TESLA: A Cautious Valuation Approach Amidst Evolving Marginal Dynamics

TESLA: A Cautious Valuation Approach Amidst Evolving Marginal Dynamics

By Ella Ming

Summary

Source: Google Finance, Tradingkey.com

Tesla has emerged as a standout stock in our analysis, boasting a year-to-date increase of 43.7%, a staggering 102.6% rise over the past six months, and an impressive 47.1% surge in just the last month. The company's profile has been further elevated following the recent election.

While we recognize that Tesla's stock price seems to be significantly overvalued, its high P/E ratio could be attributed to:

1) Capital is flowing from Money Market Funds (MMFs) into equities, particularly those with anticipated strong cash flows over the long term, rather than being invested in long-term U.S. Treasuries (USTs), the expected return on investment for Tesla from funds exiting MMFs is as low as the yield on long-term USTs.

2) In anticipation of additional Quantitative Easing (QE) measures and a significant devaluation of the U.S. dollar's purchasing power, investors are increasingly looking to stocks with strong projected long-term cash flows as an alternative to the U.S. dollar, similar to how they would consider gold (Gold has seen a robust increase of 32.7% year-to-date). This significant appreciation of gold can be taken as a barometer for the weakening of the U.S. dollar's purchasing power. Consequently, it offers a valuable perspective on the potential elevation of Tesla's P/E ratios.

3) Tesla's technological edge, Elon Musk's rapport with the U.S. government, the launch of new vehicle models, and the advancements in Full Self-Driving (FSD) technology have not yet shown any clear signs of a significant market downturn.

Given these considerations, we recommend the following strategies:

1) Conduct an event-driven analysis of Tesla's stock price trends by examining the narratives surrounding key developments.

2) Keep a close watch on the rotation dynamics among the largest technology stocks. However, due to Tesla's current premium valuation, we think there is limited opportunity for short-term investment gains.

Global industry overview

1) According to Statista, the global electric vehicle (EV) market revenue is projected to hit $786.2 billion in 2024, with a steady CAGR of 6.63% forecasted for the 2024-2029.

2) McKinsey projects that the global passenger vehicle market will exceed 80 million units by 2030, with new energy vehicles (NEVs) comprising roughly 50% of that market.

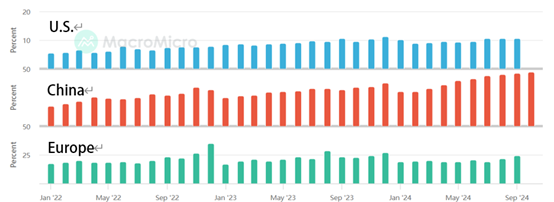

3) Despite this rapid growth in global NEV penetration, regional disparities are becoming increasingly evident. MacroMicro data indicates that, as of September 2024, NEV penetration rates in China, the US, and the EU stood at 45.82%, 10.48%, and 24.05%, respectively.

Global Penetration Rate of New Energy Vehicles

Source: MacroMicro, Tradingkey.com

U.S. industry overview

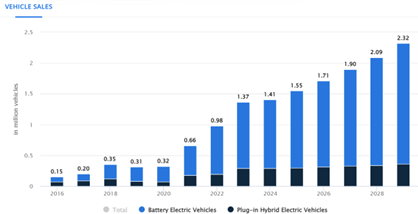

1) According to Statista, the U.S. EV market is forecasted to reach $94.9bn in revenue in 2024 and is expected to grow at a CAGR of 10.49% from 2024 to 2029, with a projected market volume of $156.3bn by 2029.

2) The unit sales of Electric Vehicles market in the United States are expected to reach 1.41m vehicles in 2024, and the volume weighted average price of Electric Vehicles market in the United States in 2024 is expected to be $67.3k.

Global Vehicle Sales Volume Prediction

Source: Statista, Tradingkey.com

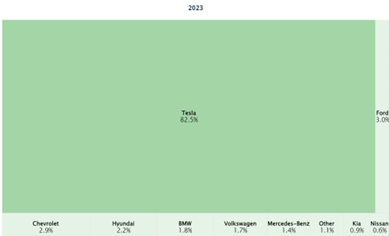

3) In the U.S. new energy market, Tesla dominates with an 82.5% share of vehicle sales in 2023, followed by Ford at 3% and Chevrolet at 2.9%.

U.S. Vehicle Sales Market Share in 2023

Source: Statista, Tradingkey.com

Brief introduction of Tesla

Tesla, founded in 2003 by engineers Martin Eberhard and Marc Tarpenning, has evolved from a Silicon Valley start-up into a pioneering force in the electric vehicle (EV) industry. The company's initial focus was to create fast and enjoyable electric cars, culminating in the release of its first product, the Roadster, in 2008. Elon Musk, a serial entrepreneur and engineer, joined the company as a major investor and eventually became its CEO and product architect, playing a pivotal role in its growth and strategy.

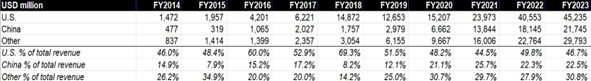

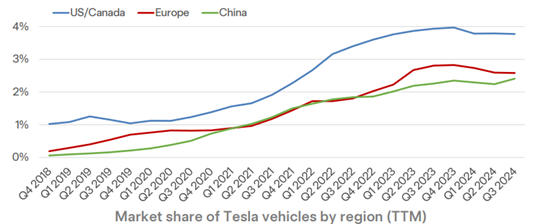

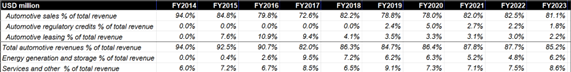

Tesla's operations encompass automotive, energy generation and storage, and service sectors, with the automotive segment being the primary revenue driver, accounting for 84.7-88.7% over the past five years. The company has a global footprint, with the U.S. and China as its major revenue contributors, at 46.7% and 22.5% respectively in 2023. Tesla operates manufacturing plants in the U.S., China, and Germany and has launched a variety of models to appeal to a broader consumer market. Despite competition from traditional automakers in the EV sector, Tesla maintains a pivotal role in the industry.

Revenue breakdown by region

Source: Company data, Tradingkey.com

1.1 Automotive related business

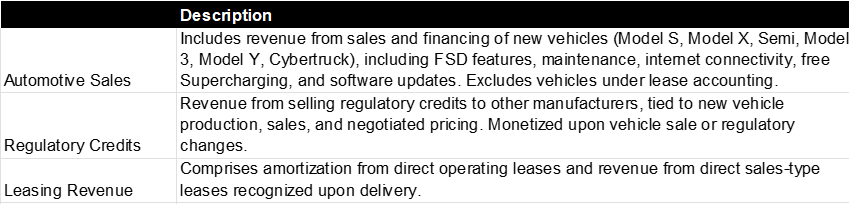

Tesla's core revenue stems from the sales of its electric vehicle lineup, encompassing the Model S, Model X, Model 3, Model Y, and Cybertruck. The company supplements this with income from the sale of regulatory credits to other manufacturers and through its vehicle leasing operations. In 2023, automotive sales constituted 81.8% of total revenue, regulatory credits contributed 1.8%, and leasing revenue made up 2.7%.

Business breakdown

Source: Company data, Tradingkey.com

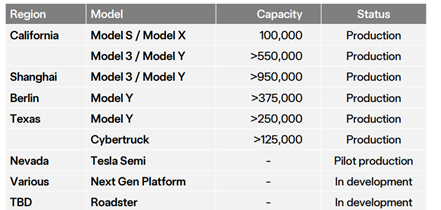

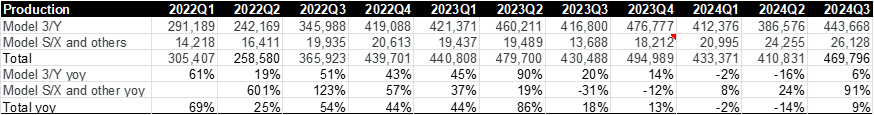

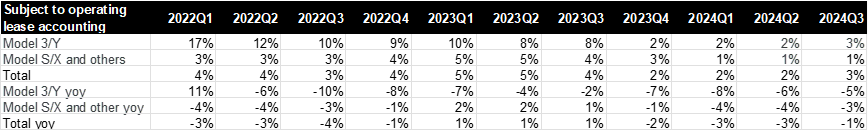

By analyzing Tesla's production capacity, delivery volumes, and average selling price, we've reached the following conclusions:

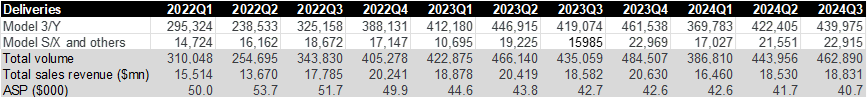

1) Tesla's vehicle average selling price (ASP) has trended downward, primarily due to frequent price cuts amidst intense competition. These strategic reductions have not only won consumer favor but also bolstered the company's financial performance. According to Tesla's Q3 2024 financial report, the company achieved a revenue of $25.2 billion, an 8% year-over-year increase, with a non-GAAP net profit of $2.5 billion. The Q3 2024 projections indicate a modest delivery increase for 2024, with plans for lower-cost EV production in H1 2025. Coupled with incentive measures, the price of electric vehicles is set to fall below the key threshold of $30,000. Elon Musk anticipates a 20-30% growth in Tesla's vehicle sales for 2025, barring any significant adverse events.

While Tesla's push to lower ASP and production costs could pressure component suppliers, its automotive leasing margins reached a robust 40.2% in 2024, leading the way for other business segments. Despite trailing behind competitors like BYD in annual sales growth, we view 2024 as a transformative year for Tesla. With new models on the horizon and ongoing AI and robotics advancements, the company is setting the stage for a new vehicle sales cycle and potential AI breakthroughs. This sets Tesla up for a new upward trajectory in the 2025-2026 period, reinforcing its market leadership in the EV sector.

Sales volume and ASP analysis

Source: Company data, Tradingkey.com

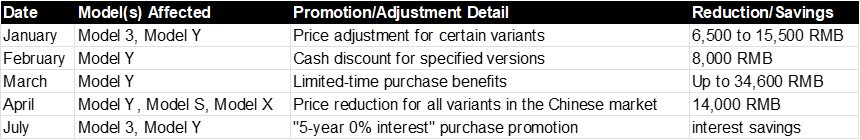

2) Tesla's current lineup includes the Model S, Model 3, Model X, Model Y, and the forthcoming Cybertruck, with production spread across four facilities, including the pilot production of the Tesla Semi at Gigafactory Nevada. The first half of 2024 saw production challenges due to factors such as reduced vehicle prices, the early production ramp-up of the refreshed Model 3 at the Fremont factory, and disruptions caused by the Red Sea conflict and a fire at the Berlin factory. Despite these setbacks, production has now rebounded as total production volume increased 9% yoy in Q3 2024.

Tesla is building scalable Gigafactories, aiming to significantly reduce costs and ensure global supply through its worldwide production footprint. The company's growth is poised to be fueled by advancements in vehicle autonomy, new product launches, and the establishment of in-house battery cell manufacturing.

Production analysis

Source: Company data, Tradingkey.com

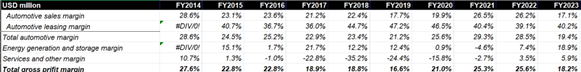

3)Gross profit margin analysis: automotive > energy generation and storage > services, within the automotive sector, leasing posted the highest margin at 40.2% in 2023. Tesla's improvements in its automotive leasing operations have resulted in a deceleration of yoy decline and a sequential qoq increase, which positively impacts the margin.

GPM analysis

Source: Company data, Tradingkey.com

1.2 FSD business

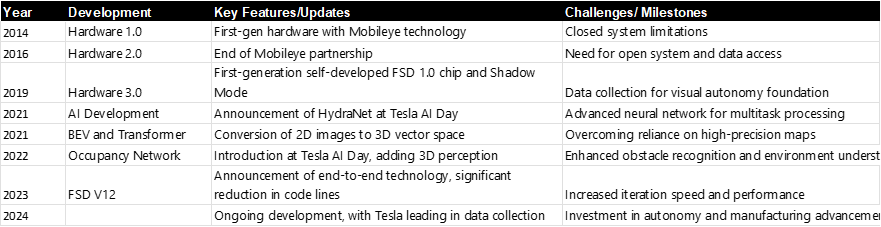

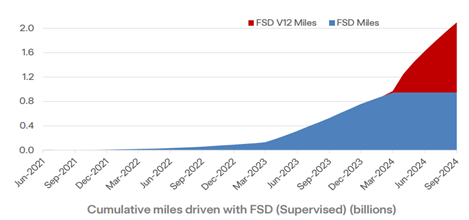

Tesla's Full Self-Driving (FSD) is an advanced driver assistance system that extends beyond traditional cruise control with capabilities like autonomous navigation, lane changing, parking, and intersection management. Despite being labeled as Autopilot or FSD, Tesla clarifies that these features require driver supervision and do not yet achieve full autonomy. The FSD, launched in 2020, represents the most autonomous iteration of Autopilot. In 2024, Tesla made significant strides with the introduction of FSD V12, shifting to neural network control and reducing dependence on hard-coded programming. This was followed by FSD V12.5 in July, which expanded operational parameters and transitioned all driving scenarios to an end-to-end AI approach. Tesla has recently launched the latest version of its Full Self-Driving (FSD) Beta software, version 13.2, marking the completion of its initial rollout. The company is now gearing up for a phased deployment to an expanded fleet of vehicles over the forthcoming weeks. This strategic rollout is anticipated to culminate in a broad update for the majority of Tesla owners by December's end, which is poised to bolster the company's revenue generation capabilities.

Tesla vehicles come standard with Autopilot assistance when sold, with the option to upgrade to Full Self-Driving (FSD) capabilities, which include features like Autopark and Smart Summon, for an additional fee. The FSD price has been variable, with several increases over the past year ($10,000 internationally), making it a significant contributor to Tesla's profits.

FSD development history

Source: Company data, Tradingkey.com

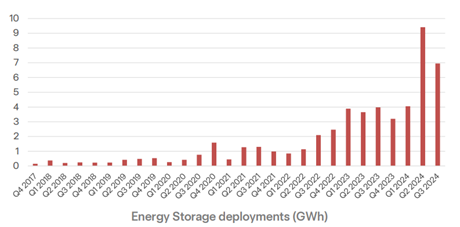

1.3 Energy related business

Tesla's energy segment reported a record 30.5% gross margin in Q3, even with reduced Megapack volumes. Deployments of the Powerwall hit another record, and the Shanghai Megafactory is on track for Megapack shipments in Q1 2025. Despite this, management anticipates margin volatility, implying a possible near-term adjustment. While we remain confident in the long-term prospects of the energy business, we factor in the potential for short-term margin pullbacks.

Source: Company data, Tradingkey.com

1.4 Robotaxi and robot business

The company's growth prospects are anchored in its humanoid robots and robotaxi initiatives. Development of the humanoid robots is actively advancing, with Musk anticipating the deployment of 1,000 units for internal use by the end of 2025, followed by mass production for external customers in 2026. The robotaxi business model involves offering rental services through owner or Tesla-owned fleets, further enhancing the company's growth potential.

Valuation

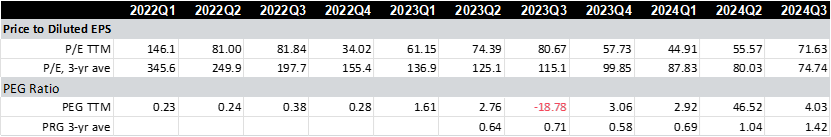

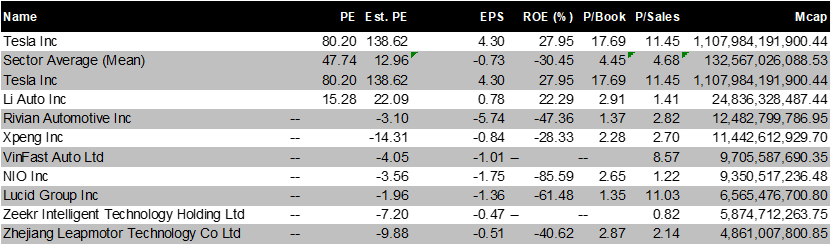

1) Tesla's P/E TTM for 2024 Q3 stands at 71.6, with a PEG TTM of 4, which is significantly higher compared to the sector and peers, whose P/E ratios remain below 20x. This valuation indicates that Tesla is currently trading at a premium.

2) In the event that Tesla's Full Self-Driving (FSD) technology does not achieve its intended success, the electric vehicle (EV) market is still poised for substantial growth, with McKinsey projecting a potential demand for EVs to reach approximately 40 million units by 2030. Assuming Tesla secures a 22% market share, this would translate to sales of 8.8 million units. With an estimated per-unit profit of $3,000, Tesla could potentially generate $26 billion in profit, leading to a market capitalization of $390 billion, assuming a high price-to-earnings (PE) ratio of 15. The energy storage division, which reported $13 billion in revenue for 2023, is anticipated to experience robust growth, with an estimated market value of around $130 billion by 2030, considering its current trajectory and potential for expansion. The market value attributed to FSD and other innovative ventures, including robotaxis and Tesla's humanoid robots, is projected to c.$500 billion, reflecting the significant potential, yet also the considerable overvaluation of these segments. However, any constraints in the development of FSD or robotaxis could lead to a significant devaluation of Tesla's stock price. Furthermore, to meet the projected production capacity, Tesla will need to invest in additional manufacturing facilities, which could entail substantial capital expenditures and potentially impact profit margins.

Peer comparison

Source: Refinitiv, Tradingkey.com

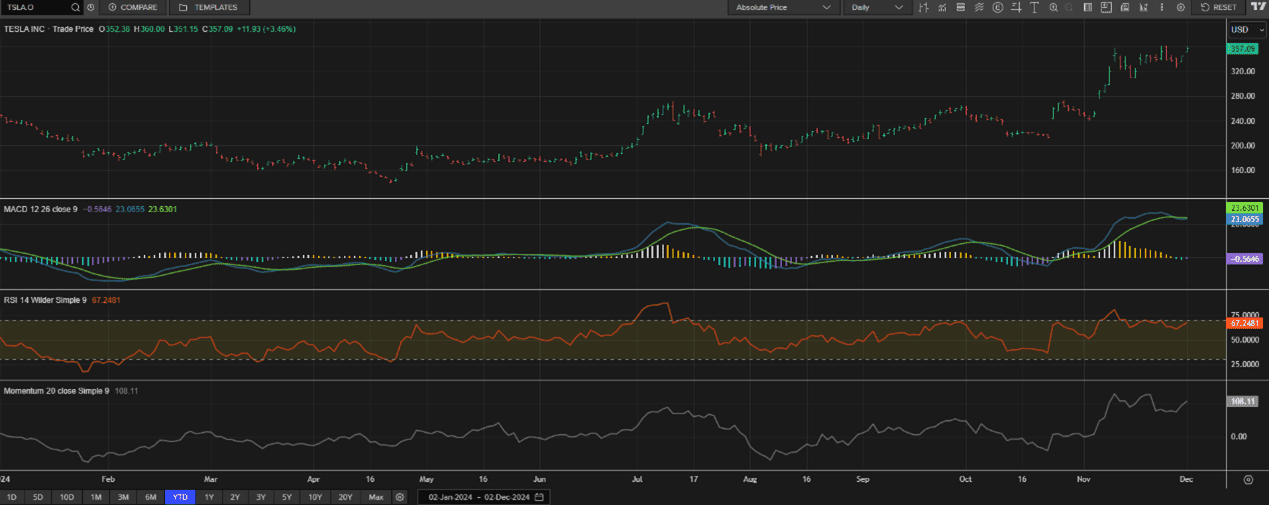

Technical analysis

1) Tesla’s stock price is below its 20-day moving average (MA 20), indicating that the stock's price is lower than the average price of the past 20 trading days. This suggests that Tesla's short-term trend is bearish, implying that market sentiment may be shifting downwards. Additionally, the stock is currently trading at a relatively high level, and trading volume has seen a recent decline.

Source: Refinitiv, Tradingkey.com

2) The recent transition of the MACD histogram from positive to negative values indicates that the MACD line has crossed below the signal line, signifying an increase in downward momentum, which may be a signal to sell. The height of the histogram reflects the intensity of price momentum, with a lower histogram suggesting weaker current price momentum.

3) The RSI 14 is a measure that analyzes the buying and selling pressure in the market by comparing the average number of closing price increases to the average number of closing price decreases over the last 14 trading periods, thereby predicting future market trends. When the RSI 14 exceeds 70, it suggests that the market may be overbought, with asset prices potentially too high and at risk of a pullback. Conversely, when the RSI falls below 30, it indicates that the market may be oversold, with asset prices possibly too low, presenting a potential buying opportunity. The current RSI 14 stands at 67.2, which is relatively high.

Source: Refinitiv, Tradingkey.com

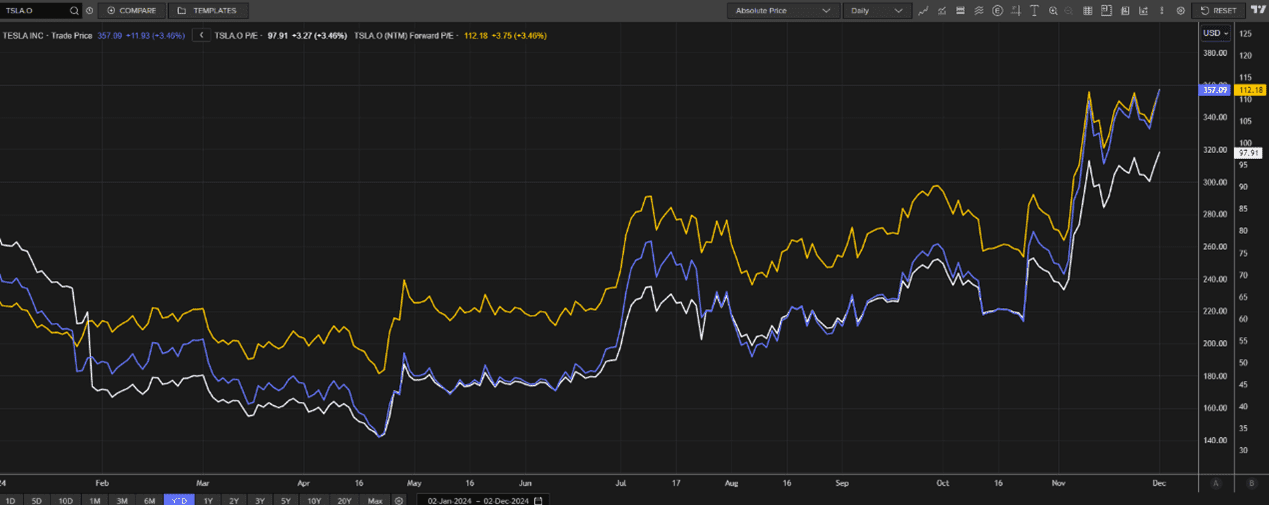

4)When comparing market expectations, we've observed that Tesla's current stock price significantly exceeds the market consensus estimates, indicating a substantial valuation premium. Concurrently, its forward P/E ratio is anticipated to maintain its current elevated levels.

Source: Refinitiv, Tradingkey.com

Recommendation: Hold

We recommend analyzing Tesla's stock from two perspectives:

1)Narrative: Track fundamental changes and catalysts that could influence stock price movements, such as FSD approval updates, political events like Trump's election, and tariffs on lithium batteries for new energy vehicles, which can lead to short-term volatility.

For instance:

a) Trump's recent election caused a sharp 30% increase in Tesla's stock price.

b) On November 14th, Reuters reported that Trump's transition team is planning to cancel the $7,500 electric vehicle consumer tax credit, which, if implemented, would have structural implications. For automakers, traditional U.S. automakers rely heavily on policy subsidies and penalty incentives to develop electric vehicles. The removal of these subsidies could enhance Tesla's product competitiveness and potentially increase its market share.

2) Monitor the rotation between the largest tech stocks; when some are significantly overvalued, capital may shift to undervalued ones. However, given Tesla's current premium, there is limited room for buying in the short term.

.jpg)