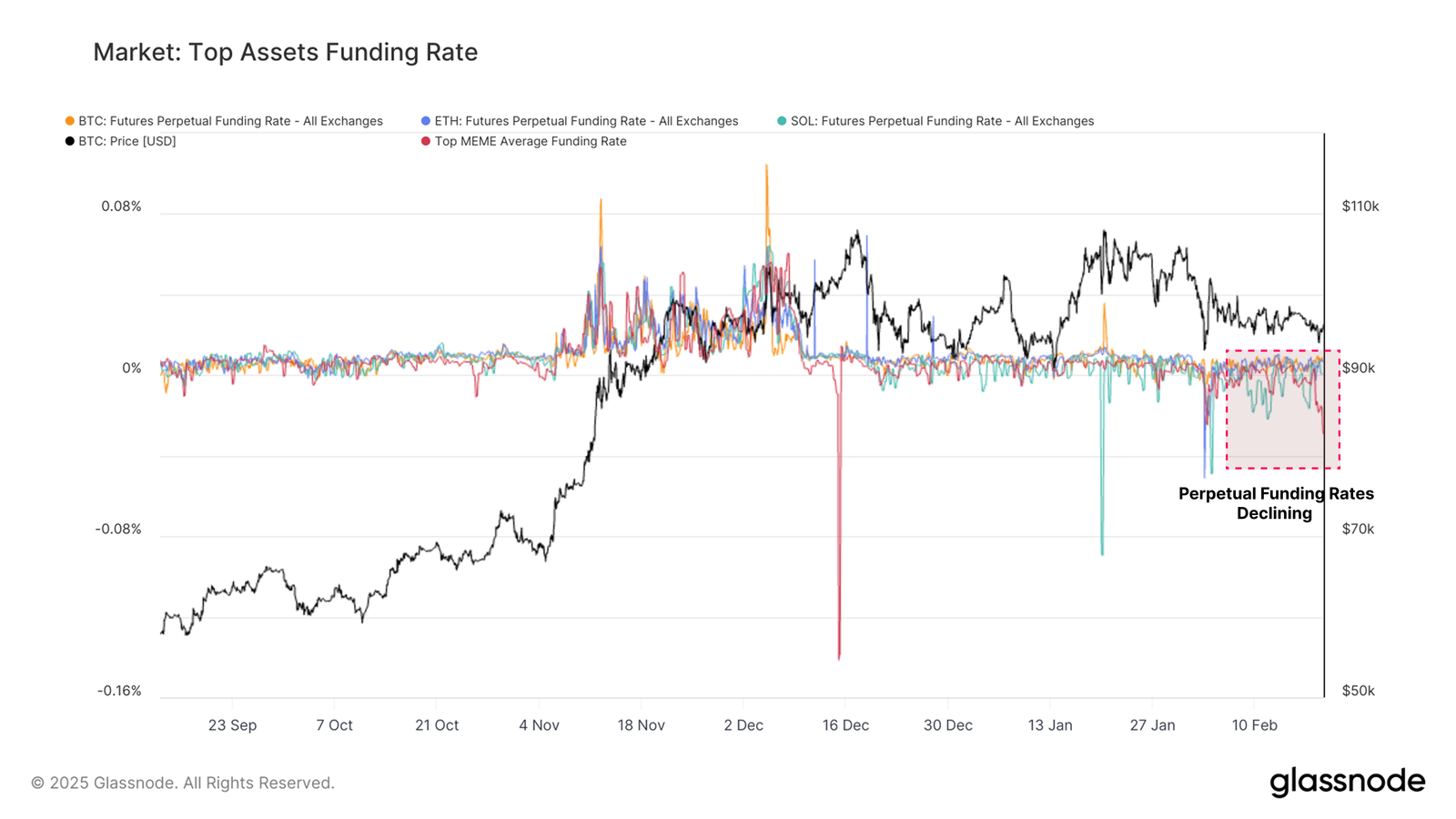

The report continued that a decline in perpetual futures funding rates further reinforces the weakening in open interest. This reflects a shift toward more bearish sentiment and an unwinding of leveraged positions, particularly in riskier assets.

Market: Top assets funding rate chart. Source: Glassnode

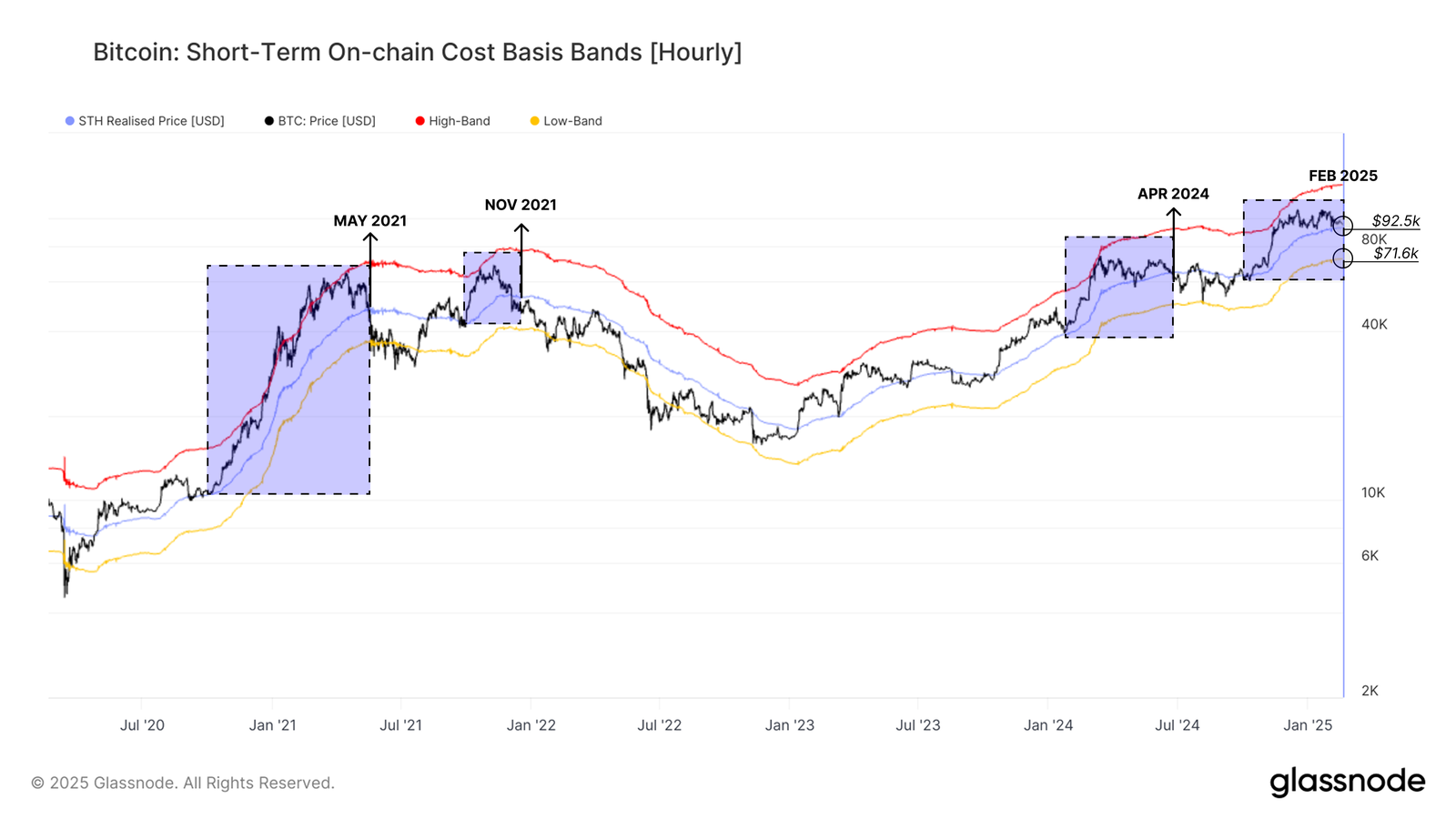

For Bitcoin, the key level to watch is the Short-Term Holder cost basis of around $92,500, as shown in the graph below. This is a pivot point at which many recent buyers will see their holdings move into unrealized losses and could precipitate more downside as panic sets in.

“The current consolidation phase appears to be nearing its later stages, and the market looks ready to trend in one direction once again,” says a Glassnode analyst.

Bitcoin: Short-term on-chain cost basis bands (hourly) chart. Source: Glassnode

Bitcoin price slowdowns amid US inflation fears and tariff tensions

QCP’s report on Wednesday highlights that inflation fears remain at the top of mind as tariff tensions escalate.

The report explains that the only confirmed hit so far — a 10% tariff on select Chinese goods — is in effect. The proposed 25% tariffs on Canada and Mexico could be avoided if a consensus is reached, while the planned steel and aluminum tariff hike from 10% to 25% is set to take effect on March 12.

Moreover, this week’s news of FTX repayments and the memecoin LIBRA scandal fueled the market correction.

The report continued that the crypto market remains under pressure, with Solana bracing for impact ahead of a 30 million token unlock on March 1. Hedging flows tied to FTX-related SOL are weighing on BTC and ETH, contributing to the broader weakness. Meanwhile, Argentina’s latest meme coin frenzy, LIBRA, saw a staggering $4 billion surge following the president’s endorsement before crashing 89%, leaving thousands of investors with significant losses.

Additionally, Micro Strategy (MSTR) did not purchase any Bitcoin last week, marking the second time its holdings remained unchanged at 478,740 BTC. However, the company plans to strengthen its Bitcoin position through a private offering of $2 billion in convertible senior notes.

“Despite these headwinds, Bitcoin remains resilient around the $95k level after dipping towards $93,000 but is struggling to break higher amid a lack of short-term catalysts,” says QCP’s analyst.

In an exclusive interview, YouHodler Chief of Markets Ruslan Lienkha told FXStreet, “Inflation trends vary by country, but in the US, inflation remains persistently high and has even shown a slight uptick, recently returning to 3%. With the Federal Reserve’s 2% target still appearing distant, interest rates will likely remain elevated for an extended period.”

Lienkha continued this prolonged high-rate environment adds selling pressure to the markets, making it more challenging for equity indices to gain momentum. As a result, Bitcoin continues to trade within a sideways channel without any clearly defined trend.

Bitcoin Price Forecast: Indecisiveness soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for more than two weeks. On Tuesday, BTC declined and found support around the lower boundary of the consolidating range and rose slightly the next day. At the time of writing on Thursday, it hovers around $97,000.

If BTC recovers and breaks above the upper boundary of the consolidating range of $100,000, it would extend the recovery to retest its January 30 high of $106,457.

The Relative Strength Index (RSI) on the daily chart reads 47, approaching its neural level of 50 and points upwards, indicating slight strength in momentum. For the bullish momentum to be sustained, the RSI must trade above its neutral level of 50.

The Moving Average Convergence Divergence (MACD) coils around each other, indicating indecisiveness among traders as consolidation in BTC’s price continues.

BTC/USDT daily chart

However, If BTC breaks and closes below the lower boundary of the consolidating range of $94,000, it could extend the decline to test its psychologically important level of $90,000.