Forex Trading Hours

What is the best timing to trade?

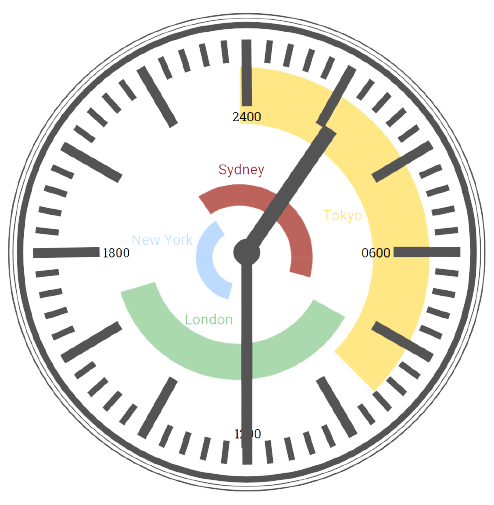

The forex market operates 24 hours everyday for 5 days a week. It is able to operate round the clock, because the trading hours are divided into four sessions across four time zones: Sydney hours, Tokyo hours, London hours, and New York hours. Following is a schedule of the opening and closing hours for each market:

Market | UTC | EST |

|---|---|---|

Tokyo | 12am to 9am (0000hrs to 0900hrs) | 7pm to 4pm (1900hrs to 0400hrs) |

London | 8am to 5pm (0800hrs to 1700hrs) | 3am to 12 noon (0300hrs to 1200hrs) |

New York | 1pm to 10pm (1300hrs to 2200hrs) | 8am to 5pm (0800hrs to 1700hrs) |

Sydney | 10pm to 7am (2200hrs to 0700hrs) | 5pm to 2am (1700hrs to 0200hrs) |

Forex market opening hours

Forex Market Hours Visualized based on UTC

Market Overlaps

As the image shows, there are always some trading hours overlapping between two markets. These overlaps usually results in high volatility and price movements because two markets are open at the same time.

Many traders determine that these overlaps are the best timing to trade due to its volatility and volume.

U.S./London: The heaviest overlap within the markets occurs in the U.S./London markets. More than 70% of all trades happen when these markets overlap because the U.S. dollar and the euro (EUR) are the two most popular currencies to trade, according to Lien.

Sydney/Tokyo : This overlap period is not as volatile as the U.S./London overlap, but it still offers a chance to trade in a period of higher pip fluctuation.

London/Tokyo: This overlap sees the least amount of action of the three because of the time (most U.S.-based traders won't be awake at this time), and the one-hour overlap gives little opportunity to watch large pip changes occur.