The basics of a Futures contract

The most important information about a futures contract lies in its basic elements, which are typically reflected in the contract itself. These are the key points that we need to pay attention to when buying or selling futures.

Basic elements of Futures contracts

- Exchanges: Where the Futures contract is traded.

- Ticker Symbol: Each futures contract has a unique code for identification purposes.

- Underlying Asset: The asset on which the futures contract is based

- Type: The type of futures contract, such as commodity futures, currency futures, or stock index futures.

- Contract Specifications: The detailed terms and conditions of the futures contract, including contract size, tick size, and contract value.

- Contract Duration: The specific month in which the contract matures and the date on which it expires.

- Trading Hours and Time Zone: The designated trading hours for the futures contract and the corresponding time zone.

- Minimum Price Fluctuation: The smallest permissible price increment by which the futures price can change.

Exchanges Where the Futures contract is traded. Ticker Symbol Each futures contract has a unique code for identification purposes. Underlying Asset The asset on which the futures contract is based Type The type of futures contract, such as commodity futures, currency futures, or stock index futures. Contract Specifications The detailed terms and conditions of the futures contract, including contract size, tick size, and contract value. Contract Duration The specific month in which the contract matures and the date on which it expires. Trading Hours and Time Zone The designated trading hours for the futures contract and the corresponding time zone. Minimum Price Fluctuation The smallest permissible price increment by which the futures price can change.

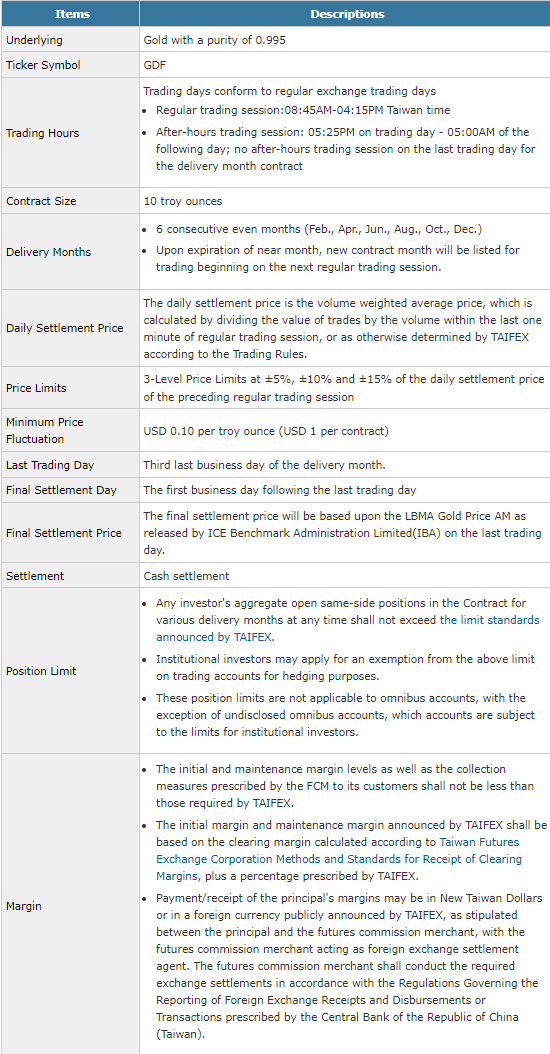

We will use the gold futures contract specifications table from the Taiwan Futures Exchange as an illustrative example, as it encompasses vital information pertaining to the fundamental elements of the contract.

source: Taiwan Futures Exchange

- Exchange and Symbol

Investors can clearly identify the exchange and code to which the futures contract belongs. The gold futures contract is traded on the Taiwan Futures Exchange, with the symbol GDF.

- Underlying Asset and Type

This refers to the asset corresponding to the futures contract and its type. The underlying asset for the gold futures contract is gold of 99.95% purity.

- Contract Specifications and Value

Contract specifications denote the standard for contract calculation and the size of the contract. The size of the gold futures contract is 10 troy ounces, and its value is calculated as 10 multiplied by the agreed-upon price of buying or selling gold. For instance, if the agreed price is $1,900 per troy ounce, the contract's value would be $19,000.

- Contract Month and Expiration Date

This indicates the month for contract delivery and the last trading date of that month. The delivery months, final settlement dates, and corresponding exercise prices for Taiwan gold futures are depicted in the following figure:

source: Taiwan Futures Exchange

- Trading Hours and Time Zone

The time of the futures contract is based on the time where the exchange is located, and the delivery month of the gold futures contract is Taiwan time (GMT+8).

- Minimum Price Fluctuation (Minimum Price Tick)

The minimum range of each price change is usually expressed in points, and the currency form of the minimum change unit can be obtained by multiplying the minimum change unit by the contract multiplier. However, the minimum unit of change for gold futures here is $0.1 per troy ounce.