Could Buying Apple Stock Today Set You Up for Life?

As of this writing, Apple (NASDAQ: AAPL) carries a gargantuan market cap of $3.4 trillion. This not only rivals the GDP figures of some large nations, but it makes the consumer technology business the world's most valuable enterprise.

Apple has surely made its early investors wealthy, as the consumer discretionary stock has soared 61,240% in the past 30 years. If you missed this incredible rise, it's important to look at the company today with clear vision.

Could buying Apple shares today set you up for life?

One of the best businesses on Earth

There's no denying that Apple is a wonderful company. Even the great Warren Buffett agrees with this view, as Berkshire Hathaway has been a sizable shareholder for nearly a decade.

Apple's innovation is second to none. The business has developed some of the most popular hardware devices the world has ever seen. It wasn't the first to launch a PC, MP3 player, laptop, smartphone, or headphones, for example, but it certainly was the best. From products of old to those of today, like the MacBook, iPhone, AirPods, and Watch, Apple has done an unbelievable job driving excitement and demand.

Add this to the company's services and software, and Apple has created a powerful ecosystem that supports its virtually unassailable competitive position. There are nearly 2.4 billion active Apple devices in the world, giving the business unmatched distribution and reach when it comes to launching new features, most recently with Apple Intelligence.

All this has resulted in tremendous profitability. Net income totaled $93.7 billion in fiscal 2024 (ended Sept. 28), equal to 24% of total revenue. That windfall allowed management to repurchase $95 billion worth of shares last fiscal year, which is not an unusual occurrence.

Return on invested capital (ROIC) is often viewed as the single most important indicator of whether a business has developed an economic moat. Apple's ROIC in the past decade has averaged a superb 37%, putting it in an elite category.

Growth prospects

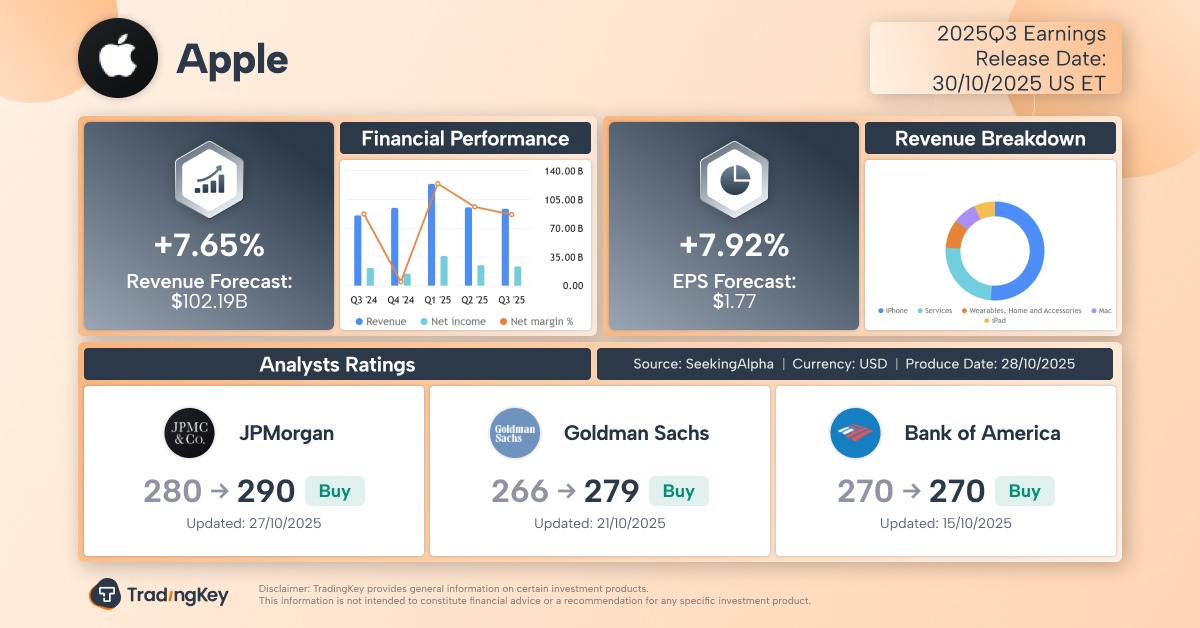

In the most recent fiscal quarter (Q1 2025 ended Dec. 28), Apple generated $124.3 billion in revenue. While this came in ahead of Wall Street expectations, it only represented a 4% year-over-year increase. Unsurprisingly, it's difficult to move the needle on such a large sales base.

Apple's flagship product remains the iPhone, which accounted for more than half of the revenue in the first quarter. The $69.1 billion sales figure disappointed Wall Street, and it showed a 1% drop from Q1 2024.

To its credit, Apple has introduced new products that have found remarkable success. The issue, however, is that none of them will likely match that of the iPhone.

That means that the business must probably find a revolutionary product to jump-start growth. Given that Apple abandoned its ambition to build an electric vehicle, I'm not confident the company can come up with a new hardware device with the market potential to propel it to new heights.

Don't reach for the Apple

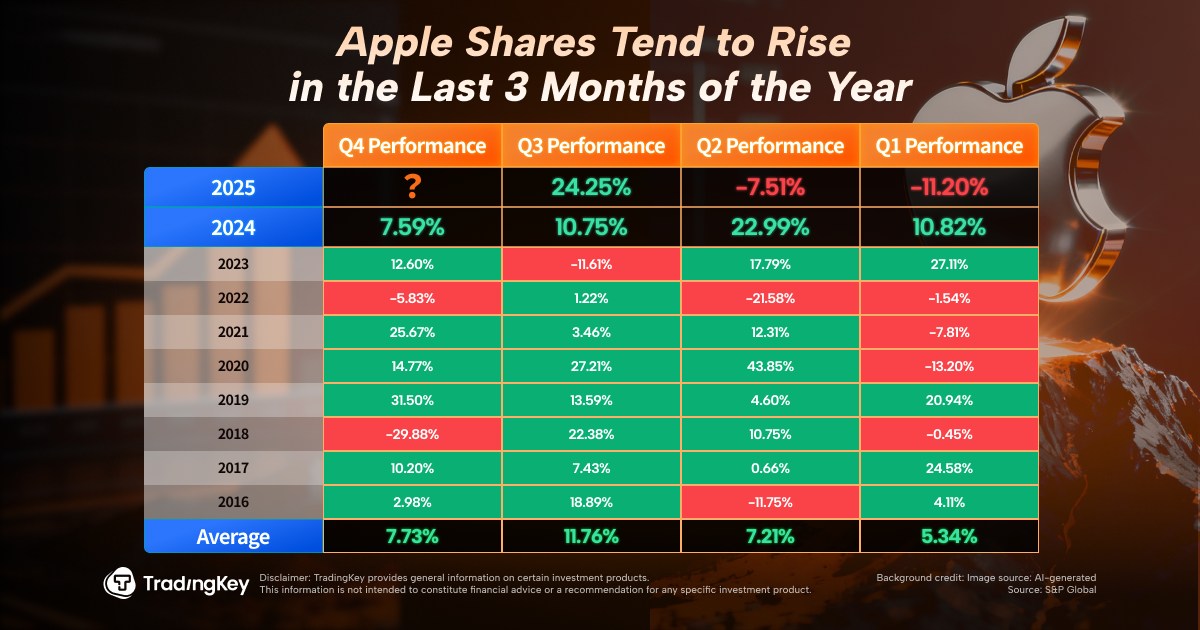

Investors who were bold and lucky enough to scoop up shares decades ago have benefited greatly. However, for those looking at the stock right now in the hopes it can set you up for life, it's best to seriously temper expectations.

Besides Apple's softer growth prospects, with analysts projecting annualized earnings per share (EPS) growth of 10.8% over the next three years, the valuation is not compelling. That's true even though the stock is 12% off its peak from December.

Shares trade at a price-to-earnings ratio of 36.2, driven by fantastic gains in recent years. The current valuation is near its most expensive level in the past decade, showcasing how much optimism the market has toward the company.

No one questions that Apple is a world-class business. But the stock isn't going to set you up for life.