Betting big on crypto: Polymarket sees $300 million monthly volume as prediction markets gain traction

Fxstreet

Jul 28, 2024 6:48 PM

- Crypto prediction market Polymarket hit a key milestone with $300 million monthly volume.

- The new all-time high in crypto betting history comes at a time of peak interest in US Presidential elections.

- Polymarket was a use case featured in the Ethereum whitepaper and the crypto betting marketplace took over a decade to turn mainstream.

- The crypto betting market is built on Polygon, the native token of the platform erased nearly 2% in value on Sunday.

Polymarket, a crypto prediction platform built on Polygon has observed the highest volume month in its history, as interest in US Presidential elections and the Olympics peaks. Crypto traders are betting on the 2024 US Presidential election forecast and the Paris Olympics.

MATIC, the native token of the platform that powers the betting market has erased nearly 2% of its value early on July 28.

Polymarket hits a new all-time high in monthly volume

Data from Dune Analytics shows that Polymarket’s higher volume month in history is July 2024, where it exceeded $300 million. The crypto betting market has gained popularity among traders as crypto is under the spotlight in US Presidential elections.

Traders bet on whether Trump would announce a strategic Bitcoin reserve at the conference, and several related topics ahead of the event in Nashville on July 25 to 27.

https://t.co/Uf6d82WIMY

— Polymarket (@Polymarket) July 27, 2024

Weiss Crypto predicted that the online betting market is set to be $24 billion in 2024. Insights from the crypto betting platform Polymarket paint a bullish narrative for Bitcoin.

From participants favoring Trump’s win in the November elections, to pro-crypto and pro-Bitcoin policy and regulation in the US, Bitcoin narrative is fueled by the decentralized oracle’s participants.

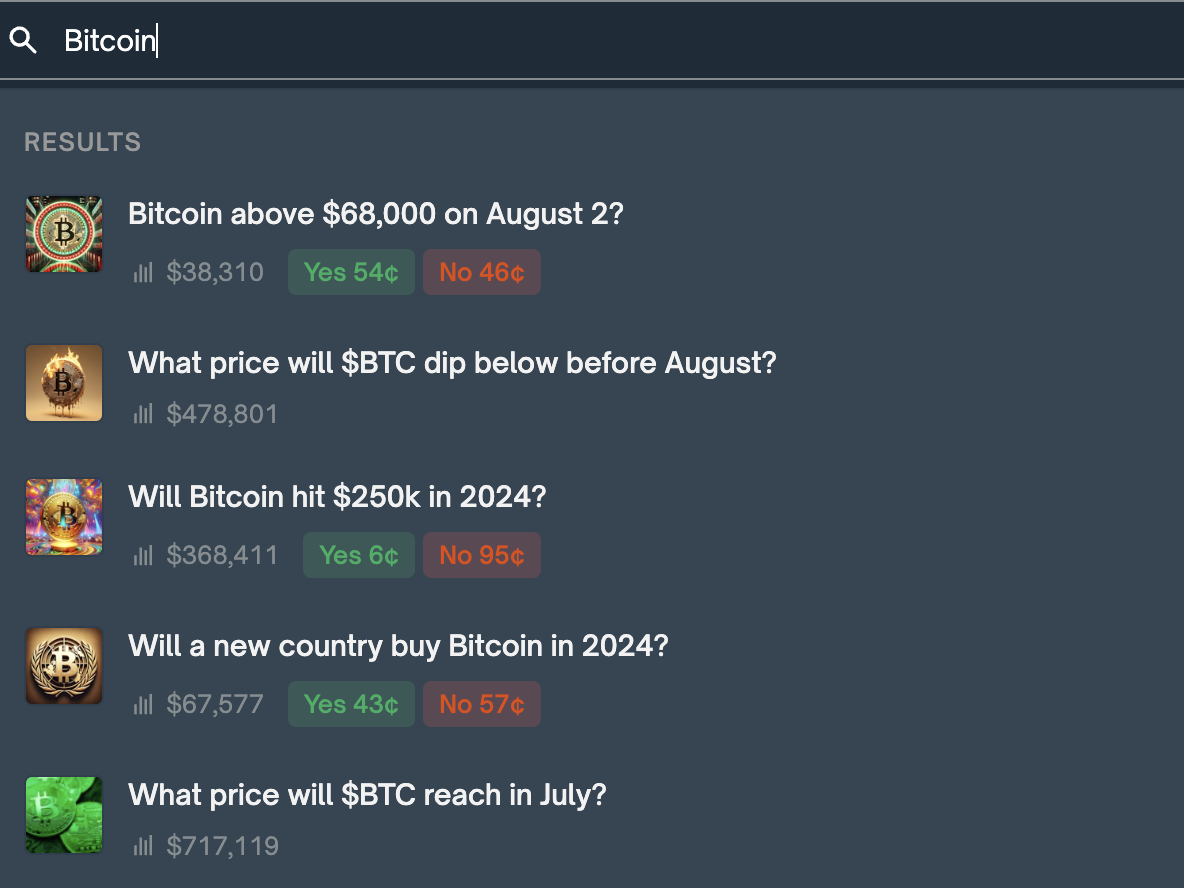

The top five results on Bitcoin exceed $1 million in bets by traders. Participants do not foresee Bitcoin hitting $250,000 in 2024, and there are other bets on the price of BTC in July.

Bitcoin bets on Polymarket

Co-host of Flywheeldefi.com says Polymarket has grown in the past decade from a usecase in the Ethereum whitepaper to the “mainstream,” supporting the narrative of crypto betting projects gaining relevance among market participants.

I don’t think people realize how hard it is to get prediction markets off the ground. This was one of the “golden use cases mentioned in the Ethereum whitepaper, first ICO on ETH with Augur and still it took nearly a decade for something like Polymarket to reach the mainstream.

— DeFi Dave ️ (@DeFiDave22) July 28, 2024

Polygon, the largest Ethereum scaling solution shared statistics on the trade volume and utility of the project in an official tweet on X:

$969m in trading volume, 4.9m+ total bets, powered by Polygon PoS.@Polymarket's success might be the most important story in crypto right now. the perfect example of product market fit at the right time, built on the right tech.

— Polygon | Aggregated (@0xPolygon) July 26, 2024

everyone’s talking about it, and they should be. pic.twitter.com/9I0Fd0pzzs

Polygon’s native token MATIC lost nearly 2% in value on Sunday. The altcoin erased nearly 6% in value in the past week and continues to fade as Ethereum fails to make a comeback above key resistance at $3,500.

MATIC trades at $0.5119 at the time of writing.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.