Before we look into the entities involved in the forex market, let's look at forex market structure to better understand how each participant falls into the picture.

Forex Market Structure

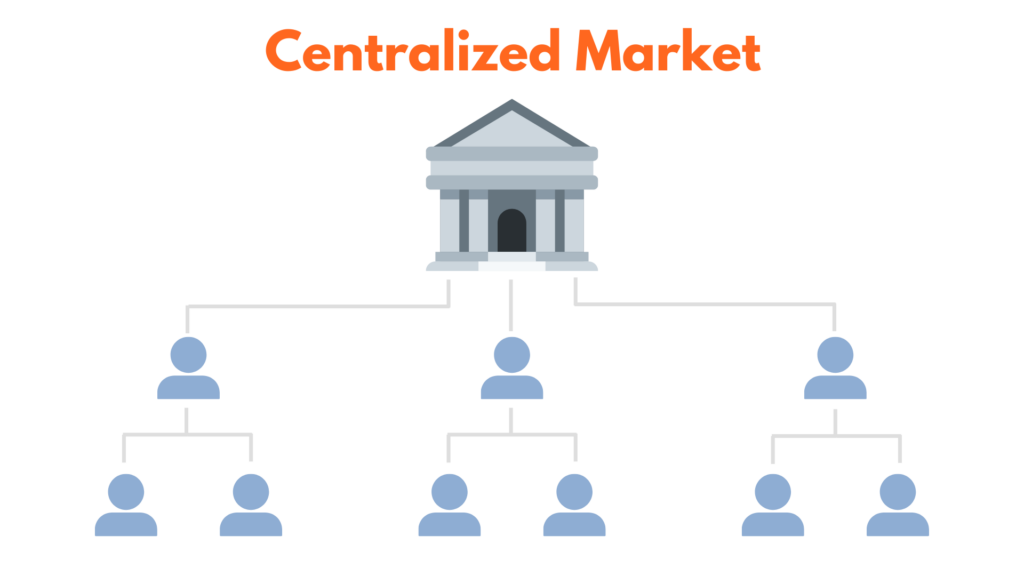

Unlike the centralized markets such as the New York Stock Exchange (NYSE) which can be very monopolistic in the sense that only one entity controls the price.

A centralized market is where all orders routed to one central exchange. The quoted prices that investors see are made available by one exchange.

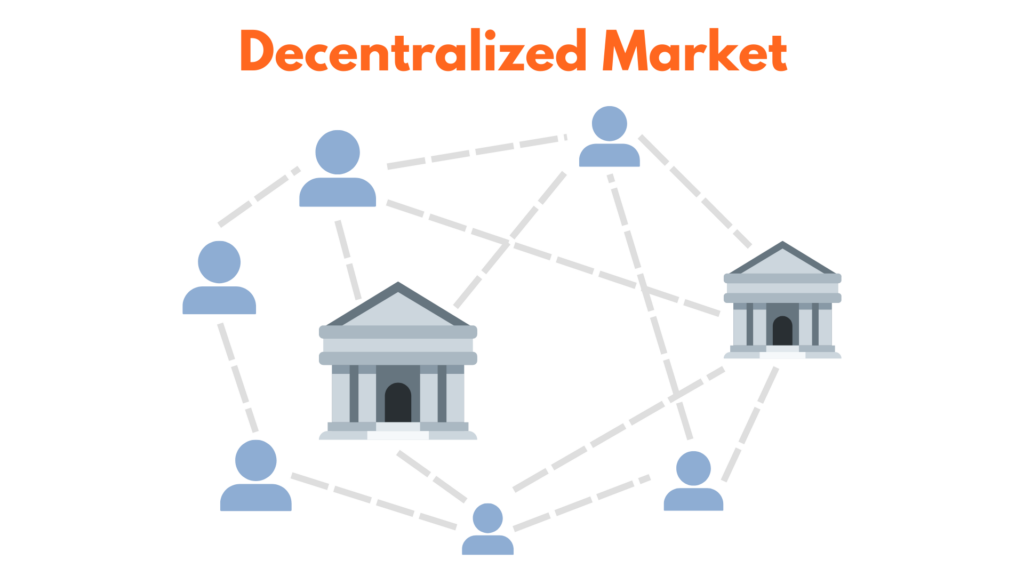

The forex market is a decentralized market where the currency quotes will vary between each broker and other entities.

It may seem very messy and chaotic, but it can be organized into a ladder to better understand the structure of the forex market.

At the very top of the forex market structure is the interbank market. Comprised of the largest banks in the world, the participants of this market trade directly with each other (“bilaterally”) or through voice or electronic brokers (such as EBS Market and Reuters Matching). The competition between the two companies, EBS and Reuters, is similar to Coke and Pepsi.

While both companies offer most currency pairs, some currency pairs are more liquid on one than the other. For the EBS platform, EUR/USD, USD/JPY, EUR/JPY, EUR/CHF, and USD/CHF are more liquid. Meanwhile, for the Reuters platform, GBP/USD, EUR/GBP, USD/CAD, AUD/USD, and NZD/USD are more liquid.

All the banks that are part of the interbank market can see the rates that each other is offering, but this doesn’t necessarily mean that anyone can make deals at those prices. The rates will be largely dependent on the established credit relationship between the trading parties. Similar to applying for a loan at your local bank. The better your credit standing and reputation with them, the better the interest rates and the larger loan you can get.

Next on the ladder are the hedge funds, corporations, retail market makers, and retail ECNs. Since these institutions do not have tight credit relationships with the participants of the interbank market, they have to do their transactions via commercial banks. Which means that their rates are slightly higher and more expensive than those who are part of the interbank market.

At the bottom of the ladder are non-professional traders known as retail traders. In the past, it used to be very challenging for retail investors to participate in the forex market. Nowadays with the advent of internet, electronic trading and retail brokers, it lowered the barrier of entry significantly for retail trading.

Market Participants

Now let's go into detail about who exactly are these people or entities participating in the forex market.

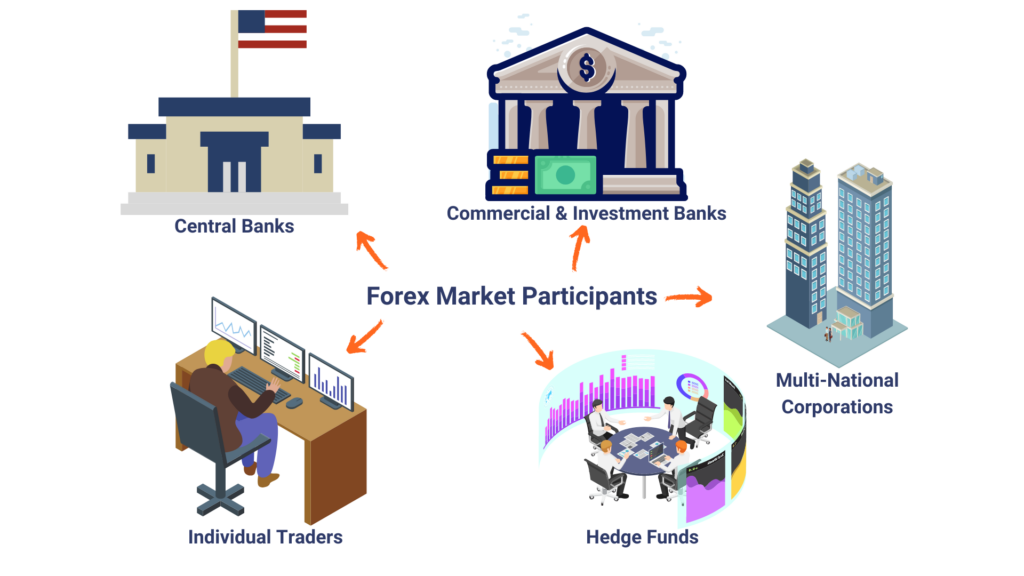

Central Banks

These banks represent their respective nation's government and are extremely important players in the forex market. Central banks are responsible for fixing the price of its nation's currency on forex. Any action taken by a central bank in the forex market is done to stabilize or increase the competitiveness of their nation's economy. E.g. The Federal Reserve, European Central Bank, Bank of Japan.

Commercial & Investment Banks

These big banks, collectively known as the interbank market, they account for a large percentage of total currency volume trades. These banks facilitate forex transactions for clients and conduct speculative trades from their own trading desks. E.g. UBS, JP Morgan, Deutsche Bank.

Multinational Companies

Firms engaged in importing and exporting conduct forex transactions to pay for goods and services. For instance, Apple must first exchange its U.S. dollars for the Japanese yen when purchasing electronic parts from Japan for its products.

Hedge Funds

Portfolio managers, and hedge funds trade currencies for large accounts such as pension funds, foundations, and endowments. Investment managers may also make speculative forex trades, while some hedge funds execute speculative currency trades as part of their investment strategies.

Individual Traders / Retail Traders

Speculation is the act of buying and holding foreign currency in the hopes of selling that currency at a higher exchange rate in the future. It is called speculation because the uncertainty in the outcome of the market direction.

Retail investors usually make their trading decisions, based on a combination of fundamentals (i.e., interest rate parity, inflation rates, and monetary policy expectations) and technical factors (i.e., support, resistance, technical indicators, price patterns).